NGI Mexico GPI | Markets | NGI All News Access

Steelmaker ArcelorMittal Secures $1 Billion Mexico Gas Supply Contract

The world’s largest steelmaker, ArcelorMittal S.A., has signed a new five-year, $1 billion natural gas supply contract with CFEnergÃa, the fuel marketing arm of Mexican state power utility Comisión Federal de Electricidad (CFE).

The contract will take effect from April 2019 and includes the option for a five-year extension after the initial term, CFEnergÃa CEO Guillermo Turrent told NGI’s Mexico Gas Price Index in an email.

The contract entails the daily supply of 200-240 million British thermal units (MMBtu) of gas imported from the Waha hub in West Texas. The gas will be transported to the border via CFE’s new Waha header system, or, alternatively, from Energy Transfer Partners’ TransPecos or Comanche Trail pipelines, Turrent said.

The gas will then be shipped to ArcelorMittal’s base of steelmaking operations in the city of Lázaro Cárdenas, Michoacán state, via pipelines owned by Sempra Energy unit Infraestructura Energética Nova, aka IEnova, and Fermaca.

ArcelorMittal’s previous supply contract with CFE was for $240 million, and entailed the supply of 160 MMcf/d over a period of 12 months.

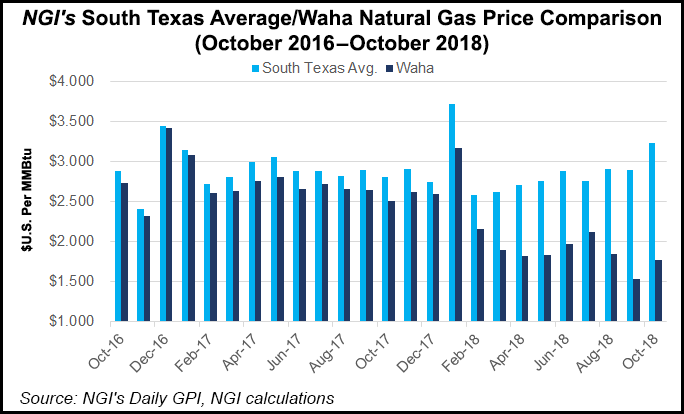

Cash market prices for gas traded in the South Texas and East Texas regions averaged between $3.020-$3.400/MMBtu and $2.940-$3.550/MMBtu, respectively, on Oct. 26, according to NGI’s Daily GPI.

By comparison, the range for the West Texas/Southeast New Mexico region was $1.500-$2.050/MMBtu.

“We’re the only ones today that have access to new infrastructure to get additional gas from this basin [West Texas],” Turrent told Mexican paper Reforma, which first reported the new contract.

The new gas contract will allow ArcelorMittal, which reported global revenue of $68.7 billion in 2017, to save on the costs of both the molecule and its transportation, the report said.

The company aims to increase its Mexico steel production from 4 Mt/d currently to approximately 5.3 Mt/d by 2020, according to a 2Q2018 earnings presentation.

CFE on Friday reported net income of 2.058 billion pesos ($103 million) for the third quarter, up from a loss of 1.49 billion pesos in the same quarter a year ago.

Revenue rose 20% to 24.02 billion pesos ($1.2 billion) on increased electricity sales, partial recognition by the government of subsidies for electricity end-users, and increased third-party fuel sales.

CFE reported a 65% increase in fuel costs due to a rise in global fuel price benchmarks, scarcity of gas supply domestically, and higher costs associated with the sale of fuel to third-parties.

Plummeting oil and gas production by national oil company Petróleos Mexicanos (Pemex) has lead to fears of gas shortages for industrial consumers in the country’s southeast.

Despite the positive quarter, CFE’s net loss for the first nine months of 2018 widened to 37.8 billion pesos from 34.5 billion pesos in the corresponding 2017 period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |