Volatile Day Ends with NatGas Futures Slightly Higher; Spot Gas Rallies After Canadian Pipe Explosion

Early-morning gains in Nymex natural gas futures were erased later Wednesday as strong cash prices drove buying interest early in the session, while slightly warmer risks in long-range weather models led to selling later in the day.

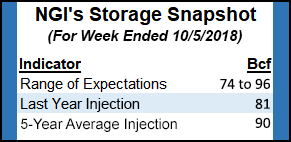

Traders also were looking to Thursday, when fresh storage data was expected to reflect a build that was closely in line with both the year-ago injection and the five-year average injection. The Nymex November gas futures contract settled at $3.284, up 1.8 cents on the day.

Spot gas prices, meanwhile, rose for a third day as the effects of a pipeline explosion in Canada rippled across U.S. markets. The NGI National Spot Gas Avg. climbed 15.5 cents to $3.155.

On the futures front, Wednesday marked the second straight day that the futures curve shifted less than a couple of pennies, although volatility remained intact as the prompt month once again traded in a more than 10-cent range. The November contract was up more than 7 cents just before the open, then climbed to an intraday high of $3.358 before tumbling back down to near its session low.

“The trend has been that the physical market is still incredibly strong; today, those strong Henry Hub prices dragged up the front of the strip between 8 and 10 a.m. ET. However, overnight model guidance stopped adding gas-weighted degree days (GWDD),” Bespoke Weather Services chief meteorologist Jacob Meisel said.

Furthermore, prices have already rallied significantly, and the market is seeing net bearish impacts from Hurricane Michael, which made landfall as a Category 4 storm across the Florida Panhandle midday Wednesday. In addition, liquefied natural gas exports “are off solidly as the storm disrupted shipments from Sabine Pass and though production is off slightly in the Gulf, we expect sizable power demand destruction in the Southeast from power outages. This comes as Canadian imports have recovered, resulting in a looser market,” Meisel told NGI.

Genscape Inc. reported that its cameras detected Sabine Pass Train 1 entering a shutdown. The alert predicted that subsequent nominations to the facility would be revised downward to reflect the operational changes.

Total reported deliveries to the plant were down to 2,328 MMcf/d Wednesday, about 572 MMcf/d below the 14-day average prior to the disruption. Nominations for gas day Oct. 9 on Transcontinental Gas Pipe Line were reduced from 1,164 MMcf/d down to 750 MMcf/d; on Creole Trail Pipeline from 1,160 MMcf/d down to 1,040 MMcf/d; and on Natural Gas Pipeline Company of America from 547 MMcf/d down to 468 MMcf/d.

NatGasWeather characterized Wednesday’s futures action as a sign that prices were getting too far too fast, with $3.33-$3.35 again acting as resistance for the Nymex November contract. Slightly stronger increases were seen in the remaining winter contracts as persistent storage deficits remain a concern in the market. December rose 3.4 cents to $3.332, January climbed 4.3 cents to $3.404, February edged up 4.7 cents to $3.309 and March tacked on 5.3 cents to $3.114.

“Prices could remain choppy until the release of tomorrow’s storage report, where most estimates we’ve seen are clustered around 85-95 Bcf,” the forecaster said.

Indeed, a Bloomberg survey of market participants had a range of 74-96 Bcf, with a median of 92 Bcf. A Reuters poll of 20 market players had a range of 86-96 Bcf, with a median build of 91 Bcf. Bespoke projected a 92 Bcf injection, while EBW Analytics expected a build of 90 Bcf.

Last year, 87 Bcf was injected into storage during the same week, while the five-year average stands at 92 Bcf. Last week, the Energy Information Administration (EIA) reported a 98 Bcf injection into inventories, which as of Sept. 28 stood at 2,866 Bcf, 636 Bcf below year-ago levels and 607 Bcf below the five-year average.

Meisel said that Bespoke’s projected 92 Bcf build for Thursday’s EIA report should be considered bearish for the market overall, as although it falls in line with historical levels, on a weather-adjusted basis, the print is solidly loose to the five-year average. “We saw far more weather-driven demand last week thanks to a very hot Southeast and cold Midwest than typical for the end of September/beginning of October, and yet supply was still impressive enough that I’m looking at a build over 90 Bcf,” he said.

Enbridge Pipe Explosion Cuts Supply While Demand Strong

Spot gas markets continued to rally on Wednesday, with markets across the western United States posting substantial day/day gains after Canadian imports became restricted following an explosion on a critical pipeline out of British Columbia.

Enbridge Inc.’s Westcoast Transmission, near the northern industrial city of Prince George, exploded and caught fire late Tuesday, shutting down the province’s main supply from northern production fields. Downstream utilities in the United States warned of possible disruptions following the explosion despite no damage to their systems.

Both FortisBC and Puget Sound Energy asked customers to conserve natural gas and electricity; Puget Sound indicated it would be switching its electric generation to alternative fuels rather than natural gas.

Genscape reported that as of Wednesday morning, flows through Station 4B South had dropped to 1,473 MMcf/d, about 50 MMcf/d below the prior day. Meanwhile, planned maintenance on TransCanada Corp.’s Alberta system that was set to start Thursday and will limit exports to the United States by roughly 300 MMcf/d added support to already strong western markets.

Operational capacity for flows at the TransCanada Mainline’s interconnect with Foothills B.C. will drop to 2,118 MMcf/d due to planned maintenance on the Western Alberta System Mainline. In the past month, these volumes have averaged 2,449 MMcf/d, so 331 MMcf/d is at risk based on that average, Genscape natural gas analyst Joe Bernardi said.

“Foothills B.C. receives this gas from TC Alberta, flows it through southeastern British Columbia to the U.S. Border at Kingsgate, and delivers it to Gas Transmission Northwest,” Bernardi said.

The maintenance event is scheduled to last through Oct. 20.

Meanwhile, Genscape meteorologists were forecasting temperatures to remain slightly below average in the Pacific Northwest during the next several days, “so there is some potential for upward price pressure in the Pacific Northwest and at Malin to help incentivize alternative flows,” Bernardi said.

Indeed, Malin next-day gas shot up 36 cents to $3.345, with volumes increasing more than 200,000 MMBtu day/day. Kingsgate surged 36 cents to $3.16, with volumes slipping 4,000 MMBtu day/day. Westcoast Station 2 in Canada, meanwhile, plunged more than C$1 to C92 cents/GJ, while volumes tumbled some 334,000 MMBtu day/day.

The cut to supplies lifted pricing points in other producing regions as well. In the Rockies, Transwestern San Juan jumped 51 cents to $2.91, and points along the El Paso Natural Gas system shot up more than 40 cents to average in the low to mid-$2.80s.

Meanwhile, Colorado Interstate Gas (CIG) was expected to shut in the Platte Valley gas processing plant for gas day Oct. 11, which may cut about 450 MMcf/d of receipts, although reroute options may be available, Genscape said. CIG’s “PLATTE VALLEY (NARCO TO CIG)” receipt point will be shut-in as part of a planned expansion project.

While production flows will be shut in at the Platte Valley receipt point, gas could be partially rerouted via the “Lancaster Meter Station.” The Lancaster gas processing plant has two gas processing trains with a combined capacity of 600 MMcf/d, Genscape said.

Western Gas, the owner of both plants, has said they are part of a single complex in Weld County, CO, according to Genscape. “Historical nominations data for the two points suggests that even though the plants seem to process gas in conjunction, drops in nominations at one plant correspond to the other plant taking only 50% of that gas in response,” Genscape natural gas analyst Matthew McDowell said.

Within the last 30 days, Lancaster has averaged 273 MMcf/d and maxed out at 550 MMcf/d back in January 2018. Using these averages, it is possible that Lancaster could take up to 275 MMcf/d of excess gas, leaving 175 MMcf/d to be restricted, McDowell said.

Given the increase in demand thanks to a strong cold front moving through the Rockies and the pipeline restrictions, CIG spot gas rocketed some 30 cents higher Wednesday to $3.25.

Elsewhere, Appalachia points moved higher by the double-digits after federal regulators approved the in-service of another key pipeline out of the region. The Federal Regulatory Energy Commission on Wednesday authorized the greenfield 1.5 Bcf/d Nexus Gas Transmission pipeline to begin service. Dominion South spot gas rose 19.5 cents to $2.78.

Meanwhile, Southeast markets were some of the only pricing points to post declines as the impacts of Hurricane Michael began to take effect. Florida Gas Zone 3 slipped by a half-cent to $3.49, and Transco Zone 3 fell 4 cents to $3.28.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |