EIA Reports Slightly Supportive 81 Bcf Storage Injection; November Natural Gas Bounces

The Energy Information Administration (EIA) reported an 81 Bcf injection into storage inventories for the week ending Oct. 12, slightly below market expectations for a build in the mid-80s Bcf.

November natural gas futures, which had been trading about 8 cents lower early Thursday due to milder weather trends, got a pop after the EIA print hit the screen at 10:30 a.m. ET, trading at $3.253, but still down 6.7 cents from Wednesday’s settle. By 11 a.m., the contract was down 7.8 cents to $3.242.

The 81 Bcf build was larger than both last year’s 55 Bcf injection and the five-year average build for the week of 79 Bcf.

“This number, if anything, is a touch supportive with a consensus closer to 83-84 Bcf, though well within the margin of error, especially with some production disruptions from Hurricane Michael,” Bespoke Weather Services said.

The reported injection, which was 1 Bcf above Bespoke’s estimate, confirms its reading of balance as quite loose overall “but just tight enough to allow for rallies should forecasts continue to cool.” Next week’s expected storage injection is expected to be even looser due to lingering demand impacts from Michael, “which can mute any impact of this print,” the forecaster said.

Meanwhile, weather forecasts remain supportive enough that with guidance confirming cold, a move towards $3.30 is possible, “but this loose weather-adjusted print is overall neutral for a market that is far more focused on the weather currently,” Meisel said.

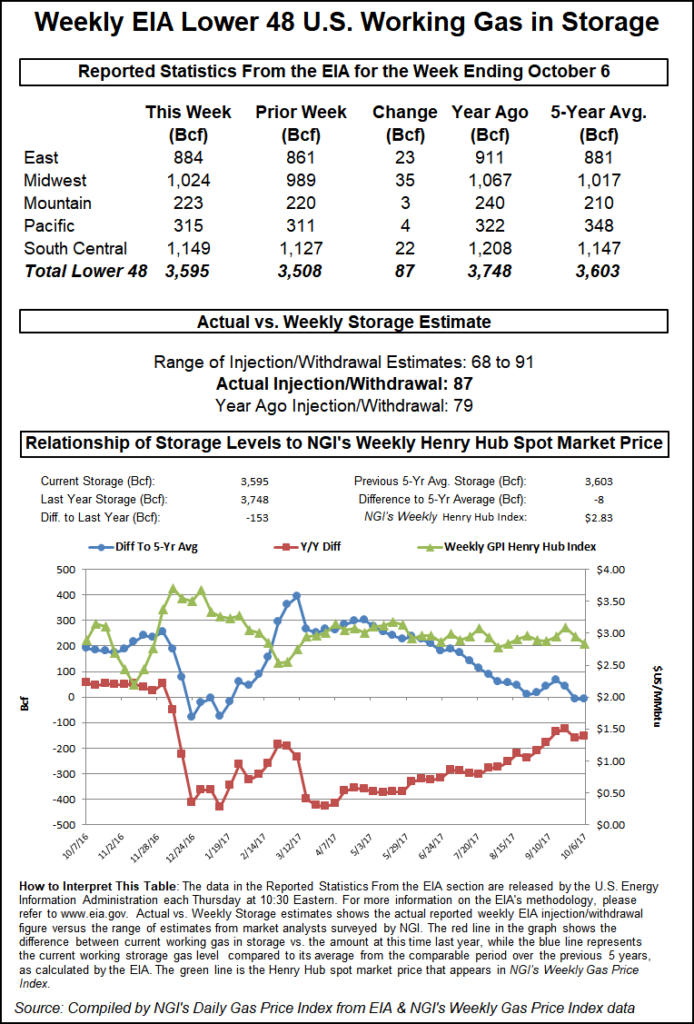

The 81 Bcf build lifted storage inventories to 3,037 Bcf, 601 Bcf below year-ago levels and 605 Bcf below the five-year average. Broken down by region, 37 Bcf was injected in the Midwest, 23 Bcf in the South Central, 22 Bcf in the East and 2 Bcf in the Pacific. The Mountain region reported a 3 Bcf withdrawal.

The draw in Mountain supplies perplexed market participants on Enelyst — a social media platform hosted by The Desk — most of whom were expecting a build of 1-2 Bcf. Among the possible explanations for the unexpected draw were the explosion on Enbridge’s Westcoast Transmission system that cut imports to the United States and an inventory drop at the Ryckman storage facility on Oct. 2, although none of those reasons supported a 3 Bcf pull from supplies, market observers said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |