NGI Mexico GPI | Markets | NGI All News Access

Colder-Trending November Lifts Natural Gas Futures; Stalled Front Fuels Spot Gas

With the threat of colder temperatures lasting into the first third of November, natural gas prices gained ground Wednesday, trading most of the day just pennies higher but then tacking on a few more cents in the last half hour of trading following new weather guidance. The Nymex November gas futures contract eventually settled at $3.32, up 8.1 cents.

Spot gas prices also strengthened as one of several cold snaps on tap for the eastern United States remained stalled over portions of the country. The NGI National Spot Gas Avg. rose 8.5 cents to $3.27.

On the futures front, the November contract waffled in a 5-cent trading range for most of the session before midday weather guidance moved the front month above a key level of technical resistance. December edged up 6.8 cents to $3.369, January rose 6.5 cents to $3.439, February tacked on 5.1 cents to $3.347 and March climbed 3.8 cents to $3.152.

Weather was front and center for traders on Wednesday as the latest data lost a little demand in the medium range, but was colder/bullish trending Oct. 28-Nov. 2 to add demand back, according to NatGasWeather. While there was no change bigger picture, the coming pattern should be considered relatively bullish because of bouts of cooler-than-normal temperatures east of the Rockies and Plains apart from milder breaks between systems, especially Oct. 25-27 when the cold is expected to reload, the forecaster said.

During the past 12-24 hours, however, the data has been colder trending for the Oct. 28-Nov. 2 period, with increasing potential for large-scale weather systems to sweep across large stretches of the country with rain, snow and cooler-than-normal temperatures, while likely lasting through much of the first week of November, the firm said.

The source region for long-range cold is unimpressive, however, which should keep gas-weighted degree days from getting too far above average, according to Bespoke Weather Services. “…but cold risks are high enough to keep traders on edge regardless,” Bespoke chief meteorologist Jacob Meisel said.

Bespoke maintained its neutral sentiment “as weather refuses to provide the cracks necessary to pull the front of the strip any lower.” Early indications were that balances were a touch tighter on Wednesday as power burns were revised up a bit and liquefied natural gas exports were back in full force.

“We are waiting to see how much production comes back online” as Canadian imports remain off and residential/commercial demand increases with sizable cold, Bespoke said.

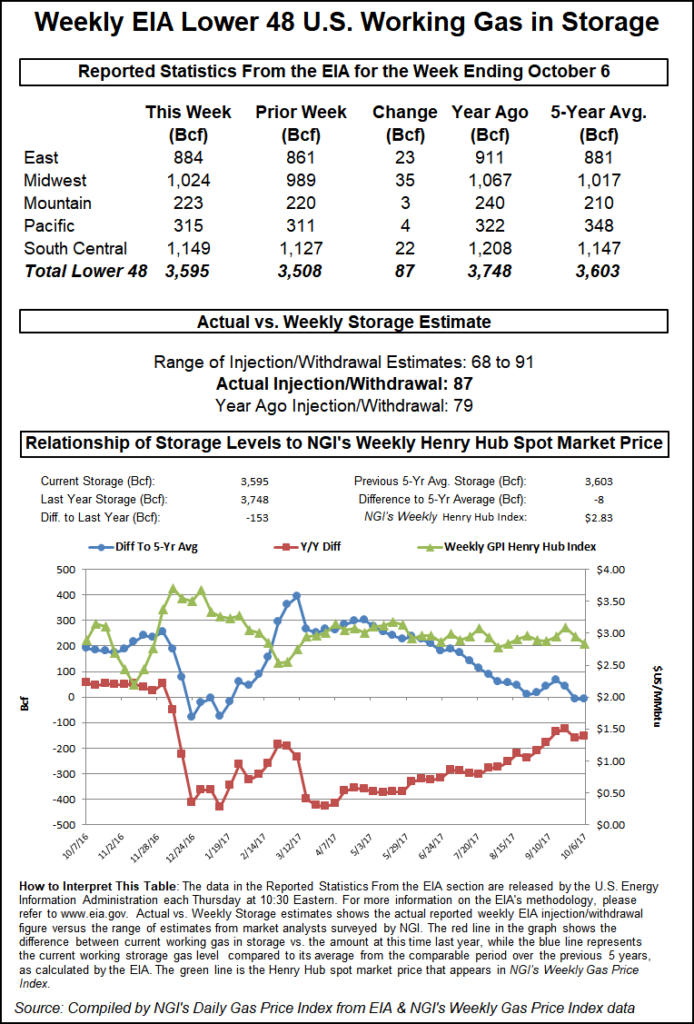

With the pre-winter cold expected to widen storage deficits even further in the coming weeks, traders were looking ahead to Thursday’s Energy Information Administration (EIA) weekly storage inventory report for at least some improvement in the dismal picture. Estimates clustered around a build in the mid- to upper 80s Bcf, which is well above last year’s 51 Bcf injection and slightly above the five-year average 79 Bcf injection.

Bespoke projected an 82 Bcf build, Kyle Cooper of IAF Advisors expected an 87 Bcf build and EBW Analytics forecast a build of 89 Bcf. A Reuters poll of 23 market participants had a range of 71-99 Bcf, with a median of 82 Bcf. A Bloomberg survey of market participants had a range of 71-99 Bcf with a median of 84 Bcf. Intercontinental Exchange also settled at an 84 Bcf injection.

Last week, the EIA reported a 90 Bcf injection that lifted inventories to 2,956 Bcf, 627 Bcf below year-ago levels and 607 Bcf below the five-year average.

As for the direction of prices in the coming weeks, NatGasWeather said with daily 10-cent trading ranges becoming common so far this month, that would portend a stronger move before too long, potentially more like 15-20 cents. “But which direction?”

To the bullish side would be impressive storage deficits and relatively bullish weather patterns. To the bearish side would be Lower 48 gas production that continuously keeps setting record highs, the firm said.

Stalled Cold Front Lifts Spot Gas

Spot gas prices continued to strengthen Wednesday as a weather system remained stalled over Texas and the South, with heavy showers and cool daytime temperatures in the 40s to 60s. At the same time, a colder front has pushed across the Midwest, Ohio Valley and Northeast, with reinforcing cool Canadian air to follow the next few days. The front was expected to drop overnight lows into the 20s and 30s for stronger-than-normal demand, NatGasWeather said.

A brief milder break between weather systems was expected to occur Friday ahead of the next Canadian blast to sweep across the Midwest and East this weekend into early next week, with chilly conditions as lows were forecast to drop into the 20s and 30s, the forecaster said.

Meanwhile, Enbridge Inc. had yet to begin repairing the portion of the Westcoast Transmission system that exploded Oct. 9, limiting exports out of British Columbia and driving up prices in downstream markets.

While most regions across the United States saw spot gas prices increases of less than a dime, stronger gains were seen in the Rockies, West Texas/southeastern New Mexico and the West. Normally one of the lowest-priced hubs in the country, Northwest Sumas has been volatile since the Westcoast explosion, trading as high as $6.50 in the days following the blast. On Wednesday, Northwest Sumas spot gas jumped 64 cents day/day to $5.20, the highest price in North America.

The Westcoast blast was having a ripple effect in other markets as well. SoCal Citygate also traded above $5 for Thursday gas delivery, while the majority of pricing points throughout the Rockies and California sported $3 handles.

In addition, Permian Basin pricing hubs continued to put up meaningful increases given the downstream demand and cut to Canadian imports. After trading around $1 for much of September, El Paso-Permian spot gas traded at $2.54 on Wednesday, a gain of 22 cents on the day. Waha jumped 23.5 cents to $2.565.

Meanwhile, blasts of cold air were expected to not only bring the lowest temperatures of the season so far to the Northeast, but also the first snowflakes to some areas and the risk of damaging wind gusts into this weekend, according to AccuWeather.

The leading edge of a new blast of cold air was forecast to sweep off the Atlantic coast Wednesday night, sending temperatures plunging into the 20s and 30s around the Great Lakes and central and northern Appalachia, and into the 30s and lower 40s along the Interstate 95 corridor.

“While some locations over the higher terrain of the Appalachians and Great Lakes region had their first snowflakes of the season last weekend, many more places over the Upper Midwest and interior Northeast are likely to at least have some wet snow mixed in with rain showers,” AccuWeather senior meteorologist Alex Sosnowski said.

The strongest wind gusts associated with the cold air’s arrival are likely to be in the neighborhood of 45 mph from Michigan to New York and into New England, AccuWeather said.

Given the pre-winter chill and strong demand in the region, Algonquin Citygate jumped nearly 50 cents to $3.92, and Tenn Zone 6 200L rose 47.5 cents to $4.035.

Meanwhile, gas quality issues led Rover to call a force majeure Wednesday because of equipment failure, shutting off deliveries to Vector, a cut of more than 1 Bcf/d, Genscape Inc. said. Rover posted a notice Tuesday that it was experiencing gas quality issues, which Vector also reported. The issues were resulting in excessive liquids content, Rover said.

Production volumes getting onto Rover on Wednesday were down nearly 0.7 Bcf/d from Tuesday, along with 0.12 Bcf/d less receipts from Equitrans at Clarington, according to Genscape. During the past week, Rover had been delivering about 1.1 Bcf/d to Vector, but evening cycle nominations fell to virtually zero.

“At the moment there is no indication that Vector is making up for the lost supply from other sources, resulting in Vector throughput to the Dawn, Ontario, market running about 0.7 Bcf/d lower day/day,” Genscape senior natural gas analyst Rick Margolin said.

Genscape said preliminary nominations on Rover for Thursday’s flows indicated a near-complete restoration of flows, however, the force majeure was called later in the day, after Genscape’s note to clients was published.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |