NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

BC Pipe Explosion Rattles Downstream U.S. Natural Gas Forward Markets

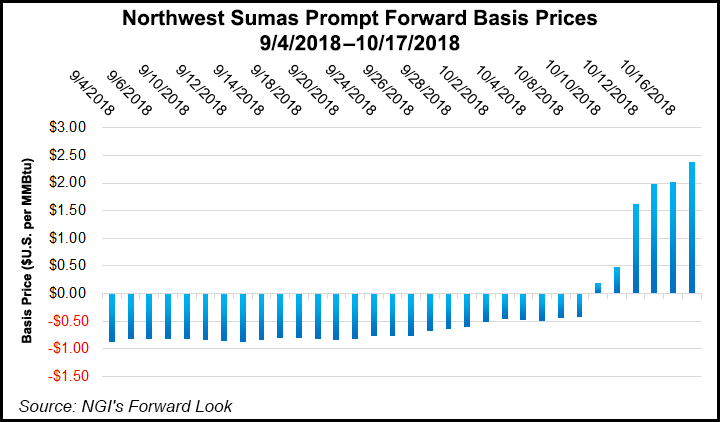

Pipeline explosion-induced cuts to imported natural gas supplies from British Columbia and strong downstream demand due to a series of cold fronts moving through the United States lifted forward prices across the West, Rockies and even the recently struggling Permian Basin, helping boost the November national average by some 20 cents from Oct. 11-17, according to NGI’s Forward Look.

While most markets typically follow the lead of Nymex futures, several pricing hubs broke out of their recent trading ranges as the cuts to supply occurred just as demand began to surge in parts of the United States. In a move that is far more typical in the volatile Northeast during the dead of winter, Northwest Sumas November prices rocketed just shy of $2.00 to $5.699. December jumped $1.50 to $5.511, and the November-March winter strip rose $1.06 to $4.52.

Elsewhere in the Rockies, Cheyenne Hub November climbed 34 cents to $2.932, December gained 25 cents to hit $3.05 and the winter strip moved up 20 cents to $2.82.

Malin November was up 39 cents to $3.245, December jumped 21 cents to $3.251 and the winter strip rose 22 cents to $3.09.

Given increased volatility in Southern California due to already limited import capacity and storage constraints at Aliso Canyon, prices there put up solid gains as well. SoCal Citygate November cimbed 54 cents from Oct. 11-17 to reach $5.16, December jumped 24 cents to $8.712 and the winter strip tacked on 27 cents to $6.45, Forward Look data show.

Enbridge Inc.’s Westcoast Transmission pipeline ruptured on Oct. 9, and repairs have yet to begin. One day after the explosion, Enbridge received approval to restart an unharmed 30-inch diameter natural gas pipeline that is in the same right-of-way as the 36-inch pipeline that exploded. The unharmed 30-inch diameter line had stopped flowing as a precaution, and was expected to operate at 80% of its normal operating capacity.

Meanwhile, a series of unseasonably strong cold fronts continued across the country, elevating demand in the eastern half of the country, including parts of Texas. The bump in demand was enough to send pricing hubs in the Permian Basin, where November prices were in the $1.30s at the start of the month, to the $1.80s for the Oct. 11-17 period. El Paso-Permian November jumped 33 cents to $1.843, December climbed 22 cents to $2.143 and the winter strip edged up 23 cents to $1.92. Waha moved similarly.

Nymex Volatility Continues

Though not as strong as last week, Nymex futures continued to strengthen during the Oct. 11-17 period as weather dominated trading action. While weather models earlier in the week indicated cold snaps continuing into the end of October and early November, the early morning and midday American model on Thursday backed off on the amount of cold across the United States for Oct. 29-Nov. 2.

“The weather models are struggling with the Oct. 29-Nov. 2 pattern as they try to resolve just how much colder-than-normal temperatures to expect and also which regions will be impacted greatest,” NatGasWeather said.

The midday American model wasn’t nearly as cold as it has been over the past few days, losing nearly 10 heating degree days in demand the past two runs, the forecaster said. The European model maintained a relatively chilly bullish pattern Wednesday and overnight, but certainly could back off on the afternoon run if it catches on to what the American model is seeing. “If not, then inconsistent weather data will need to be resolved before the weekend break,” NatGasWeather said.

With the possibility of not-so-cold weather to finish out the month, as well as reports of Lower 48 dry gas production moving back near record highs in recent days, the Nymex November gas futures contract was trading about 8 cents lower early Thursday ahead of the Energy Information Administration’s (EIA) weekly storage report.

The EIA reported an 81 Bcf injection into storage inventories for the week ending Oct. 12, slightly below market expectations for a build in the mid-80s Bcf. The November contract got a slight pop after the EIA print hit the screen at 10:30 a.m. ET but was still trading nearly 7 cents lower day/day at $3.253. The prompt month went on to settle Thursday at $3.198, down 12.2 cents.

The 81 Bcf build was larger than both last year’s 55 Bcf injection and the five-year average build for the week of 79 Bcf.

“This number, if anything, is a touch supportive with a consensus closer to 83-84 Bcf, though well within the margin of error, especially with some production disruptions from Hurricane Michael,” Bespoke Weather Services said.

The reported injection, which was 1 Bcf above Bespoke’s estimate, confirms its reading of balance as quite loose overall “but just tight enough to allow for rallies should forecasts continue to cool.” Next week’s expected storage injection is expected to be even looser due to lingering demand impacts from Michael, “which can mute any impact of this print,” the forecaster said.

But Mobius Risk Group analysts cautioned about reading too much into Thursday’s injection. “An individual weekly data point is far from a trend.”

During the next couple of weeks, underlying supply/demand balance will likely take a back seat to the “inject-at-any-cost” environment currently being displayed at salt caverns, Mobius said. If spot prices remain as strong as they have been the past two weeks, downside risk may be limited.

Thereafter, the market will eagerly await early November production data for any signs of strong sequential growth heading into winter, the Houston-based firm said. “Here we also advise against being too focused on minutiae, and suggest a more holistic fundamental assessment of the market is needed. An overt fixation on production growth is what caused some market participants to be surprised by recent strength at the front of the Nymex curve,” analysts said.

The 81 Bcf build lifted storage inventories to 3,037 Bcf, 601 Bcf below year-ago levels and 605 Bcf below the five-year average. Broken down by region, 37 Bcf was injected in the Midwest, 23 Bcf in the South Central, 22 Bcf in the East and 2 Bcf in the Pacific. The Mountain region reported a 3 Bcf withdrawal.

The draw in Mountain supplies perplexed market participants on Enelyst — a social media platform hosted by The Desk — most of whom were expecting a build of 1-2 Bcf. Among the possible explanations for the unexpected draw were the explosion on the Westcoast system and an inventory drop at the Ryckman storage facility on Oct. 2, although none of those reasons supported a 3 Bcf pull from supplies, market observers said.

Before Thursday’s dramatic sell-off, the November contract (and the entire winter strip for that matter) sat at multi-year highs, at $3.32 and $3.325, respectively. The last time the November contract reached this level was in August 2015, while the winter 2018-2019 strip last breached $3.30 in September 2015, Mobius said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |