NGI Mexico GPI | Markets | NGI All News Access

November Natural Gas Futures Bounce Back Despite Bearish Storage Data; Spot Gas Slides

Debatable weather outlooks for November ruled the natural gas market Thursday as a bearish storage injection wasn’t enough to stop a rally for Nymex futures. The prompt month settled 3.6 cents higher at $3.202, while December rose 2.9 cents to $3.256 and the winter moved up 2.3 cents to $3.198.

Spot gas prices, however, finally pulled back after several days of gains. Interestingly, the decline came as cooler-than-normal conditions were expected to linger over the eastern half of the United States before another reinforcing cold shot expected to arrive during the weekend. Led by steep declines in the Northeast and Rockies, the NGI National Spot Gas Avg. fell 15.5 cents to $3.22.

Just as production growth was the talk for the much of the summer, weather has ruled the roost throughout October as unseasonably chilly weather and dramatic shifts in weather models for November have led to increased volatility in Nymex futures, particularly for the winter months.

Midday outlooks indicated some milder weather could be around the corner. The Global Forecast System data was milder trending for this weekend, but then notably colder Nov. 3-5 as it reflected a stronger cool shot into the central United States and Midwest, which the overnight European model also showed, according to NatGasWeather.

The pattern is still mostly mild Nov. 6-9 in most of the data, but the cooler central United States trend Nov. 2-5 will make milder days before and after less impactful, the forecaster said. “The focus remains on how long this milder Nov. 6-9 pattern will last, with the data still suggesting around Nov. 12-13 before stronger cold blasts return,” the firm said.

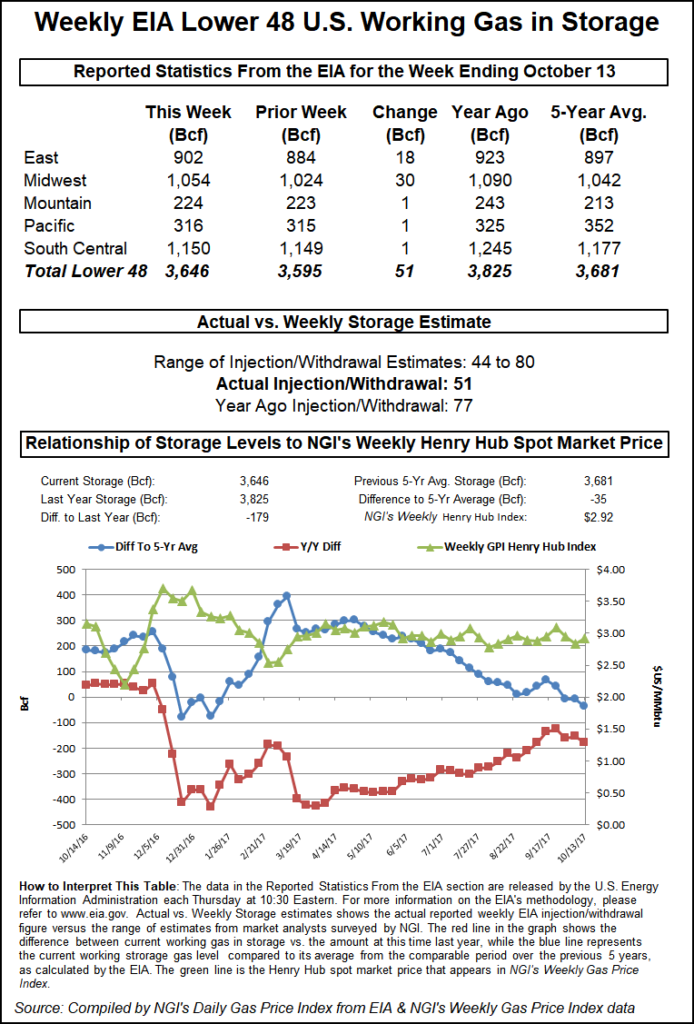

Thursday’s market reaction was revealing given the Energy Information Administration’s (EIA) bearish storage data, NatGasWeather said. The EIA reported a 58 Bcf injection into storage inventories for the week ending Oct. 19, although the implied flow was an even greater 63 Bcf build due to a reclassification of 5 Bcf that decreased working gas in South Central non-salt gas stocks.

“Though stockpiles were decreased by 5 Bcf in the revision, the net implied flow of 63 Bcf is incredibly loose and indicates a market far looser than even we had expected,” Bespoke Weather Services chief meteorologist Jacob Meisel said.

Wood Mackenzie analyst Gabe Harris, however, said that any build that is below the five-year injection with a 600 Bcf storage deficit heading into November “is pretty supportive.” Last year, 63 Bcf was injected into storage, while the five-year average injection is 77 Bcf.

“I get excited about the low numbers and possibility of shortages in February as anyone”, but the last 10 days of big weather-adjusted injections “makes me very skittish. Production seems bigly,” Harris said Thursday on Enelyst, an energy-focused chat service hosted by The Desk.

Broken down by region, the EIA reported a 26 Bcf build in the Midwest, a 13 Bcf build into the East, a 2 Bcf withdrawal in the Pacific and a 24 Bcf build in the South Central region. Salt storage inventories grew by 15 Bcf, while non-salt grew by 10 Bcf, including the reclassification.

Also Thursday, the EIA said that starting with the Weekly Natural Gas Storage Report (WNGSR) release on Nov. 15, it would include a tab showing the net change for each report week to the WNGSR history file.

Working gas in storage as of Oct. 19 was 3,095 Bcf, 606 Bcf less than last year at this time and 624 Bcf below the five-year average of 3,719 Bcf.

Salt storage operators have been hustling to refill inventories ahead of the peak winter season, and market observers said continued buying in the weeks ahead should keep some support for prices, whereas any sustained cold could spark a rally.

With the November contract expiring soon, however, there could be potential for “selling for a day or two to allow the new front-month contract to better settle into the recent front-month trading range of $3.10-$3.35,” NatGasWeather said.

That won’t be necessary, however, if weather data were to trend any colder during the first or second week of November, it said.

Spot Gas Plummets Despite Approaching Nor’easter

Spot gas prices were lower at most pricing locations across the United States despite some chilly weather in store for the eastern half of the country. Cool weather remained on tap for Friday, while reinforcing cool shots were expected to follow across these same regions Saturday and again early next week, according to NatGasWeather. Perhaps the reason for the decline in prices was that the latest weather models indicated the cold fronts would not be nearly as chilly as recent weather systems that have hit the region.

Still, in preparation for the storm, New York utility Con Edison said it has secured more than 130 additional utility contractors skilled at restoring power lines and clearing roads blocked by fallen trees and wires.

Northeast spot gas prices plunged as much as 77.5 cents at Algonquin Citygate, which dropped to $3.43 as demand in the New England region was expected to fall. This comes after regional demand Wednesday totaled 3.12 Bcf/d, a 450 MMcf/d day/day increase and the third highest demand day this month, according to Genscape Inc. Transco Zone 6 NY dropped 16.5 cents to $3.32.

In Appalachia, most pricing locations posted double-digit losses, with Texas Eastern M-3, Delivery notching the most dramatic decline of 18.5 cents to $3.24 despite some pipeline maintenance events that were expected to lift prices there.

On Wednesday, Texas Eastern Transmission (Tetco) announced a series of maintenance events along the northern M3 Penn Jersey line from Delmont, PA, to Bechtelsville, PA. These events are currently scheduled to run from Oct. 26 to Nov. 2, with varying degrees of impact on specific compressors.

“Flows through this line have increased significantly over the last month as heating demand materializes in the Northeast, and each event will be impactful aside from the Lilly Compressor Station (CS) event,” Genscape natural gas analyst Josh Garcia said.

The northern M3 line has some alternative supply options, but their availability is dependent on their location upstream or downstream of each outage, Garcia said. The most significant event will be the Delmont CS outage on Oct. 26 and 27, which will cut more than 0.5 Bcf/d of capacity through the line. The outage presents the most opportunity for alternative supply as it is the farthest upstream, according to Genscape.

“This event should add bullish pressure on M3 and the hubs it supplies on top of already colder-than-normal temperatures in the Northeast, as these constraints should incentivize competition for existing and alternative supply,” Garcia said.

Further upstream in M2, Tetco declared an unplanned outage on Oct. 23 affecting its 24-inch diameter line from its Sarahsville, OH, CS to the Lebanon Lateral, just a week after ending its last major outage on this segment, Genscape said. This outage became effective on Thursday and was expected to last five days.

“Flows have been impacted by as much as 152 MMcf/d compared to average flows since the restoration of service last week,” Garcia said. While this event and the outages on the 30-inch and Penn Jersey Lines creates bearish pressure on M2 as three out of four of its export lines are constrained, “the bullish influence brought by increased heating demand should outweigh that downward pressure.”

That was not the case on Thursday, however, as Texas Eastern M-2, 30 Receipt spot gas tumbled 14.5 cents to $3.035.

Out West, Rockies and California prices mostly moderated as most pricing locations put up declines generally between 15 and 35 cents. The exceptions were SoCal Citygate and Northwest Sumas, the latter of which continues to be volatile after an explosion on Enbridge Inc.’s Westcoast Transmission system cut imports from British Columbia. Northwest Sumas jumped $1.35 to $7.55, while SoCal Citygate rose $1.245 to $5.72.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |