NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Wild October Slowed for Some NatGas Markets, While Pipe Work Led to Volatile Week for Others

Natural gas prices were mixed for the period between Oct. 22 and 26 as unseasonably chilly weather moved across the eastern half of the country. Gains were somewhat tempered compared with recent weeks, although several maintenance events across the country boosted some points by a couple of dollars. The NGI Weekly National Avg. was up a far more modest 6 cents to $3.24.

On the other hand, a string of back-to-back maintenance events planned on Transwestern Pipeline for the remainder of the month dropped prices in the Permian Basin back to levels not seen in a month. El Paso-Permian prices tumbled 36.5 cents for the week to $2.03. Waha was even more dismal as prices plunged 37 cents to $1.95.

While the pipeline work certainly didn’t help Permian prices, a turn to unseasonably mild fall weather for the West, Texas and the Southeast also sapped demand. In fact, in a highly unusual turn of events, SoCal Citygate ended the week a mere half-cent higher at $4.525.

Still, other California points, as well as those in the Rockies, remained volatile due to the ongoing cuts to imported supplies from Canada. PG&E Citygate prices shot up 35.5 cents for the week to $4.165, while Northwest Sumas surged more than $2 to $7.825.

Enbridge Inc. on Oct. 18 indicated that Westcoast Transmission’s 36-inch line that was damaged in an Oct. 9 explosion would return to service by mid-November, but it would return at a reduced 80% capacity. An unharmed parallel 30-inch line returned shortly after the rupture, but also at the reduced level.

This week, Enbridge said it continues to prioritize work on the pipe segments with the highest capacity gain. Based on its current forecast plan, the engineering assessments and approvals for these high priority segments are expected to be complete by Nov. 30th. This will result in increasing the Huntingdon constraint capacity to 1.2-1.3 Bcf/d.

Over in the Northeast, the normally more erratic Algonquin Citygate and Transco Zone 6 NY posted gains of around 15 cents, while Tenn Zone 6 200L jumped a far more substantial $1.22 to $4.84. Tennessee Gas Pipeline operated with several restrictions in place throughout the week and an operational flow order on two days.

Nymex Volatility Could Ease as November Warms

While unseasonably chilly October weather took the natural gas market by surprise, traders shifted their focus to November weather this week, even though fluctuating weather models provided little certainty. The Nymex November gas futures contract continued to swing in more than 10-cent ranges on most days but eventually rose just 4.7 cents to $3.185 between Oct. 22 and 26.

At the forefront of weather discussions was the likelihood of milder weather by mid-November, with models hinting at the possibility at the start of the week. Then, models backed off some of the warmer risks and some forecasters even predicted that colder-than-normal weather could arrive by mid-month.

Friday’s weather data was more clear that milder would arrive Nov. 6-10, with much of the country warming above normal in all datasets except the European model, which was slightly cooler compared to Thursday’s exceptionally mild run, according to NatGasWeather. “Going forward, the focus remains on how long this milder Nov. 6-10 pattern will last, with our data still suggesting around Nov. 12-13 before the next opportunity for stronger cold blasts to return.”

Bespoke Weather Services said climate guidance continues to show that the middle of November will have sizable warm risks across the East, something it agrees with as well. European guidance similarly shows any cold shot being fleeting in the medium range, as though it may briefly boost heating demand, it is unlikely to stick around. Meanwhile, the upstream tropical forcing signal favors further warming to the forecast, and it expects models to warm further, especially during the weekend.

Given record production, which reached an 84.43 Bcf/d high last Saturday (Oct. 20), and the more bearish turns expected in weather models, Bespoke said it expected November gas prices to test $3.10 on Friday and likely break through that level next week.

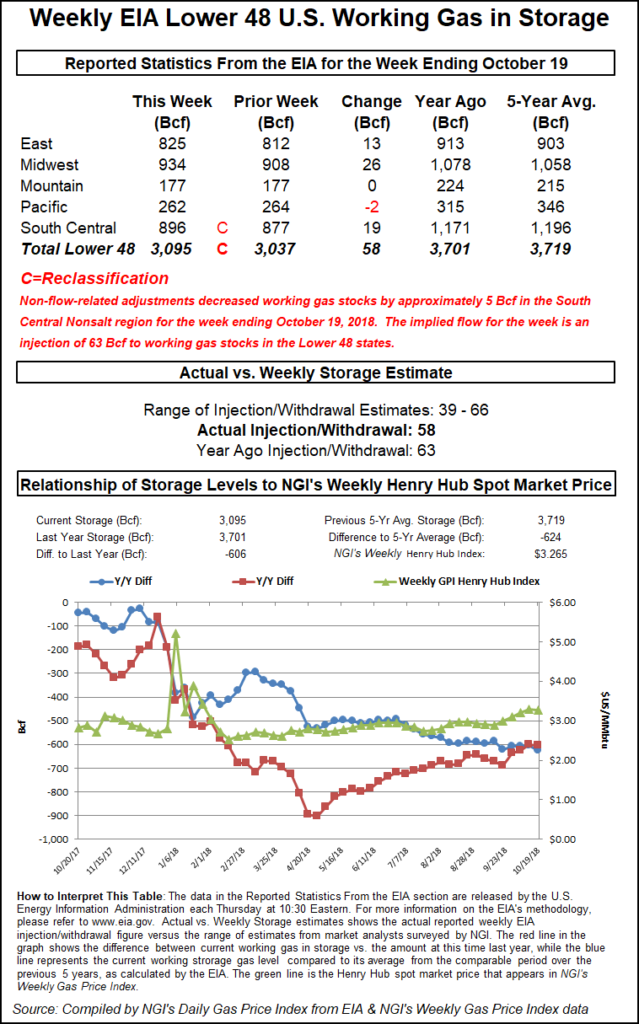

Still, storage deficits remain a sharp tool in market bulls’ shed, with deficits growing with Thursday’s Energy Information Administration (EIA) report. The EIA reported a 58 Bcf injection into storage inventories, but a non-flow-related reclassification of 5 Bcf that decreased working gas actually reflected a 63 Bcf implied flow.

Despite the bearish injection, inventory deficits expanded by 5 Bcf to the year-ago level and by 19 Bcf to the five-year average, and as a result, the storage deficit will head in to the final two reports of the traditional injection season at 600 Bcf-plus on both metrics, Mobius Risk Group said.

Bullish comparisons to historical data aside, some market observers pointed to the weather-adjusted looseness that was reflected in Thursday’s report. Compared to degree days and normal seasonality, the 63 Bcf injection was approximately 6.6 Bcf/d loose versus the five-year average, as degree days totals increased by 30 week/week (w/w), “but the storage injection only fell by 18 Bcf versus last week’s reported injection,” according to Genscape natural gas analyst Eric Fell.

“Relative to degree days and normal seasonality, this is the loosest weekly storage number of the last five years, and looser than all but a handful of weekly stats going all the way back to 2005,” he said.

Added looseness in this week’s stat was driven by an unusually large w/w decline in power generation (driven by a large w/w decline in cooling degree days) and the fact that this was the first big cold shot of the season. “Residential/commercial demand never performs as well as raw weather models would imply in the first cold event, Fell said.

Going forward, EBW Analytics said the question remains the likely weather pattern after the end of the 15-day window. The American and European models are in direct conflict, with the American model predicting intensification of the warming and the European model showing returning cold. “The resolution of this conflict could send prices back below $3.00 — or result in a strong rebound.”

Increased clarity may be possible by early next week, according to EBW. For now, current Nymex strip prices and in Weather Decision Technologies’ most-likely weather scenario, the firm expects U.S. storage inventories to end the injection season slightly above 3,200 Bcf. The projected mid-November inventory would be by far the smallest since 2010, 618 Bcf (-16.1%) below the eight-year average and almost 550 Bcf below year-ago levels.

“Although the market appears comfortable with below-normal storage going into the heating season, bullish weather shifts — and particularly any freeze-offs this winter — could still prompt higher cash and futures prices,” EBW CEO Andy Weissman said.

Spot Gas Slides Ahead of Mild Weekend

Spot gas prices continued to decline Friday as most of the country was due for relatively mild weather. The exception was in the East, where a mild and wet weather system was expected to track up the coast Friday and Saturday with gusty winds and rain, according to forecasts.

Some of the moisture fueling the heavy rain can be traced back to former Hurricane Willa, which made landfall in northwestern Mexico this past Tuesday. The storm heading northward along the Atlantic coast is not Willa, but rather a new storm that formed along the upper Gulf Coast. Willa met its demise over the high mountains of Mexico, according to AccuWeather.

“Right now it looks like the worst conditions in terms of coastal flooding will occur during the high tide cycle during Saturday morning and midday from the upper mid-Atlantic coast to southern New England,” AccuWeather senior meteorologist Dave Dombek said. “The winds may be strong enough, with gusts from 40-60 mph for a few hours, to break tree limbs and cause sporadic power outages,” he said.

In terms of snow, since the coldest air was expected to be on the way out as the storm moves up, wintry precipitation and most of the accumulation was likely to be mainly limited to the northern tier, according to AccuWeather. “Accumulating snow is not likely over most of the central Appalachians,” senior meteorologist Brian Wimer said.

Much of the area at risk for snow and perhaps sleet will be the same as those that received snow from the storm of the past week, which brought one-to-12 inches of snow over parts of northern New England and locally higher amounts over the Presidential Range, the forecaster said.

A small, but quick-moving storm may bring a period of rain and perhaps wet snow to part of the region during Sunday night and Monday, and there was a chance that the first few snowflakes of the season fall on the Interstate 95 corridor, AccuWeather said.

Despite the prospects for a small amount of pre-winter snow, Northeast spot gas prices continued to fall from their recent highs. Algonquin Citygate tumbled 26.5 cents to $3.165, and Transco Zone 6 NY dropped 19.5 cents to $3.125.

Appalachia prices posted decreases of more than a dime across the region, while losses in the Rockies ranged from just 3.5 cents at CIG to 46.5 cents at Transwestern San Juan. Declines at both of pricing locations were related to ongoing maintenance events on Colorado Interstate Gas and Transwestern Pipeline.

The pipeline work on Transwestern also continued to pull down Permian Basin prices, with Friday’s deals well below $2. Still, some of that loss was traced to the lack of demand in and around the region as prices across the West, Texas and the greater Southeast posted double-digit drops.

North of the border in Western Canada, several maintenance events across TransCanada Corp.’s NGTL system continued to wreak havoc on the market. TPH analysts noted Friday that if one added up NOVA/AECO cash prices over the seven days through Thursday, the C$3.78 ($2.91) sum would still be less than the daily average spot price at most major U.S. hubs.

Friday’s transactions didn’t fare any better as NOVA/AECO spot gas averaged just C38 cents after tumbling 24.5 cents.

“Large swaths of maintenance across the entire NGTL system are limiting exports and the ability to inject into storage, leaving the gas stranded without a buyer,” TPH analysts said. “Of course, this all changes when we flip over to withdrawals, which can’t come soon enough for the AECO-exposed producers.”

Temperatures in Calgary for the week ahead were forecast to dip below zero, which could mark the start of the winter gas rally, TPH said. In total, 2 Bcf crept into Western Canada storage over the past few days, putting storage 13% below the five-year average. On the other side of the country, Dawn injected 1 Bcf, compared to a norm of 6 Bcf. Still, Dawn storage now sits directly in line with the five-year average, TPH said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |