NGI Mexico GPI | Markets | NGI All News Access

Mexican Pipe Delays, New LNG Demand Could Lead to Erratic Price Swings in U.S. South Central This Winter

*Part 2 of 3. Historically low storage inventories are doing battle with surging unconventional output — raising the stakes and uncertainty for bears and bulls heading into the winter. This series lays out a roadmap for what could influence natural gas markets during the upcoming Winter 2018/19 heating season. Part 1 looked at markets in the East and Midwest. Part 3 focused on West Coast markets.

The recently announced delay of two Mexican natural gas pipelines will postpone much needed relief in the constrained Permian Basin this winter, likely leading to increased flaring, possible production shut-ins and price volatility. Meanwhile, the start-up of two liquefied natural gas (LNG) trains could tighten supply and lead to higher prices if winter conditions are worse than currently forecast, analysts said.

Early winter outlooks for the South Central region reflect the return of an El Niño weather pattern that is expected to have a significant influence on the winter season, particularly for the Southeast, Tennessee Valley and Gulf Coast, according to AccuWeather. January and February are expected to be particularly conducive to snow and ice threats, with multiple storms forecast. As cold shots become more frequent from mid- to late-season, the central and western Gulf Coast then would be susceptible to frost and freezes.

A cold winter would bear a stark contrast to the winter of 2017-2018, when February brought well above-normal temperatures to the region. Areas from Dallas stretching into Little Rock, AR, would be susceptible, AccuWeather said.

“Anytime you get these deep shots of cold air like we’re calling for in the late season, there’s always a big threat” in areas around Central Texas, AccuWeather expert long-range forecaster Paul Pastelok said. “We’re worried there could be shots of cold getting down into the mid-20s in some places.”

The cold, wet weather could cause some concern for Permian producers, as midstream companies have not invested as much in line insulation and freeze prevention since cold is less frequent there than in the Rockies or the Northeast, according to Genscape Inc. However, with production increasingly migrating to oilier, liquids-rich plays like the Permian, the risk of freeze-offs is a growing concern.

“That said, the Permian really only had one major freeze-off event last winter right after the new year,” Genscape senior natural gas analyst Rick Margolin said. “That event took out about 6 Bcf over a four-day period, with one day losing 2 Bcf.”

Despite the expected cold fronts that could hit the region later this winter, the National Oceanic and Atmospheric Administration said no part of the United States was favored to have below-average temperatures between December and February.

Pipe Delays Hamper Permian

In October, Fermaca, Mexico’s second largest oil and gas company, confirmed that its 1.2 Bcf/d La Laguna-Aguascalientes and 0.9 Bcf/d Villa de Reyes-Aguascalientes-Guadalajara (VAG) pipeline would not enter service until March, two months later than expected.

The La Laguna-Aguascalientes and Villa de Reyes-Aguascalientes-Guadalajara legs are expected to play a key role in allowing U.S.-sourced pipeline gas to displace Mexico’s supply from LNG imports at the Manzanillo terminal on the Pacific coast and the Altamira terminal on the Gulf of Mexico, according to Genscape.

But more important for the United States and the Permian in particular, the lines are expected to provide significant debottlenecking relief to the region, “where production has grown so fast that it exceeds current pipeline takeaway capacity,” the firm said.

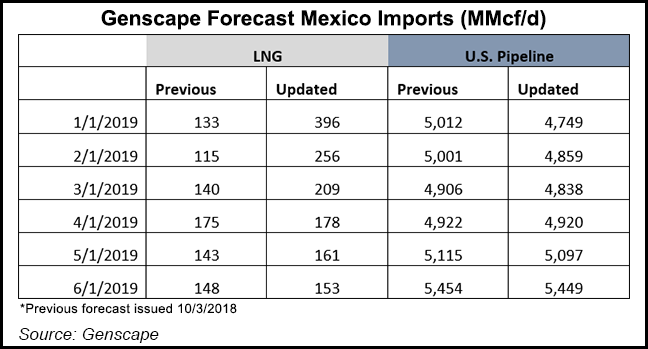

“We were expecting Mexico to import an average 150 MMcf/d in Calendar ’19, but now expect 190 MMcf/d” because Permian supply to displace LNG imports will be delayed, Margolin said.

Genscape’s revised forecast still assumes that displacing Altamira LNG volumes will begin in January, though not with Permian gas. “The Sur de Texas-Tuxpan subsea pipeline should be the first source of displacement as it now appears on pace to come online” before Villa de Reyes-Aguascalientes-Guadalajara, possibly in December.

Genscape’s model assumes South Texas gas will begin displacing 50% of Altamira LNG imports starting in January, then increasing to 75% displacement in February through the remainder of the year.

Displacing Manzanillo LNG imports, however, does not appear possible until Villa de Reyes-Aguascalientes-Guadalajara is in place. In its revised model, Genscape begins displacing about 50% of Manzanillo volumes in March, increasing to 75% displacement in April.

“Since we now anticipate higher volumes of LNG imports, we expect lower U.S. pipeline flows to Mexico in 1Q2019. Previously, we were forecasting 1Q2019 flows would average 4.97 Bcf/d; we now expect volumes just shy of 4.82 Bcf/d,” Margolin said.

While the impact to total U.S. pipeline exports to Mexico is not drastic, the impact on Permian growth is, he said. In its previous forecast, Genscape had projected Permian-to-Mexico exports increasing by 0.84 Bcf/d by the end of 2018. “These delays now mean that bump will not materialize until March 2019.”

Last winter, Mexico imported an average of 4.45 Bcf/d via U.S. pipelines and 0.48 Bcf/d of LNG, the analytics firm said.

Permian Flaring

The constraints in the Permian have already led to increased gas flaring, with permits allowing producers to burn excess gas common in Texas. Companies that approach the Railroad Commission of Texas typically are issued a standard 45-day permit that allows them to “flare whatever they need to”, according to Commissioner Ryan Sitton. If flaring is needed beyond the sequential 180-day window permitted, then producers have to request a hearing with the Commission.

Recent satellite data utilized by BTU Analytics implies that Permian gas flaring volumes reached an average of 330 MMcf/d between June to August, a 23% increase over May. In late 2017, a lack of gas processing capacity in the Permian Delaware sub-basin led to more gas flaring occurring there. Correspondingly, a smaller percentage of Permian flaring occurred in the Midland sub-basin, the firm said.

Multiple gas processing plants have ramped up in the Delaware over the past few months, however, easing natural gas flaring activity in northern Reeves County, TX, according to BTU. “But this relief has not occurred across the Delaware, as flaring has continued in New Mexico and increased in Ward and Pecos counties” in West Texas. Flaring in the Midland of West Texas “has increased significantly in northwest Howard County, likely driven by large multi-well pads coming online at once,” BTU natural gas analyst Matt Hagerty said.

Pipeline delays, whether in Mexico or the United States, will complicate the already difficult takeaway situation from the Permian, BTU said. The firm would project an incremental 2.5 Bcf/d (annual average) of gas making its way to market in 2019 from 2018 given current activity. Because of infrastructure and other constraints, however, “that number is cut nearly in half,” BTU analyst Matthew Hoza, said.

As the data and analytics firm’s projected marketable production will come in lower than its previous forecast, the difference is expected to be flared and/or shut-in, he said. Genscape’s Margolin agreed there could be some moderate increases in flaring this winter, “but not radically so.”

Genscape does see Permian production growth slowing because the basin is currently constrained by about 130 MMcf/d, with that number potentially increasing to 160 MMcf/d by January and 300 MMcf/d by February, Margolin said.

There’s roughly 8.8 Bcf/d of capacity out of the Permian. One of the largest pipelines — El Paso Natural Gas’ 2.4 Bcf/d South Mainline — averaged 2.28 Bcf/d in flows last winter. Energy Transfer LP’s 1.3 Bcf/d Trans-Pecos line to Mexico didn’t flow last winter, while its 1.1 Bcf/d Comanche Trail to Mexico line flowed about 0.1 Bcf/d, according to Genscape.

Smaller Pipelines Offering Some Relief

Several major midstream companies have announced plans to boost infrastructure out of the Permian. Kinder Morgan Inc. is developing Gulf Coast Express (GCX), which would transport 2 Bcf/d from the Permian to the Agua Dulce hub in South Texas, as well as the Permian Highway Pipeline (PHP) Project, a 2.0 Bcf/d pipeline from the Waha hub in West Texas to the Texas Coast and potentially on to Mexico markets.

GCX isn’t due online until October, with PHP not expected in service until late 2020. The 2 Bcf/d Whistler pipeline project, being jointly developed by Targa Resources and three other operators, is also due in service in late 2020.

With significant Permian debottlenecking not expected for at least another year, producers are eyeing several incremental projects that are due online in the coming months. Among those are the Old Ocean natural gas pipeline, which was resurrected in May by Energy Transfer and Enterprise Product Partners LP (EPD). The 24-inch diameter Texas pipeline, which originates in Maypearl and extends south 240 miles to Sweeny near the coast, has an initial design capacity of 160,000 MMBtu/d.

ETP and EPD also are expanding their jointly owned North Texas pipeline, which would provide around 160,000 MMBtu/d of additional capacity from West Texas for deliveries into Old Ocean. The North Texas pipeline expansion is expected to be completed by year’s end.

Perhaps the biggest infrastructure addition likely to impact gas will come in the form of an oil pipeline that started up in October, according to RBN Energy LLC’s Jason Ferguson. “All indications are that Plains All American (PAA) remains on track to start up its 500 million b/d Sunrise expansion.” PAA has publicly stated that the pipeline is likely to provide about 220 million b/d of takeaway capacity from the Permian in the near term, with associated gas likely to grow with the startup.

Genscape’s Ryan Saxton, manager of oil transportation, said that based on its flyover imagery and on-the-ground intelligence, “we think they’ve been able to initialize operations at some point in October.”

As of Oct. 25, Plains All American had three out of five pumps connected to the trunk line at Colorado City, their main pumping station to push crude out of the Permian to Wichita Falls, Saxton said. Genscape also has seen the Basin pipeline, to which Sunrise Expansion connects at Wichita Falls, average around 427,000 b/d in October.

“That’s a more than 70,000 b/d increase over September, which suggests that Basin may be getting extra feedstock from Sunrise at Wichita Falls already,” Saxton said.

All the evidence strongly suggests that Sunrise began operations in October on a limited basis, though not yet able to achieve full capacity, he said.

LNG Driving Permian Expansions

Abundant, low-cost gas supplies have driven a wave of LNG export projects, primarily on the Gulf Coast, bolstering demand in a long dormant region. Cheniere Energy Inc. was first out of the gate with its Sabine Pass terminal, with the first four trains at the 3.5 Bcf/d facility already in operation.

Last month, FERC authorized Cheniere’s Sabine Pass Liquefaction LLC and Sabine Pass LNG LP to introduce refrigerants into the Cameron Parish, LA, facility’s Train 5. Based on past operational train timelines, Ferguson expects Train 5 likely to be online by the end of March, with peak volumes in February.

Federal Energy Regulatory Commission staff also approved a request from Cheniere’s Corpus Christi Liquefaction LLC to introduce refrigerants into Train 1 at the South Texas LNG facility. In-service is expected in January, with substantial completion expected in 1H2019 for Train 1 and in 2H2019 for Train 2, Ferguson said.

In late October, significant flows began to Corpus Christi LNG’s Train 1 as it undergoes commissioning, according to global consulting firm Energy Aspects. Meanwhile, Cheniere’s Sabine Pass feed gas flows hit an all-time high on Oct. 24 at 3.5 Bcf/d, indicating the start of commissioning flows to the Louisiana export facility’s fifth train, the firm said.

Cameron LNG is also scheduled to go online in the first quarter, and 50-percent owner Sempra Energy on Friday announced that commissioning activities for the Hackberry, LA, facility had begun. The commissioning process includes testing of all support systems, combustion turbines and compressors, as well as the delivery of feed gas from the transmission pipeline and production of the first LNG.

Last winter was the first one with four trains running at Sabine Pass, and pipeline nominations to the terminal held steady at around 3.2 Bcf/d in January despite record cold across the United States, according to BTU. “The other notable takeaway is Sabine Pass with four trains running is more than the equivalent of deliveries to the major New York City utility meters at peak winter levels at over 3.0 Bcf/d,” BTU CEO Andrew Bradford said.

Large LNG export projects have consumed 3.16 Bcf/d this year, up 1.16 Bcf/d (58.1%) year/year, according to EBW Analytics. If Sabine Pass Train 5 and Corpus Christi Train 1 begin accepting larger quantities of feed gas later this year, “that could potentially add up to another 1.6 Bcf/d of gas demand by late winter, months ahead of schedule,” CEO Andy Weissman said.

U.S. LNG exports through the first half of 2018 rose 58% compared with the same period in 2017, averaging 2.72 Bcf/d, according to the Energy Information Administration (EIA). In its September Short-Term Energy Outlook, the administration said it expected net gas exports to continue increasing, driven by continued growth in LNG export capacity and continued natural gas infrastructure buildout in Mexico to facilitate additional exports.

“Overall, net natural gas exports are expected to average 2.0 Bcf/d in 2018 and 5.8 Bcf/d in 2019,” according to EIA.

Meanwhile, the slew of LNG export projects slated to enter service along the Gulf Coast has led to an increase in U.S. pipeline capacity into the region as producers and midstreamers aim to capture the new demand. EIA estimated that natural gas pipeline capacity into the South Central region will reach 19 Bcf/d this year.

Possible Price Spikes

The expected increase in demand from LNG could lead to higher prices this winter at the benchmark Henry Hub, especially given the historically low levels at which South Central storage inventories now sit. South Central storage stood at 919 Bcf as of Oct. 26, down from 1,195 Bcf a year ago and down from the 1,223 Bcf five-year average, according to EIA.

Henry Hub cash prices averaged $2.99 last winter, while Nymex winter futures settled Oct. 29 at $3.154.

Still, many market observers continue to look to record production to quickly refill storage before lasting winter temperatures arrive. Genscape reported that Lower 48 production is believed to have set yet another daily record high during the Oct. 27-28 weekend as its daily pipe production estimate surpassed 86 Bcf/d.

The gains were largely driven by increased volumes in the East, which have been more than enough to offset some declines that have been occurring in Texas as well as the Gulf of Mexico (GOM), where volumes continue to recover from former Hurricane Michael. Genscape estimated Monday’s GOM volumes at 2,671 MMcf/d.

“While that is nearly 1.19 Bcf/d greater than the low hit during the worst of Michael, it remains about 154 MMcf/d below the seven-day average before platform evacuations began,” Margolin said.

Even with production expected to continue growing during the remainder of the year, Permian operators have been rushing to inject into facilities ahead of the winter, despite stronger price signals from the cash market. During the second week of October, Permian storage facilities injected an average 90 MMcf/d into area storage fields that post volumes to interstate pipeline bulletin boards, according to RBN.

While low storage has been bullish on its own for Permian area pricing, a pipeline explosion in early October in Canada has provided additional support. As recently as September, gas prices in the Permian languished close to $1 as constraints and soft demand pressured regional pricing hubs. That changed when a 36-inch diameter pipeline that is part of Enbridge Inc.’s Westcoast Transmission in British Columbia ruptured Oct. 9, cutting off 2 Bcf/d of gas flows, of which nearly half typically cross the border into the United States.

A parallel 30-inch diameter line that was unharmed in the explosion returned to service the following day, although it was continuing to operate at 80% capacity. On Oct. 18, Enbridge said the 36-inch line would likely be back by mid-November, but also at the 80% reduced capacity. Once the repairs are complete and the 36-inch line is back in service at reduced pressure, capacity on the TSouth system is estimated to generally range between 0.9 Bcf/d to 1.3 Bcf/d through the balance of the winter gas season, Enbridge said.

“By comparison, average southbound flows last winter at Station 4B were around 1.8 Bcf/d, so this would still represent a cut of 0.5-0.9 Bcf/d of flows year over year,” Genscape natural gas analyst Joe Bernardi said.

Westcoast’s deliveries to Northwest Pipeline at Sumas had averaged about 1.0 Bcf/d prior to the explosion, and have been roughly in the 0.3-0.5 Bcf/d range since the partial restoration of flow capacity. Westcoast on Thursday announced that it had completed repairs on the section of 36-inch diameter pipeline that exploded, and as a result expected to return additional southbound flow capacity over the Nov. 3-4 weekend. The increased flows on the T-South system will allow between 820 and 900 MMcf/d of gas flows. Previously, this maximum capacity was 800-850 MMcf/d.

Enbridge said it continues to prioritize work on the pipe segments with the highest capacity gain. Based on its current forecast plan, the engineering assessments and approvals for these high-priority segments are expected to be complete by Nov. 30. This would result in increasing the Huntingdon constraint capacity to 1.2-1.3 Bcf/d.

The continued restrictions on the Westcoast system resuscitated struggling Permian prices as alternative flows have been needed to meet demand. El Paso-Permian cash prices the day after the explosion jumped 34 cents to average $1.915 and reached a high of $2.57 on Oct. 18 before easing in the days since due to a wider regional retreat caused by maintenance on the Transwestern Pipeline, NGI price data show.

Forward prices have also responded, although gains there have lagged those seen in the cash market and recently declined given the Transwestern work. As of Oct. 29, El Paso-Permian November sat at $1.72, December sat at $2.00 and the winter strip (November-March) sat at $1.81, according to NGI Forward Look data.

A similar story has played out at Waha as cash prices shot up 28.5 cents the day after the explosion to hit $1.755 and then reached a high of $2.57 on Oct. 18 before softening back below the $2 mark due to the Transwestern maintenance. Forward prices as of Oct. 29 showed Waha November at $1.476, December at $1.918 and the winter strip at $1.714.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |