NGI The Weekly Gas Market Report | Markets | NGI All News Access

Raymond James Boosts ’19 Natural Gas Price Forecast; Longer Term, Look Out Below

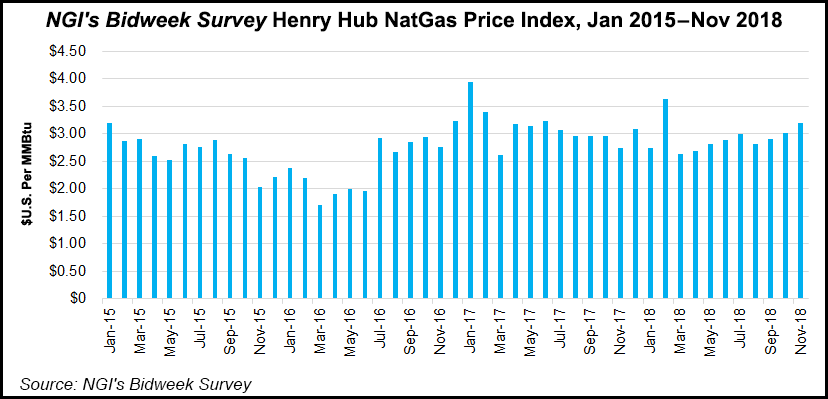

Raymond James & Associates Inc. has increased its Henry Hub natural gas forecast for 2019, but beyond next year, analysts see lots of obstacles to higher prices.

The gas forecast for 2019 has been increased to $2.75/Mcf from $2.25. The storage inventory exited the summer injection season near a multi-year low, and prices have rallied recently on “surprisingly” strong demand growth, said analysts led by J. Marshall Adkins and Pavel Molchanov.

“Overall, we still remain bearish relative to the futures curve and consensus, forecasting a Henry Hub average to see a cyclical trough of $2.25 in 2020,” a 25-cent decline from a previous forecast. Gas prices longer term should “level out” at $2.50.

The bearishness by Raymond James can be traced to the U.S. gas market’s increasingly “inverse” relationship with oil prices. Last month, the analyst team increased the oil price forecast for the third time this year.

“As higher oil prices spur growth in oil production, they also drive increasing supply of associated gas — whether or not anyone actually wants that gas,” analysts said. “Simply put, the better things get for oil prices, the worse the read-through for gas prices.”

More pipeline takeaway from Appalachia and into late 2019 from the Permian Basin would also allow pent-up supply to flow, also pressuring prices.

The U.S. gas supply side of the equation has outweighed what has been a “mostly upbeat” gas demand story, led by liquefied natural gas (LNG) exports, Mexico pipeline exports, replaced coal-fired generation and increasing petrochemical-related demand. There’s always the weather wildcard too, with El Niño raising the possibility of a warmer-than-normal winter.

“That said, weather has been a significant tightening (bullish) factor for natural gas in 2018, partially helping to explain why U.S. storage levels are near multi-year lows in the face of unprecedented growth in U.S. natural gas supply,” analysts said.

In its 10-year normal weather model for long-term projections, Raymond James is forecasting year/year (y/y) weather will be a bearish factor of 0.8 Bcf/d in 2019, assuming a reversion to the long-term weather average.

Several meteorological models are forecasting the possibility of El Niño conditions developing in the coming months, suggesting a likely warmer-than-normal winter. If El Niño conditions were to occur, that effectively could put put the kibosh on a bullish weather impact in 2018, equating to a price reduction “of as much as 50 cents/Mcf versus our 2019 forecast of $2.75,” analysts said.

For now, domestic supply is poised to surge at sub-$3.00/Mcf Henry Hub, driven in large part by onshore associated gas.

The Raymond James team is projecting a 3.2 Bcf/d y/y increase in associated gas next year, with another 2.7 Bcf/d y/y increase in 2020.

“When combined with gas-directed activity, the average U.S. gas supply should increase by 6-8 Bcf/d over the next several years,” analysts said.

Meanwhile. associated gas is going to happen regardless of the price as oil drilling continues to increase onshore, especially in the Permian Basin.

“The Permian alone should provide as much as 3.7 Bcf/d of additional gas by 2020,” with the Eagle Ford Shale providing 1.8 Bcf/d by 2020. More dry gas growth also should come from the Marcellus and Utica shales as pipeline takeaway is boosted.

“Breakevens throughout the Marcellus and in parts of the Utica remain well below $2.00/Mcf, incentivizing increased gas-directed drilling and completion activity as long as additional pipeline takeaway capacity is available,” Adkins and his team said. “As more gas pipeline capacity comes online, regional prices should strengthen relative to Henry Hub.”

There is already evidence of differential compression, which should accelerate, “spurring even those producers that do not have access to takeaway capacity to produce at higher rates.”

Reduced cycle times, improved well productivity and the drawdown in drilled but uncompleted wells also are setting up higher volumes from Appalachia.

“In the Marcellus alone, our model indicates 4.2 Bcf/d of supply growth over the next two years, comprising more than a third of overall dry gas growth,” analysts said.

Other gas-rich plays, including the Haynesville Shale, are also coming to life, and they too will boost output.

“Putting everything together, we project supply growth of 6.6 Bcf/d in 2019 and 5.7 Bcf/d in 2020 — well ahead of demand growth,” the Raymond James team said.

On the demand side, Mexico pipeline exports are not coming without glitches. Simply adding capacity and interconnections at the Texas-Mexico border won’t guarantee physical flows south, despite improving demand. Raymond James is forecasting exports to Mexico to increase to a total of 1.7 Bcf/d by 2020.

For U.S. LNG, analysts are predicting domestic exports will increase by 1 Bcf/d in 2019 and another 3.1 Bcf/d in 2020.“The first steady-state year for all of the U.S. LNG export facilities — totaling 9 Bcf/d — will likely be 2021,” analysts said.

Watch out for growth in wind and solar, too, according to Raymond James. Hampering growth in the power sector, the single largest component of domestic gas demand is the increase in renewables.

Coal retirements are going to continue, creating opportunities for gas, but on average “we anticipate wind/solar to capture two-thirds of the coal retirement share with the remaining one-third accruing to gas.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |