NGI The Weekly Gas Market Report | E&P | NGI All News Access

Shell Profits Hit Four-Year High as Commodity Prices Strengthen

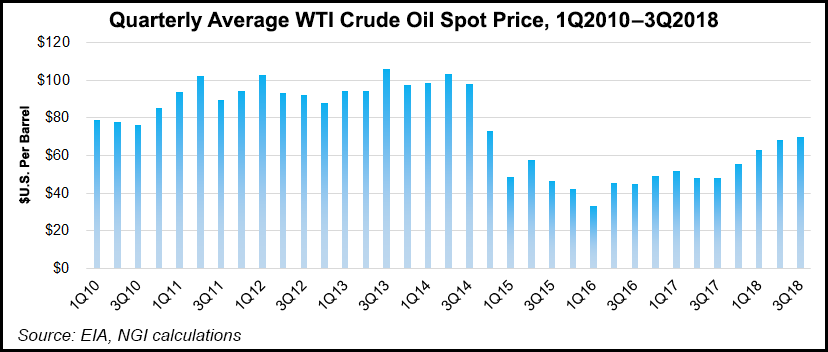

Capitalizing on higher oil and natural gas prices, Royal Dutch Shell plc’s earnings struck a four-year high in the third quarter, with net income rising 43% year/year and operational cash flow surging 59%.

Shell’s net income, using the European metric current cost of supply that strips out changes in the value of inventories, increased to $5.6 billion (67 cents/share) from $3.7 billion (45 cents) in 3Q2017. The Anglo-Dutch supermajor earned $4.7 billion in 2Q2018.

Cash flow from operations soared to $12.1 billion in 3Q2018, up 59% from a year ago, while operating expenses declined by 2%.

“Good operational delivery across all Shell businesses produced one of our strongest-ever quarters,” CEO Ben van Beurden said. “Our strong financial performance allowed us to cover the cash dividend, interest payments, share buybacks and to further pay down debt…

“Meanwhile, the transformation of our portfolio continued,” with more asset sales and a positive final investment decision to move forward the first liquefied natural gas (LNG) exports from Western Canada via the LNG Canada facility planned for Kitimat, BC, which Shell would operate with a 40% stake.

The project, now under construction, expects initial LNG exports to begin “before the middle of the next decade.”

Production during the quarter was a mixed bag, with overall oil and gas production slipping 2% year/year to 3.6 million boe. Natural gas production jumped 4% to 6.2 Bcf/d, while liquids production was off 1% to 1.602 million boe/d. Excluding portfolio changes, overall upstream production was 4% higher year/year.

LNG sales volumes increased 2% from 3Q2017 to 17.27 million metric tons (mmt), but production was 8% lower, mainly because of higher maintenance activity. Liquefaction volumes were 3% lower at 8.18 mmt, which Shell said followed divestments.

Higher production volumes are forecast for the fourth quarter, with estimated output about 80,000-120,000 boe/d higher because of lower maintenance activity and new field growth. LNG volumes also are forecast higher, up about 0.3 mmt, “mainly driven by increased feed gas availability and lower maintenance activity.”

Upstream profits in 3Q2018, which benefited from higher commodity prices, increased 291% from a year ago to $2.25 billion from $575 million, with cash flow up 58% to $6.66 billion.

In the downstream unit, which includes oil products and chemicals, segment profits fell 29% year/year to $1.71 billion. While oil product sales were up 2%, chemical sales fell 9% year/year.

Gearing, i.e. the debt/equity ratio, fell to 23% from 26%, while shareholder dividends totaled $3.9 billion. Shell on Thursday launched a second tranche of buybacks to the end of January for up to $2.5 billion; plans are to buy back $25 billion of shares by the end of 2020.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |