Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Apache Raises Full-Year Guidance as Alpine High Again Outperforms

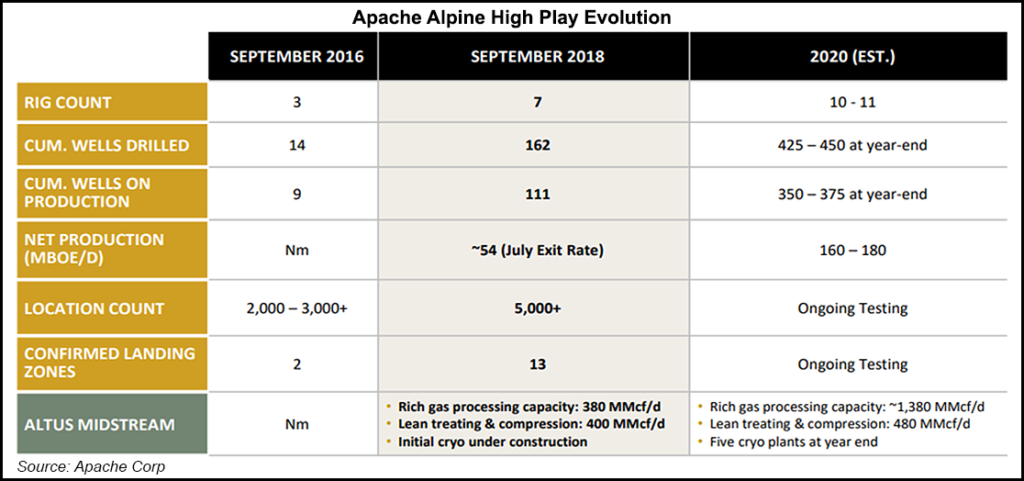

Apache Corp. has raised its full-year production guidance following a solid performance in the third quarter, propelled yet again by Alpine High development in the Permian Basin, where natural gas volumes climbed 86% from a year ago.

Total U.S. production averaged 272,000 boe/d in 3Q2018. Nearly all of that output, or 222,000 boe/d came from the Permian, where year/year volumes were up 38%.

“Apache continued our strong performance in the third quarter of 2018, delivering 31% growth in U.S. production year/year,” CEO John Christmann said. “The Permian Basin continues to be the key driver…Our positive production trends will continue in the fourth quarter, prompting us to again raise our full-year 2018 U.S. production guidance.”

Alpine High, a West Texas play in the Delaware sub-basin pioneered by Apache two years ago, continued to be the lynchpin of production, averaging 49,000 boe/d in 3Q2018, up 52% sequentially.

Total U.S. natural gas volumes, pulled from the Permian, Gulf Coast/Midcontinent and Gulf of Mexico, jumped 61% from a year ago and by 28% from the second quarter to 651,782 Mcf/d. Permian gas output alone fueled an 86% increase and a 28% sequential gain to 516,930 Mcf/d.

Domestic oil volumes also were higher, up 14%, but they fell 2% sequentially to 103,538 b/d. Permian oil volumes rose by 16% to 90,434 b/d, while the basin’s natural gas liquids volumes climbed to to 44,693 b/d, a 24% gain and 2% higher than the second quarter.

Apache secured a way to fund its future midstream investment needs at Alpine High, after joining with Kayne Anderson Acquisition Corp. in August to form Altus Midstream LP. The pure-play Permian operator holds substantially all of Apache’s gathering, processing and transportation assets, helping to offset rising costs to build out needed infrastructure.

“Importantly, the deal will allow Apache to maintain control of the midstream buildout as we ramp up production at Alpine High,” Christmann said.

In the Permian, the company averaged 18 rigs and five fracture crews between July and September, with 47 gross-operated wells drilled/completed (D&C).

In the Delaware, 23 wells were D&C’d in the Alpine High. Drilling, completion and equipment costs/lateral foot fell in Alpine High by 25% year-to-date from 2017. Delaware activity also is underway in the Dixieland and Pecos Bend areas of West Texas in Reeves County, as well as the Slope play in New Mexico.

Apache also is working Delaware’s twin, the Midland sub-basin, where activity remains focused on pad development in the Wolfcamp formation, where 11 wells were D&C’d during 3Q2018.

Capital spending for upstream operations totaled $844 million during the quarter, including $48 million for incremental leasehold acquisition/retention. Another $122 million was invested for Alpine High midstream infrastructure.

During 4Q2018, Apache expects capital spend to be about $800 million, bringing the 2018 upstream budget to about $3.1 billion. Spending in 2019 is expected to be slightly lower at around $3 billion, Christmann said.

Strong well performance during the third quarter prompted Apache to raise its U.S. production guidance to 262,000 boe/d.

“During the third quarter, we increased activity to optimize drilling and completions and improve efficiencies through longer laterals, larger fractures and facility expansions,” Christmann said. “Looking ahead to the fourth quarter, we expect our upstream capital spending to be in line with levels we have maintained for more than a year.”

The company has increased its 2018 U.S. production guidance to 262,000 boe/d, with adjusted international production guiding at 133,000 boe/d. Production levels for 2019 at the high-end of guidance are forecast at 410,000-440,000 boe/d, with 15% growth in the United States and 10% growth overall.

Net earnings climbed to $81 million (21 cents/share) in 3Q2018 from $63 million (16 cents) in 3Q2017. Revenue increased from a year ago to $1.98 billion from $1.58 billion. Net cash from operating activities rose 82% to $1 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |