NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

TransCanada Expecting Constructive Relationship with AMLO Government

TransCanada Corp. plans to build a friendly relationship with Mexico’s next government to advance its various natural gas pipeline projects in the next few years, a top executive said last week.

The Calgary-based pipeline operator’s third quarter earnings call last Thursday came amid a tumultuous week for stakeholders in Mexico’s economy, as President-Elect Andrés Manuel López Obrador affirmed plans to cancel a new international airport on which construction is already underway. The announcement led Fitch Ratings to downgrade its issuer default rating (IDR) outlook for the government.

Valuation of the country’s currency, bonds, and top stocks tumbled on the news, which left analysts wondering whether similar disruptive measures could be expected in the energy sector.

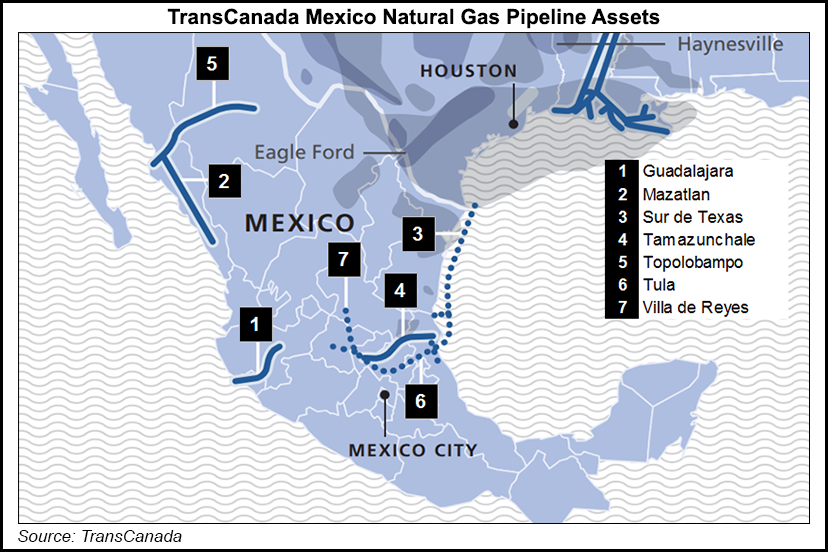

TransCanada has three natural gas pipelines now under construction in Mexico at a combined total cost of about $2.9 billion. During a conference call with financial analysts to discuss third quarter performance, Executive Vice President Karl Johansson, who oversees Canada and Mexico natural gas, attempted to allay any concerns about the company’s work south of the border.

“I’m aware of the issue that you’re talking about,” he said in response to a question about the recent volatility. The management team plans to have more in-depth conversations with the new administration after López Obrador is sworn in on Dec. 1. “But from where I sit right now, their natural gas [import] strategy…is very important for the future growth of the Mexico economy.”

Johansson cited the outgoing government’s plan to replace fuel oil-fired power plants with affordable and less polluting gas-fired capacity, as well as the importance of gas for industrial consumers.

“So my expectation is that the [new] government will work with us to make sure that this infrastructure plays an important part in this economy,” Johansson said. Once the projects are in place, the management team expects “we’ll be working well with the government to make sure that these gas pipelines are fully utilized and the benefits to Mexico are realized through the work we do.”

The undersea Sur de Texas-Tuxpan pipeline, a joint-venture with IEnova for which offshore construction was completed in May, is expected to enter service by the end of the year, TransCanada CEO Russell Girling said during the call, although IEnova executives said during their 3Q2018 earnings call on October 25 that a start-up date in early 2019 is more likely.

TransCanada’s Tula-Villa de Reyes and Tuxpan-Tula pipelines in Mexico are expected to enter service in 2019 and 2020, respectively, Johansson said.

To meet demand from the power and industrial segment, Mexico has been forced to ramp up imports of both piped gas from the United States and liquefied natural gas from global suppliers because of declining domestic oil and gas output by national oil company Petróleos Mexicanos (Pemex).

Construction of TransCanada’s C$6.2 billion ($4.73 billion), 420-mile Coastal GasLink Pipeline (CGL) project in British Columbia is expected to begin in January, with a planned in-service date of 2023. All necessary permits have been received for the project, which will supply the $31 billion LNG Canada gas export terminal, a joint venture led by Royal Dutch Shell plc.

Construction on a C$1.5 expansion of the Nova Gas Transmission Ltd. (NGTL) supply and collection grid in Alberta and British Columbia could start as early as 3Q2020, pending the regulatory approval, TransCanada said. The NGTL 2022 Expansion Program envisions intra-basin delivery services beginning in April 2022.

Including CGL and NGTL 2022, TransCanada now has a portfolio of C$36 billion ($27.5 billion) of projects expected to enter service by 2023.

TransCanada’s net income totaled C$928 million ($708 million) or C$1.02/share in 3Q2018, up from C$612 million (C70 cents) in 3Q2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |