Shale Daily | Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Lower 48 Powers 3Q Earnings, Production for ConocoPhillips

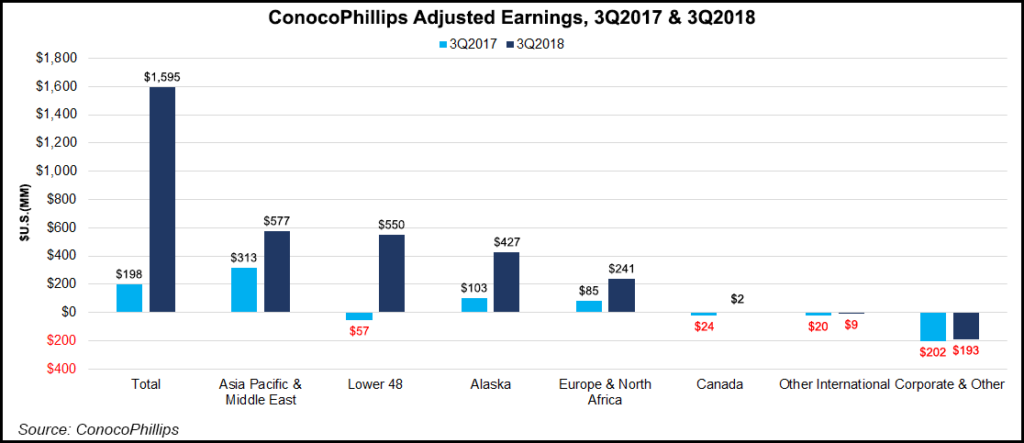

ConocoPhillips reported increased earnings and higher production in the third quarter, especially from its top three onshore assets in the Lower 48, as it moved forward with projects in Alaska and Louisiana.

Excluding Libya, ConocoPhillips reported 1.22 million boe/d of production in 3Q2018, up 1.8% (220,000 boe/d) from the year-ago quarter. Lower 48 production was 414,000 boe/d in 3Q2018, a 13.1% year/year (y/y) increase (366,000 boe/d). Natural gas production in the Lower 48 fell 20.5% to 608 MMcf/d from 765 MMcf/d in 3Q2017, but crude oil production rose 37.1% to 240,000 b/d from 175,000 b/d.

Big Three production grew 48% y/y to 313,000 boe/d, although the year-ago quarter was impacted by a loss of 15,000 boe/d from Hurricane Harvey.

The Houston-based independent has bumped capital expenditures (capex) for 2018 to $6.1 billion from $6 billion, but there are no plans to increase spending next year in the Big Three U.S. onshore assets, the Eagle Ford and Bakken shales and the Permian Basin’s Delaware sub-basin.

The 2018 capex increase excludes $400 million in bolt-on acquisition costs in Alaska’s western North Slope and $100 million to acquire additional acreage in the Montney Shale in Canada. The company also narrowed its full-year production guidance to 1.24-1.25 million boe/d from 1.23-1.26 million boe/d.

During an earnings call Thursday to discuss 3Q2018, CEO Ryan Lance disclosed that the capex budget for 2019, to be released in December, will be similar to 2018.

“You can expect our capital to be roughly in line with this year’s capital, excluding acquisitions,” he said. “I think this is a clear indication that we’re not straying from our strategies, so no surprises there.”

Executive Vice President Al Hirschberg, who handles production, drilling and projects, said no significant changes are planned in the Lower 48 next year. Plans to spend about $500 million on new projects would be offset by a roll-off of about $500 million on other projects that are wrapping up.

New projects planned next year include the Greater Mooses Tooth No. 2 prospect within the National Petroleum Reserve in Alaska (NPR-A); the Barossa offshore gas and light condensate project in Australia; the Montney; Alaska’s western North Slope; and an increased working interest in the Alaska Kuparuk River Unit.

Hirschberg said offshore projects in Australia, China, Norway, the Shetland Islands and Timor-Leste are wrapping up.

“Those roughly offset each other,” Hirschberg said. “That’s how we get to a plan that is roughly what Ryan was describing, where the major project roll-on, roll-off are roughly offsetting and we’re staying similar in our Lower 48 activity levels.”

Earlier this month, subsidiary ConocoPhillips Alaska Inc. reported first oil production from the GMT1 prospect within the NPR-A. The company received a favorable environmental review by the Interior Department’s Bureau of Land Management for the project in September.

Planning is also underway for an exploration drilling season in Alaska in 2019. The company said its Willow prospect in the NPR-A may hold up to 750 million boe, and could be rich enough to justify constructing a standalone crude oil hub in the region. A final investment decision on whether to proceed isn’t expected before 2021.

ConocoPhillips also reported that it spud its first appraisal well in Louisiana’s Austin Chalk. Results are expected in the first half of 2019. The company purchased about 245,000 net acres in the limestone-rich formation last April.

Net earnings were $1.86 billion ($1.59/share) in 3Q2018, compared with net earnings of $420 million (34 cents) in the year-ago quarter.

ConocoPhillips also expanded its share repurchase program by 50% in July to $3 billion from $2 billion. The company plans to use cash from operations to fully fund the program for 2018, plus dividend and capital expenditures costs. The board also expanded the repurchase authorization to a total of $15 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |