Shale Daily | Bakken Shale | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Enable Doubling Down with Anadarko, Williston Expansion Plans

Oklahoma City-based Enable Midstream Partners LP moved Wednesday to expand its liquids reach in the Anadarko and Williston basins in concurrent deals that include buying Oklahoma operator Velocity Holdings LLC for $442 million.

With Velocity, Enable would gain an oil and condensate gathering and transportation system that traverses the Merge play, as well as the South Central Oklahoma Oil Province, aka SCOOP.

The Williston agreement would add contractual commitments to expand crude and water gathering systems with more than 90,000 gross acres of dedication within the Bakken Shale.

The dual transactions “continue Enable’s strategy of extending our reach across the midstream value chain by significantly expanding our crude business,” said Enable CEO Rod Sailor. “The Velocity acquisition builds on Enable’s market-leading Anadarko Basin midstream platform that now offers customers complete wellhead-to-market solutions for both natural gas and crude.

“The combination of the Velocity acquisition and the expansion of our Williston Basin assets increases the scale and contribution of our crude and water businesses, providing for fee-based growth as producers continue to target crude oil production.”

The expansions are expected to be accretive to distributable cash flow/unit beginning in 2019.

Velocity has about 150 miles of pipeline capable of flowing 225,000 b/d, along with more than 400,000 bbl of owned and leased storage and 26 truck bays capable of unloading more than 100,000 b/d.

The Velocity transaction, set to be completed by Nov. 1, has a 60% stake in a 26-mile joint venture pipeline that owns and operates a refinery. Operations are backed via long-term, fee-based contracts across more than two million dedicated acres of Oklahoma.

With the Williston deal, Enable plans to expand existing gathering systems in North Dakota’s Dunn and McKenzie counties that potentially could add up to 72,000 b/d, bringing total capacity to as much as 130,000 b/d.

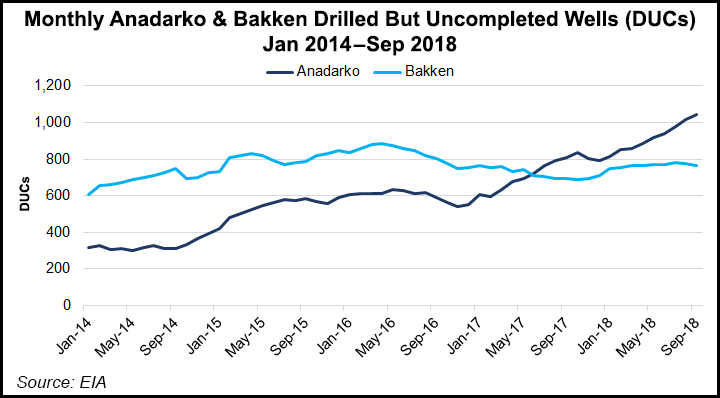

Enable expects to begin gathering Bakken volumes associated with the system expansions in the first half of 2019, “including volumes from a significant number of drilled but uncompleted wells,” it said.

Just last month the master limited partnership said it was testing support for Gulf Run Pipeline, a proposed 165-mile “large-diameter” interstate natural gas transportation project backed by a 20-year precedent agreement. The 1.1 Bcf/d system, once federal approvals are in hand, would be constructed from northern Louisiana to Gulf Coast markets and use existing Enable Gas Transmission LLC infrastructure to provide access to the Haynesville, Marcellus, Utica and Barnett shales, as well as the Midcontinent. The project, once permits are in hand, could be in service in 2022.

Enable now owns, operates and develops natural gas and oil infrastructure assets, with more than 13,200 miles of gathering pipelines and 2.6 Bcf/d of processing capacity. It also has 7,800 miles of interstate pipelines, including its 50% stake in Southeast Supply Header LLC, along with 2,200 miles of intrastate pipelines and eight storage facilities with 86 Bcf of capacity.

The Anadarko/Bakken announcement “doubles down on a strategic pivot to liquids,” according to Tudor, Pickering Holt & Co. The investments “signal a commitment to expanding Enable liquids exposure,” however, there is “ambiguity on throughput assumptions and capital needs” that could temper “market enthusiasm” ahead of the third quarter earnings call.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |