NGI Mexico GPI | E&P | NGI All News Access

Apache’s Alpine High in Permian to Move Oil, Gas and NGLs to South Texas and Beyond

Houston-based Apache Corp.’s foray into a sparse patch of West Texas set off no alarm bells a few years ago when exploration began in earnest in a part of the Permian Basin long considered too geologically complex to develop.

Unearthing Alpine High in 2016 has changed perceptions, CEO John Christmann said last week at the inaugural PermiCon event in Houston, which was sponsored by RBN Energy LLC.

Today, “the industry is right along our doorstep,” he said to a standing-room-only crowd. “What we’ve proven today is we’ve got a 6,000-foot column and multiple targets” for natural gas, oil and natural gas liquids (NGL). “We now have decades of high return inventory that we are excited about.”

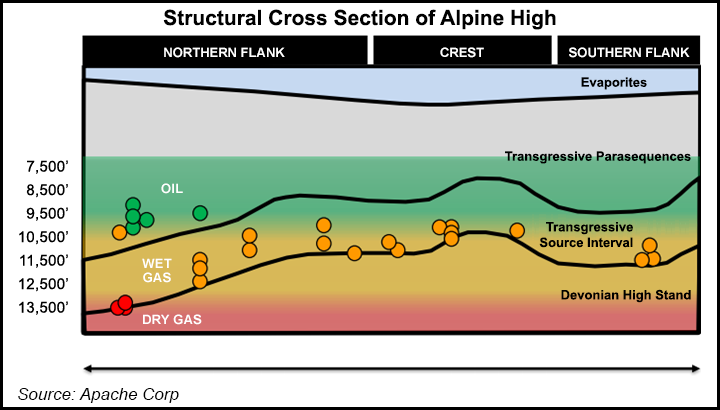

Apache has taken the play by the horns and built a remarkable inventory within the Delaware sub-basin in two years. It now has 340,000 net acres mostly in Reeves County in West Texas, with the geologic boundary of Reeves to the foothills of the Davis Mountains. The hydrocarbon column, vertically stacked with oil, rich gas and dry gas, spans formations from the Woodford to the Barnett and from the Wolfcamp and Bone Springs.

“It’s an unconventional kitchen,” Christmann said, with oil on top of wet gas and wet gas on top of dry gas.

When the play was unveiled in September 2016, Apache pegged reserves in place at 75 Tcf of rich gas and 3 billion bbl of oil. Since the discovery, however, Alpine High has evolved significantly.

For example, last year Apache sold its substantial Canadian operations, where production in 2Q2017 averaged 300 MMcfe/d. As of July, Alpine High output had replaced the Canadian output, Christmann said, including a near-70% gain in natural gas output. Average net gas, oil and NGL production from Alpine High in 2Q2018 rose 23% sequentially to 32,000 boe/d. By the end of July, production was averaging 54,000 boe/d, up 70% overall year/year.

Today cumulative wells in Alpine High stand at about 162 from 14 in 2016, with 111 wells producing, versus nine two years ago. Apache’s rig count in Alpine High alone has risen to seven from three.

Confirmed landing zones in the vertically stacked play have climbed to 13 from two, with the location count jumping to 5,000-plus from up to 3,000. Christmann told the audience the figures are higher than that, but Apache had not yet updated the figures.

Alpine High’s net production in July was about 54,000 boe/d, a number expected to reach as much as 180,000 boe/d in 2020. Over the next two years, Apache also expects to have up to 375 wells on production, with up to 450 wells drilled. As many as 11 rigs are forecast to be running.

Backstopping its Alpine High production efforts, said Christmann, is Altus Midstream LP, a joint venture with Kayne Anderson Acquisition Corp. that is to hold nearly all of the play’s gathering, processing and transportation assets. Altus also holds options to gain equity participation in five natural gas, NGL and crude oil pipeline projects under construction or proposed that would traverse the Permian to various points on the Texas coast.

Apache in June joined in the proposed Permian Highway Pipeline Project (PHP), a 42-inch diameter natural gas system that is to run about 430 miles to the Texas coast and potentially into Mexico.

PHP would complement the Kinder-led 2 Bcf/d Gulf Coast Express Pipeline Project now underway, the first greenfield pipeline to carry gas supplies from the basin. Apache has 500 MMcf/d of transport capacity via GCX to transport its Permian gas south.

“Looking forward, other pipelines need to be built out” to allow for gas exports and serve consumer and petrochemical demand, Christmann said. He was a bit skeptical, though, about building out capacity to Mexico too soon because he thinks it may take longer to develop. However, “I imagine we will be working on other pipeline projects” to move all of the Permian output to come.

Altus had rich gas processing capacity totaling 380 MMcf/d in September, with lean treating/compression at 400 MMcf/d. As Alpine High transitions to full-field development as expected, Altus by the end of 2020 plans to have five cryogenic processing plants operational, with rich gas processing at about 1,300 MMcf/d and lean treating/compression at 480 MMcf/d.

“We’re still doing a lot of testing,” but Apache has begun the transition to full-field development, said the CEO. “We’re doing pad and spacing tests,” with focus on improving drilling and cost efficiencies.

Apache is positioning itself to deliver all of its Permian output to the Gulf Coast. The plan is “to think longer term…bigger picture,” to provide “10-plus years of growth.”

Initial commentary about Alpine High long has focused on the dry gas, but the play by itself, combined with Apache’s holdings across the Permian are substantial, according to Christmann.

The dry gas claimed the most attention first because Apache initially began developing the North Flank of the play because it needed to hold the lease by production. The remainder of the column is situated along the bottom of the Woodford’s rich gas and oil formation, but Apache “had to drill down to the base of the Woodford to hold the acreage,” Christmann said.

The global independent now is making plans to move up the North Flank column to pull out more rich gas and oil.

Alpine High is a “very, very large resource” and unique as there are windows in the Woodford and Barnett formations that generate wet gas and oil. The key is to keep finding and development costs as low as possible.

This year nearly two-thirds of the global operator’s $3.4 billion capital expenditures are being directed to the Permian, with about one-quarter of the spend in Alpine High and nearly one-third to the other Permian holdings, including the Midland. Another 16% is being directed to Alpine High midstream, 7% to other U.S. holdings and 20% set aside for international operations.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |