Shale Daily | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

Denbury Adding Eagle Ford to EOR Roster with Penn Virginia Merger

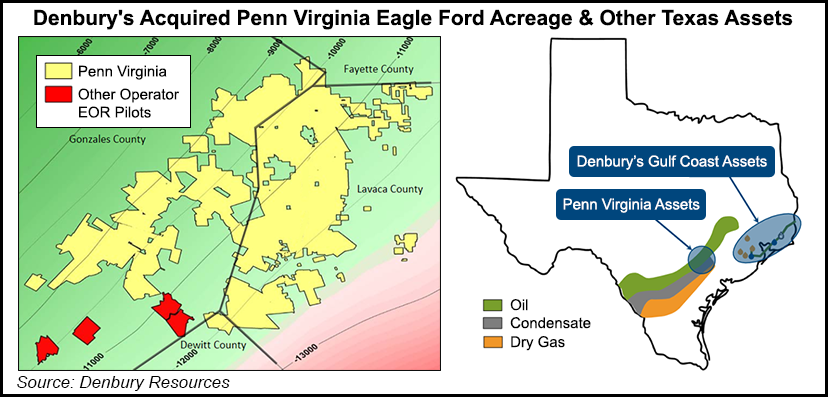

Denbury Resources Inc. has clinched a merger agreement with Eagle Ford Shale pure-play Penn Virginia Corp., a transaction valued at $1.7 billion plus debt that would build a substantial foothold in South Texas.

Combined oil, natural gas liquids and natural gas reserves at the end of 2017 were 343 million boe, 94% liquids weighted, with second quarter output of 84,000 boe/d.

Denbury is an expert at enhanced oil recovery (EOR) using carbon dioxide (CO2) flooding, which allows it to capture stranded reserves. Houston-based Penn Virginia, whose production focus has been whittled down in recent years, in July signaled it was seeking strategic alternatives.

“This transaction marks a defining moment for Denbury, meeting multiple strategic objectives to create a balanced, resilient, and growing business with significant scale, while reinforcing our position as the highest oil-weighted producer in our peer group,” Denbury CEO Chris Kendall said. “Through this combination, we plan to focus Denbury’s significant enhanced oil recovery expertise on the prolific Eagle Ford Shale, positioning us at the forefront of this exciting new arena for EOR. Denbury’s passion for improved oil recovery and our deep technical knowledge give us a strong advantage on this new frontier.”

Denbury’s strategy is to develop stranded reserves via CO2 EOR. In most U.S. oilfields, about 30-40% of the original oil in place is recoverable through primary and secondary methods, which Denbury estimates may be increased to 50-60% using EOR.

Denbury’s reserves at the end of 2017 were an estimated 259.7 million boe. Properties with proved and producing reserves in the Gulf Coast region are situated in Alabama, Louisiana, Mississippi and Texas. The Rockies assets include the Cedar Creek Anticline in Montana and parts of the Dakotas, and Wyoming’s Salt Creek field and the Grieve project.

“Following the comprehensive strategic review process, we believe a merger with Denbury Resources maximizes value for our shareholders and represents an ideal outcome for our company and all of our stakeholders,” Penn Virginia CEO John A. Brooks said. “Applying Denbury’s demonstrated expertise in EOR to the oil-rich resources of our large, contiguous Eagle Ford acreage provides our shareholders the opportunity to maximize value acceleration of Penn Virginia’s South Texas unconventional oil shale assets.”

Estimated enterprise value of the combined company would be around $6 billion, according to Denbury.

Each board has unanimously approved the agreement. Penn Virginia shareholders controlling 15% of the outstanding stock also voted for the transaction.

Under the terms of the definitive agreement, Penn Virginia shareholders would receive for each share a combination of 12.4 shares of Denbury common stock and $25.86 in cash. Once completed, Denbury stockholders would own about 71% of the combined company, while Penn Virginia would own the remaining 29%.

The transaction, set to close by the end of March, is subject to shareholder approval. The merger agreement contains a covenant that upon its closing, Denbury’s board would be expanded to 10 from eight directors, including two independent members of Penn Virginia’s board.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |