NGI Mexico GPI | Markets | NGI All News Access

Bears Look to Regain Control as November Natural Gas Slips; Spot Gas Slides on Increased Supply

Traders got the news they needed to meaningfully move natural gas futures prices Thursday in the form of milder weather that showed up in long-range outlooks. Nymex November gas futures settled at $3.222, down 6.2 cents on the day. Spot gas prices also were overwhelmingly lower, with dramatic day/day (d/d) declines seen across the country and especially in the Midcontinent, Rockies and West. The NGI National Spot Gas Avg. fell 19.5 cents to $2.96.

On the futures front, the November contract was down from the start of trading as long-range forecasts showed milder conditions arriving by around Oct. 20. The prompt month opened the session at $3.276, off about a penny from Wednesday’s settle but then fell to an intraday low of $3.153 following the Energy Information Administration’s (EIA) weekly storage inventory report.

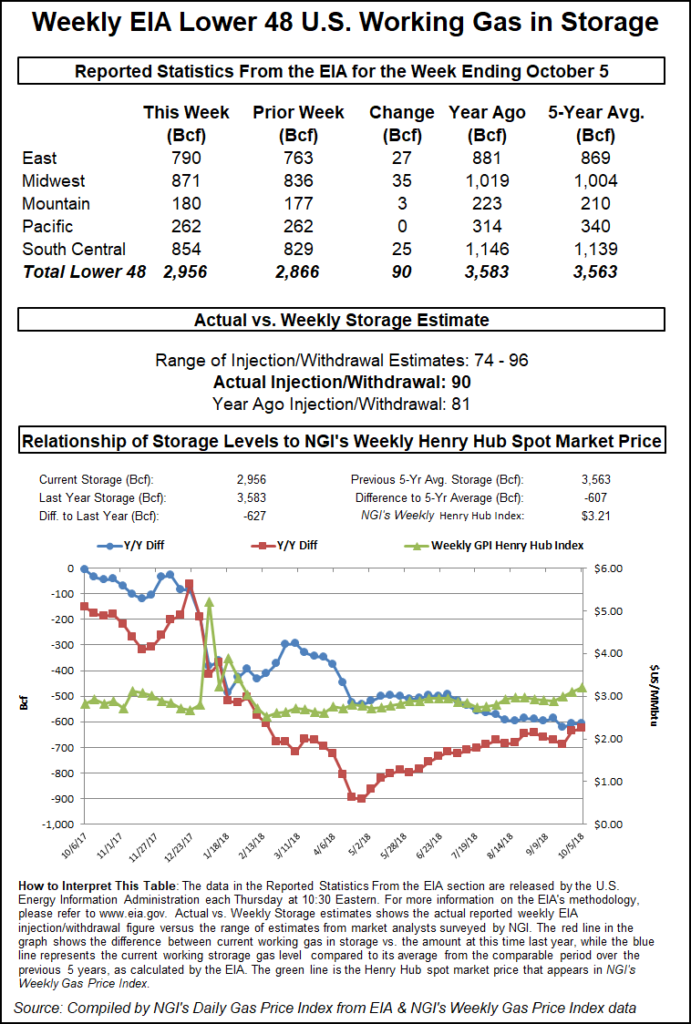

The EIA reported a 90 Bcf injection into storage inventories for the week ending Oct. 5. The reported build was in line with market expectations and did little to revive a market that was already trading significantly lower before the EIA’s release. “This fits with our reading of burns loosening off a bit and production continuing to grow with Canadian imports returning last week,” Bespoke Weather Services said.

Other market observers, however, were perplexed by the sharp downtrend in the market even with the 90 Bcf build. “I’m still dumbfounded by lack of demand talk, all about production still,” said Corey Lefkof, a natural gas and power meteorologist.

But Bespoke’s Jacob Meisel said the structural growth in power burns appears more impressive than in the residential/commercial sector, which makes the demand story more impressive in summer than in winter, barring extreme winter temperatures.

Thursday’s reported 90 Bcf build lifted inventories to 2,956 Bcf, 627 Bcf below year-ago levels and 607 Bcf below the five-year average. Broken down by region, the Midwest injected 35 Bcf, the East injected 27 Bcf and the South injected 25 Bcf, including 10 Bcf into salt dome facilities and 15 Bcf into non-salt facilities.

Despite the 90 Bcf build, Mobius Risk Group said there is no guarantee there be will be further deficit reductions before withdrawals begin in earnest. “As heating demand moves eastward, daily injection data will be closely followed by the market.”

NatGasWeather echoed those sentiments, saying, that 600-plus Bcf storage deficits would likely improve only slightly next week, “then increase further in the weeks after as the coming cool shots are accounted for.”

EBW Analytics, meanwhile, said that over the next month, the recently approved in-service of the Atlantic Sunrise and Nexus Gas Transmission projects, combined with post-Michael recovery in Gulf of Mexico production, should improve the supply picture. Of course, any resulting dip in prices, “is predicated on weather forecasts not continuing to shift in a bullish direction,” EBW CEO Andy Weissman said.

Weather forecasts remain highly susceptible to typhoon activity in the Pacific and are virtually unforeseeable even only seven to 10 days out, EBW said. These recurving typhoons helped underlie the fast-moving cold air mass descending from Canada. A faster expansion of cold air also means the air stays colder as it reaches the Lower 48, which resulted in the significant cold shift since Friday, the firm said.

By November, however, significantly warmer temperatures are likely — a cold October/warm November is a classic el Nino signature — potentially ending the recent rally and pulling Nymex futures lower. During the two storage weeks from Oct. 12-25, heating demand is projected at 33 gas-weighted degree days (GWDD) above normal. “For November, however, the current forecast is for 18 GWDDs below normal, with warmer-than-normal temperatures across the northern tier particularly limiting space heating demand,” Weissman said.

Spot Gas Tumbles as Michael Traverses Mid-Atlantic Coast

Spot gas prices bled Thursday as the first in a series of pre-winter cold snaps tracked across the Great Lakes, while tropical cyclone Michael also steered across the Mid-Atlantic Coast with heavy rains, according to NatGasWeather. Chilly conditions with daytime lows in the 20s to 40s were forecast behind the cool front across the Great Lakes, with another reinforcing cold shot expected to push into the northern and central United States this weekend.

“With high pressure setting up over the West next week, this will allow cool air out of Canada to steadily stream across the Midwest and into the eastern U.S. late next week, although likely with a milder break between systems” around Oct. 20-21 and where the overnight data lost heating degree days, the forecaster said.

Data, however, supports additional weather systems/cold shots Oct. 22-26, continuing the active and cooler-than-normal Great Lakes and eastern United States pattern, it said. There is also likely to be cooler air pushing into North Texas and portions of the South with a few of these systems as early as next week. Overall, however, the southern United States will be mostly mild to warm with mostly light demand.

“What remains of primary interest is when the pattern will change to stop the barrage of weather systems/cool shots across the Great Lakes and Northeast,” NatGasWeather said.

Some of the most dramatic declines occurred in the very markets that skyrocketed one day earlier. The Midcontinent, Rockies and West all posted losses upward of 20 cents after Enbridge Inc. was given approval late Wednesday to restart an unharmed 30-inch diameter natural gas pipeline that is in the same right-of-way as the 36-inch pipeline that exploded in British Columbia (BC) on Tuesday.

Repair crews had scrambled Wednesday to fix damage done to the pipeline in the right-of-way for BC’s main natural gas conduit that ruptured and exploded. The mishap shut down both of the Westcoast Transmission system pipes. The unharmed 30-inch diameter line had stopped flowing as a precaution.

With the 30-inch line deemed fit for service, “our restart plan is to gradually bring the line’s pressure up to approximately 80% of normal operating capacity. Once this process is safely completed, some much need capacity will be restored for our customers,” the National Energy Board said.

Given the expected increase in supply, downstream U.S. markets softened considerably. Malin spot gas plunged 43 cents to $2.915, and PG&E Citygate tumbled 26 cents to $3.505.

In the Rockies, Kingsgate dropped 38.5 cents to $2.775, and Opal fell 38.5 cents to $2.865.

Canadian points, meanwhile, bounced back from Wednesday, with next-day gas at Westcoast Station 2 jumping more than $1 to $1.95 on the increased takeaway capacity. NOVA/AECO C climbed 13.5 cents to $1.65.

Meanwhile, other markets across the Southeast and Mid-Atlantic continued to get hit with torrential rains from Hurricane Michael, lowering demand and thus prices in those regions. Hundreds of thousands were without power, while pipeline nominations showed signs of offshore production returning.

Michael, which made landfall Wednesday as a Category 4, had been downgraded to a tropical storm as it made its way across the Carolinas Thursday. As of 2 p.m. ET, Michael was about 25 miles south of Greensboro, NC, traveling northeast at 23 mph, according to the National Hurricane Center. The storm was expected to move across central and eastern North Carolina and southeastern Virginia Thursday before moving out over the Atlantic.

Around 860,000 electricity customers across Alabama, Florida, Georgia, North Carolina and South Carolina were without power as of 9 a.m. ET Thursday, according to the Edison Electric Institute.

Genscape Inc. reported that its aggregate demand sample for Florida, Georgia, Alabama and Mississippi had dropped about 470 MMcf/d Thursday to 9.38 Bcf/d, a 14-day low after averaging 10.19 Bcf/d over the prior two weeks.

“The biggest losses came from Mississippi, where demand fell about 180 MMcf/d d/d to 1.09 Bcf/d after averaging 1.34 Bcf/d over the last two weeks,” Genscape analysts Dominic Eggerman and Josh Garcia told clients Thursday. “Most of the losses came from lower power plant demand.”

The Energy Information Administration (EIA) reported 22.1 GW of nuclear capacity outages Thursday, well above 11.5 GW of capacity outages at this time last year and more than the max of the prior five-year range. The nuclear outages included a 70% capacity outage at Alabama Power’s Farley plant, consistent with the utility’s stated plans to partially power down the facility ahead of Michael’s landfall this week.

In terms of supply, there were signs of Gulf of Mexico (GOM) operators getting underway with restoration activities, Eggerman and Garcia said. Genscape’s daily pipeline production estimate showed GOM output climbing 69 MMcf/d to 1,553 MMcf/d on Thursday, with that number subject to revision.

“Nautilus lifted the force majeure that evacuated personnel from the Ship Shoal 207 platform and shut in the Manta Ray Meter B,” the analysts said. “Previous 30-day average flows onto Nautilus at the Manta Ray Meter B gathering system averaged 204 MMcf/d.”

The Bureau of Safety and Environmental Enforcement reported that 744 MMcf/d (29.1%) of offshore gas production and 680,107 b/d (40.0%) of oil production had been shut in Thursday due to Michael.

Given the expected further gains in production, Transco Zone 4 next-day gas fell 18 cents to $3.145, and Transco Zone 5 dropped 23 cents to $3.115.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |