NGI The Weekly Gas Market Report | E&P | Infrastructure | LNG | Markets | NGI All News Access

Winter Preview Part 1: East Coast NatGas Markets on Edge with Narrow Margins; Midwest Looks Well Supplied

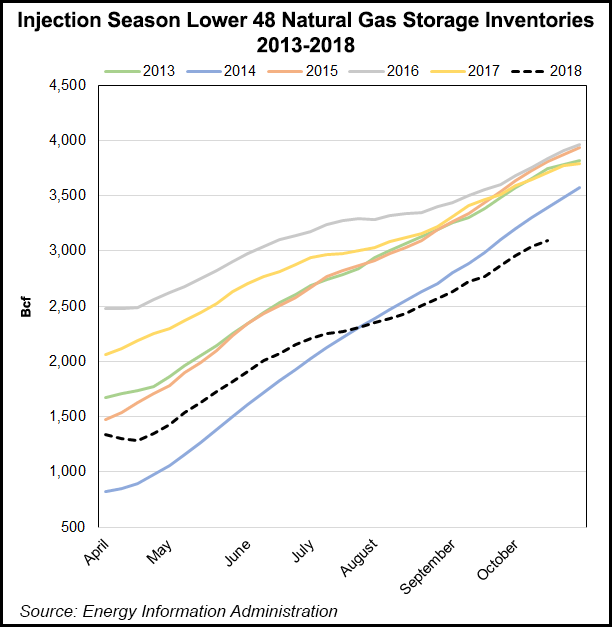

*Part 1 of 3. Historically low storage inventories are doing battle with surging unconventional output — raising the stakes and uncertainty for bears and bulls heading into the winter. This series lays out a roadmap for what could influence natural gas markets during the upcoming Winter 2018/19 heating season. Part 2 examined the South Central region. Part 3 focused on West Coast markets.

The natural gas market is balanced on a knife’s edge heading into Winter 2018/19. Meager end-October stockpiles could create problems getting the gas to where it’s needed if cold weather surprises, analysts say, while surging Lower 48 production growth could see the market loosen significantly should winter weather fail to impress.

Meanwhile, Northeast and Mid-Atlantic spot markets continue to run the risk of price spikes this winter, although infrastructure additions should help get more Appalachian production to demand centers.

“The primary purpose of the gas market is to make sure we have enough gas for the winter,” Genscape Inc. analyst Eric Fell said during a recent webinar on the firm’s 2018/19 winter outlook. Given current stockpiles, “the odds of violating that rule are higher than they’ve been in 10 years.

“Given that’s what the market generally tries to avoid, it begs the question: How did we get here? How did we allow this to happen?”

One theory might be that surging Lower 48 production growth fed complacency despite strong demand during the April-October injection period, thus putting the market on track to enter the November-March heating season with the lowest inventories in years. While higher production should help close the gap in stockpiles under a normal or mild winter, a cold surprise could put some dicey scenarios in play, according to analysts.

“The theme for this upcoming heating season’s cash market will be deliverability versus availability,” according to analysts global consulting firm Energy Aspects. Even with record-high production, “cash value will be determined by getting gas to where it is need at the time it is needed.”

As of the week ended Oct. 19, total working gas in underground storage stood at 3,095 Bcf, making a sub-3.3 Tcf end-October scenario a virtual lock. On Oct. 24, Intercontinental Exchange EIA end of storage index futures settled a hair under 3.2 Tcf.

“A sub-3.3 Tcf starting point will lead to an end-March inventory level just below 1.5 Tcf in our balances based on 10-year normal weather,” Energy Aspects analysts said. “Such a figure makes no allowance for winter wellhead disruptions, which have muted supply in recent winters. Superimposing a 5% colder-than-normal scenario underscores the weather-risk that comes with such a carryout.

“Making adjustments for residential/commercial (res/com) and industrial heating increases, power load increases and price-related givebacks in the power sector as well as winter-wellhead disruptions and an uptick in net trade with Canada, such a scenario puts end-March storage near 1.0 Tcf.”

Conversely, a 5% milder-than-normal scenario could push end-March inventories to a slack 1.8 Tcf, the firm said.

Whether the upcoming winter ends up colder or warmer, recent history suggests it will probably deviate from last year, according to Fell. Based on observed degree days for each winter spanning the last decade or so, “we’ve had two winters in the last 10 that have even been close to each other and close to normal, and then the rest of them have been fairly far from normal. So there’s been a lot more volatility in weather. Weather’s not necessarily as normally distributed perhaps as people think.”

Under a base-case normal weather scenario that assumes 8 Bcf/d of incremental supply this winter but also significant demand growth, including structural demand growth from res/com, Genscape is expecting a much lower withdrawal for Winter 2018/19 compared with last winter. The firm is projecting a roughly 1,700 Bcf drawdown November to March, versus more than 2,400 Bcf withdrawn for the Nov. 2017-March 2018 period.

But inventories are down so much from last year the market will need a lower withdrawal this winter to avoid risking deliverability issues, Fell said. “If we repeated last winter’s draw…we would end up with 700 Bcf in the ground, or less potentially.”

To evaluate various winter weather scenarios, Genscape ran gas-weighted heating degree day totals from the past 30 winters into a model showing what end-March storage outcomes would look like based on current inventories. Those 30 weather-driven demand scenarios produced a wide range of outcomes, including three scenarios where weather is mild enough that storage exits the winter well above 2 Tcf, but also four scenarios where end-March inventories fall below 1 Tcf, according to Fell.

“Those four scenarios represent significant likely deliverability issues at some point during the winter,” Fell said.

Aside from weather, liquefied natural gas (LNG) exports, pipeline exports to Mexico and demand from the industrial sector all should continue to provide incremental demand for gas in the Lower 48 this winter, according to Energy Aspects. LNG, including full use of Dominion Energy Cove Point’s export terminal out of the Mid-Atlantic, should add 1 Bcf/d more demand year/year (y/y), while exports to Mexico and industrial use should each account for around 0.6 Bcf/d more demand y/y this winter.

Also on the demand side, winter power burn should be 1.2 Bcf/d higher y/y, with the gain driven by expected lower prices in January and a return to normal weather in February, according to the firm.

“The ongoing shift in the generation stack will have a mixed effect, with coal and nuclear retirements over the past year offset by continued growth in wind capacity (negative for thermal generation)” and new combined-cycle gas turbines (CCGT) that displace more expensive coal and inefficient gas-fired capacity, Energy Aspects analysts said.

“A total of 17 GW of new CCGTs were due to enter service in 2018,” with all of that capacity on track to enter service by December, including Dominion’s Greensville County Power Station in Virginia and the second half of Duke Energy’s Citrus County combined-cycle plant in Florida, each expected to add about 1.6 GW of gas-fired capacity. “The pull from these two plants should help maintain the Transco Zone 5 winter basis premium.”

Potentially helping to alleviate some of the constraints along the East Coast this winter, Williams started up the greenfield portion of its Atlantic Sunrise expansion in early October, bringing the full designed 1.7 Bcf/d capacity to market.

Cabot Oil & Gas Corp., which holds most of the capacity on Atlantic Sunrise, unleashed an additional 1.05 Bcf/d with the start-up of the new capacity.

“Cabot plans to move about 350 MMcf/d of its volumes” to Cove Point, “while another 500 MMcf/d is earmarked for consumption in the Washington, DC, area,” RBN Energy analyst Sheetal Nasta said recently. “Florida Power and Light Co. and Duke Energy also are counting on Atlantic Sunrise, in conjunction with Transco’s Hillabee Expansion, to supply the Sabal Trail Pipeline, which in turn serves growing gas-fired electric generation demand in southern Florida.”

As of last Friday’s (Oct. 26) trading, Forward Look showed Transco Zone 5 South forward basis for January and February trading at premium of just above $4 to Henry Hub, perhaps reflecting the risk of a repeat of last winter’s price spikes, when day-ahead prices at Transco Zone 5 jumped as high as $150.

For the month of January 2018, Transco Zone 5 day-ahead prices averaged just over $17, while a much milder February 2018 saw day-ahead prices average about $3.17, Daily GPI historical data show.

El Niño Points to Mild Winter, But New England Cold Spells Possible

According to the National Oceanic and Atmospheric Administration’s Climate Prediction Center (CPC), the United States could see a mild winter, with above-average temperatures most likely across the northern and western portions of the country. No U.S. region is favored to experience below-average temperatures, and there’s a 70-75% chance of an El Niño developing, according to the forecaster.

“We expect El Niño to be in place in late fall to early winter,” CPC deputy director Mike Halpert said. “Although a weak El Niño is expected, it may still influence the winter season by bringing wetter conditions across the southern United States, and warmer, drier conditions to parts of the North.”

As last winter demonstrated, the broader temperature trends won’t matter much to day-ahead markets in the capacity-constrained demand centers along the East Coast — and in New England in particular. All it takes is one stretch of extreme cold to send gas prices through the roof.

“Really our concern is extended cold weather. It’s not whether the winter is above average or below average,” ISO New England Vice President Peter Brandien, who leads system operations for the grid operator, told the Federal Energy Regulatory Commission during a recent technical conference to discuss the upcoming heating season.

Brandien pointed to a stretch of cold temperatures from Dec. 26, 2017, to Jan. 8, 2018 — sometimes dubbed the “bomb cyclone” due to a rapidly forming storm that hammered the Northeast and Mid-Atlantic. That cold stretch sparked outsized price spikes as heating and electric demand competed for limited natural gas imports, even as December, January and February all produced above-average temperatures on the whole, Brandien noted.

“It’s those kinds of spells that have us concerned,” he said.

This winter, ISO New England is switching from its old winter reliability program to a pay-for-performance model, according to Brandien.

“It looks like a short-duration cold spell — five, six, seven days — I feel comfortable that we’re in the same place” as under the old winter reliability program, but extended cold spells could be cause for greater concern, he said.

ISO New England is likely to continue operating “pretty much right on the edge” for the foreseeable future, according to Brandien. “From a resilience perspective…if we have one major pipe interruption, we’re going to have to reduce the load and then pick up what load we can…We’re not very resilient from a fuel supply or energy supply perspective.”

Structural growth in res/com demand is an “important feature” of the gas market to keep in mind this winter, according to Genscape’s Fell. He pointed specifically to homes, businesses and multi-family units in the Northeast and Mid-Atlantic states switching to gas from fuel oil.

“You can have a scenario play out where because there’s been so much explosive growth of res/com demand that if you get a cold enough weather scenario in the middle of winter you can actually have a deliverability problem without actually running out at the end of winter,” Fell said. So in addition to the possibility of a colder-than-normal winter drawing inventories below 1 Tcf, “I would throw into the mix last winter’s weather scenario where the overall winter might not have been as cold but you had a freakishly cold scenario play out in December and January.”

As of Oct. 26, Algonquin Citygate forwards for January and February were each trading at a near $8 premium to Henry, according to Forward Look. January 2018 day-ahead prices averaged $16.37 at Algonquin Citygate, including trades as high as $125 on Jan. 4. Prices moderated in February 2018 to average $4.72, according to Daily GPI.

Further south, Transco Zone 6 NY, which saw trades as high as $175 on Jan. 4, was trading at a roughly $6 premium to the hub for January and February 2019 forwards as of Oct. 26. January 2018 day-ahead prices at Transco Zone 6 NY averaged $18.31 before moderating to an average of $3.28 for February 2018, Daily GPI historical data show.

Appalachia Driving Supply Growth

“The supply picture for the upcoming heating season can be described in one word — long,” Energy Aspects team said. “Appalachia will continue to be the main driver of growth.”

The start-up of Atlantic Sunrise, Nexus Gas Transmission and Mountaineer XPress capacity allows additional volumes to hit the market just in time for the winter months, and the firm said this underpins its expectation for a “steady stream of gains in the region.”

Basis differentials indicate that recent pipeline additions have largely de-bottlenecked the Appalachian producing region in 2018.

“Takeaway capacity this summer generally outpaced production growth, which effectively means the Appalachian supply region was less capacity constrained than it has been in years,” RBN’s Nasta said. That allowed basis at Dominion South and Tennessee Zone 4 to “strengthen considerably” versus recent years. “That trend developed as Energy Transfer’s Rover Pipeline project ramped up over the past year and has solidified with the full completion of Williams/Transco’s Atlantic Sunrise earlier this month, and now Nexus’ partial service.”

Including a brief basis blowout in late September, which Nasta attributed to producers ramping up in anticipation of the Atlantic Sunrise capacity, Dominion South spot basis has averaged minus 51 cents to Henry year-to-date in 2018, according to Daily GPI. That’s versus an average of minus 85 cents for the comparable year-ago period.

“At the same time, an unconstrained Northeast market means downward pressure on downstream prices,” Nasta said. “In the case of Nexus…we can expect basis at Michigan Consolidated and Dawn (and eventually also Chicago Citygate) to come under pressure as the expansion capacity fills up.

“However, unlike some of the major expansions out of the Northeast, which have filled up like clockwork almost as soon they came online, Nexus is less predictable in how it will fill.”

This is partly because of reduced takeaway constraints out of the Northeast, according to the analyst, but also partly because of characteristics unique to Nexus, a 1.5 Bcf/d, 255-mile greenfield project backed by Enbridge Inc. and DTE Energy. For instance, Nexus is only about two-thirds subscribed, and only about half of that capacity is held by producers, Nasta said.

“Even if all that capacity fills, it won’t necessarily be with all new production volumes, especially given that the easing takeaway constraints allow producers greater optionality in how they get their gas to market,” according to the RBN analyst. “What we do know is that as Nexus — along with the final pieces of Rover — ramps up, it’s sure to worsen oversupply conditions downstream and weaken basis in the Midwest longer term.

“Demand in the region is expected to remain relatively flat, which means that incremental supplies into Michigan and Dawn via Nexus will crowd these market areas, ultimately competing with gas from the Midcontinent and/or Canada that has traditionally served the region.”

Chicago Citygate forwards for January and February 2019 were trading at a roughly 40-cent premium to the Hub as of Oct. 26, according to Forward Look. That’s versus a January 2018 day-ahead average of $3.87 and an average of $2.59 in February 2018, Daily GPI historical data show.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |