NGI Weekly Gas Price Index | Markets | NGI All News Access

Early-Season Cold, Ongoing Supply Cuts Behind Weekly Gains

With temperatures across the eastern half of the country plunging to levels more typical of the winter season and more cold on the way, weekly gas prices skyrocketed as imports from Canada remained strained after an Oct. 9 pipeline explosion in British Columbia. Sharp increases from the Permian Basin to the Rockies led the way, and the NGI Weekly National Avg. rose 17.5 cents to $3.18.

British Columbia supplies continued to be restricted after a rupture on Enbridge Inc.’s Westcoast Transmission. Although gas flows resumed the following day on a smaller parallel line, downstream demand has been strong due to a series of cold fronts that continue to move across the United States.

The Energy Information Administration (EIA) reported that Enbridge has been clearing the way for a temporary road to be built leading to the site of the rupture, but so far the company has provided no timeline on when repairs would be complete.

Northwest Sumas prices have been volatile since the explosion occurred, and weekly prices jumped roughly a half-cent shy of $2 from Oct. 15-19 to reach $5.64, beating out SoCal Citygate for highest price in the country. Still, SoCal Citygate jumped an impressive 93.5 cents on its own to reach $4.52.

PG&E Citygate was up 24 cents to $3.81, partly due to a Pacific Gas and Electric Co. power line falling, which started a fire Wednesday near Chevron Pipe Line Co.’s valve junction on the Northern California Gas Line, near Pittsburg.

With strong demand in multiple neighboring regions, Permian Basin prices continued to strengthen throughout the week. El Paso-Permian prices shot up about 60 cents to $2.395, and Waha rose 68 cents to $ 2.37.

Westcoast Station 2 prices, meanwhile, plunged $1.505 during the week to just C3 cents. NOVA/AECO C dropped $1.305 to C53.5 cents.

Nymex Futures End Volatile Week Penny Higher

On the futures front, the early season cold stoked the market early in the week — with the November contract jumping 8 cents on Monday — especially as weather models pointed to even colder conditions by the end of the month that were expected to linger through the first week of November.

A reload of cold was forecast into the long range because of overhead and downstream blocking, which is often more difficult to break down, according to Bespoke Weather Services. Models were surprisingly consistent with its strength and orientation, the firm said.

Despite its skepticism that the chilly forecast would break down quickly, Bespoke also noted looseness in the natural gas market that was at the ready to push prices lower at the first signs of easing weather outlooks.

By Thursday, weather models began hinting that the end-of-October outlooks would be not as cold as initially thought, shedding several heating degree days (HDD) during the last couple of model runs. The prompt month went on to settle around 12 cents lower on the day at $3.198.

On Friday morning, some data was more clear in showing a breakdown of the cold, with the Global Forecasting System and the European model pointing to warmer conditions for the end of the month.

Still, with changes between models occurring so frequently in recent runs, NatGasWeather said “the weather data has turned into a muddled mess after next week. Essentially, the models have quickly become inconsistent and are now really struggling trying to resolve if the late October pattern will be impressively cold or not.”

Bespoke Weather Services was more confident in the warmer risks to finish out the month. Despite the variations in the weather models, the end result “is a solid decline in HDD expectations overnight” and though the forecaster still expects demand to run slightly above average on net through the next couple of weeks, the long-range pattern is not quite as threatening and the medium-range continues to sustain warm risks.

“We do see lingering blocking into Week 3 that could keep some cold across key heating demand regions”, but still favor a Madden-Julian Oscillation propagation into mid-November that displaces that blocking “and increases the chances of the pattern reverting to a warmer base state,” Bespoke chief meteorologist Jacob Meisel said.

The forecaster also noted looser weather-adjusted power burns for Friday after looser revisions on Thursday, with more production coming back online and Canadian imports rising again. “Balances thus look firmly looser right as warmer weather risks are arriving as well, opening the risk for further downside into next week,” Meisel said.

By Friday afternoon, the Global Forecasting System (GFS) model flipped back much colder, specifically for late next week, seeing conditions less mild in the latest run with high pressure not building in as strongly, NatGasWeather said. The midday GFS also flipped back notably colder for the end of October and early November to add back numerous HDDs.

“Clearly, the weather models are playing games with the natural gas markets as daily price swings of more than 10 cents continue, and mostly in the direction of national temperature trends,” the forecaster said.

The Nymex November contract went on to settle Friday at $3.25, up 5.2 cents.

With market bulls back in the game, they will be looking to storage to keep their seat at the table. Storage inventories remain at direly low levels just weeks before the start of winter. The early-season series of cold fronts that began circulating around the country last week and were expected to continue through next week are expected to only worsen the situation.

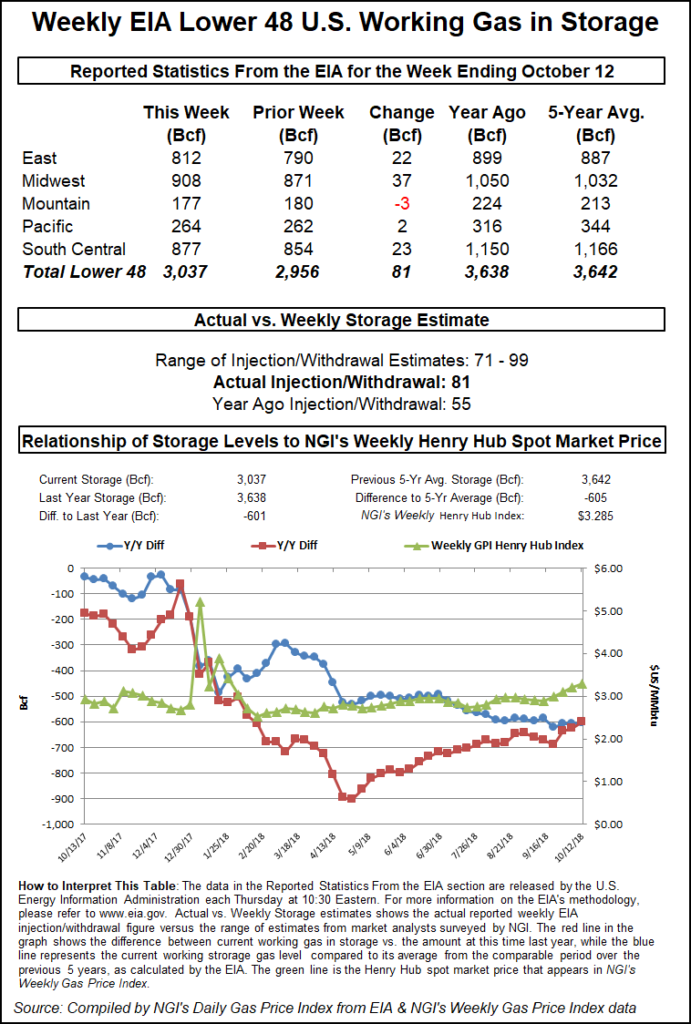

The EIA on Thursday reported an 81 Bcf injection into storage inventories for the week ending Oct. 12 that lifted stocks to 3,037 Bcf, 601 Bcf below year-ago levels and 605 Bcf below the five-year average. Deficits are expected to grow even more next week when the cold fronts that moved across the country this week are accounted for, according to NatGasWeather. An early range of expectations for the next storage report shows a build in inventories between 50 Bcf and 72 Bcf.

“This should keep the background state bullish for quite some time, putting the onus on record production improving them, which they have still yet to do by a single Bcf after many months,” the forecaster said.

Meanwhile, when taking a closer look at the EIA’s weekly storage data, a comparison versus the same week last year shows the 26 Bcf of additional gas that was stored primarily went in to salt domes, according to Mobius Risk Group. These facilities built 12 Bcf versus withdrawing 6 Bcf in the same week last year, the firm said.

“Interestingly, this occurred despite spot prices comfortably outpacing daily prompt-month pricing,” Mobius analysts said.

The bid salt storage capacity holders are showing in the market is helping to support the front of the curve and concurrently reducing the large year/year deficit in high-turn storage, Mobius said. “This dynamic may be present for another four to eight weeks, and thus spot price resilience may insulate the market against warmer forecast revisions in the near term.”

Spot Gas Sinks Ahead of Mild Weekend

While several markets across the United States posted a second day of declines given the mild weather in store for some areas during the weekend, several key regions rebounded in Friday trading as a renewed wave of cold air, locally damaging winds, rain and snow showers was expected to sweep through the midwestern and northeastern United States.

The region’s first significant cold sweep of the season arrived midweek, with some areas seeing their first snowflakes since the spring, according to AccuWeather. The week ended on a rather pleasant note with sunshine, light winds and highs in the 50s and 60s, however, a reinforcing shot of colder air was forecast to head for the Northeast.

“This next cold front means business,” said AccuWeather chief meteorologist Elliot Abrams.

Temperatures during both the days and nights were expected to be several degrees lower than their coldest levels this past week. Cold air was also forecast to dip much farther west when compared to the extent of the cold this past week, Abrams said.

The chill was expected to first reach the Upper Midwest and Great Lakes before sweeping through the Northeast through Sunday night. High temperatures were forecast to be held 10-15 degrees below normal in the wake of the cold sweep, generally in the 40s across the Great Lakes and interior Northeast and 50s closer to the coast, AccuWeather said.

The quick reload of cold air was enough to drive significant gains in the Northeast. Tenn Zone 6 200L spot gas jumped 36.5 cents to $3.695, and Transco Zone 6 NY rose 13.5 cents to $3.11.

In Appalachia, Millennium East Pool was up 9.5 cents to $2.965, and Transco-Leidy Line was up 6.5 cents to $3.025. Texas Eastern M-3, Delivery, however, tumbled 21 cents to $3.055 as Texas Eastern Transmission (Tetco) was scheduled to conduct investigations on its 30-inch Line 15 between its Owingsville, KY, and Wheelersburg, OH, compressor stations (CS).

This line has been under constant maintenance this fall, and flows from the Berne CS to the Barton CS are to be reduced by as much as 224 MMcf/d for the duration of the event, which is scheduled for Monday through Saturday (Oct. 22-28).

“This is the first of several events that will leave the 30-inch Line constrained until mid-December, cutting exports to one of Tetco’s demand hubs in East Louisiana,” Genscape natural gas analyst Josh Garcia said.

Over in the Midcontinent, prices generally rose a few cents, although ANR Southwest and NGPL Midcontinent slipped. Midwest markets, meanwhile, were mostly stronger as gains of a few pennies to as much as 8 cents were seen in the region.

In the West, it was a sea of red as after a prolonged dry and mild stretch, the northwestern United States was due for a flip to cool, rainy weather as Pacific storms return in the upcoming week. Highs through Monday were expected to be in the 60s around Seattle and 70s in Portland, OR.

Increasing cloud coverage expected on Tuesday will be a sign of the changes to come for the remainder of the week ahead, AccuWeather said. Following a couple of mainly dry weeks in the Pacific Northwest, the area of high pressure should work its way far enough inland for Pacific storms finally to reach the region next week, according to AccuWeather Senior Meteorologist Jack Boston.

“This will bring back rain and mountain snow chances,” he said.

Two to three storms were forecast to roll through the area with opportunities for wet weather. The first storm was expected to arrive late Tuesday, and a second could follow by Thursday, with the potential for a third storm to sweep in by the end of the week, according to AccuWeather.

California spot gas was lower almost across the board, with SoCal Citygate plunging $1.685 to $3.33. The lone exception to the regional downtrend was PG&E Citygate, which rose a couple of cents to $3.91, likely in response to the Pacific Gas and Electric Co. power line falling.

Meanwhile, an unplanned maintenance event was expected to slightly limit Northwest Pipeline’s (NWPL) ability to bring in Rockies gas as an alternative to the supply lost because of the Westcoast explosion, Genscape Inc. said.

An engine failure at the Lava Hot Springs compressor in southeast Idaho has led to a reduction of 58 MMcf/d of operating capacity, to 573 MMcf/d from 631 MMcf/d, natural gas analyst Joe Bernardi said. Since the Westcoast explosion, this location has flowed an average of 534 MMcf/d, and the previous three days have been above 600 MMcf/d. The two-week average flow prior to the Westcoast explosion was 238 MMcf/d, he said.

NWPL currently expects the work to last through Thursday (Oct. 26). The pipeline will likely be able to draw more gas from the Jackson Prairie storage facility in Washington State to accommodate for the slight decrease in flows through Lava Hot Springs, Genscape said.

Despite the modest cut to supply, Northwest Sumas spot gas tumbled 22.5 cents to $6.625.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |