Regulatory | Markets | Mexico | NGI All News Access | NGI Mexico GPI

López Obrador’s Pledge to Respect Mexico Contracts Has Canada’s Renaissance Oil Breathing Easy

Renaissance Oil Corp. executives are praising Mexico President-Elect Andrés Manuel López Obrador for committing to respect the validity of exploration and production (E&P) contracts awarded through bid rounds under the current government.

In a Sept. 27 meeting with the Asociación Mexicana de Empresas de Hidrocarburos (AMEXHI), a trade group composed of oil and gas companies with operations in the country, López Obrador “assured private energy executives…that their contracts will not be canceled if they meet existing terms,” Renaissance said late Tuesday.

“Renaissance is reassured by these developments and encouraged that the Mexican government is supportive of the important role international oil companies, like Renaissance, play in the development of the Mexican petroleum industry,” CEO Craig Steinke said.

The Vancouver-based E&P said, “Renaissance continues to make progress on its journey to become a major Mexican producer.”

The meeting appears to have marked a breakthrough of sorts between the oil industry and López Obrador, who opposed the 2013 constitutional energy reform that liberalized the state-dominated energy industry and paved the way for the bid rounds. The president-elect, who takes office Dec. 1, pledged during the campaign to review all 107 contracts awarded through the rounds for irregularities, leading to speculation that he would contest the contracts’ legality or suspend subsequent rounds indefinitely.

The president-elect also has said that he will seek to strengthen national oil company Petróleos Mexicanos (Pemex) by giving it a bigger E&P budget, and by modifying the reform’s secondary legislation to give Pemex more autonomy in choosing its joint-venture partners.

The incoming president “is learning on the job,” Duncan Wood told NGI’s Mexico GPI. Wood directs the Wilson Center’s Mexico Institute. “Or rather, he’s learning before he gets on the job. He’s getting the opportunity to look inside the government’s finances, inside Pemex’s finances. He’s learning about how the oil industry works…

“That’s why meetings like the one last week with the AMEXHI are so important. I think that as the realization dawns on him that there are very limited resources and that Pemex has very limited capacity, he’s going to recognize that the private sector is an essential partner.”

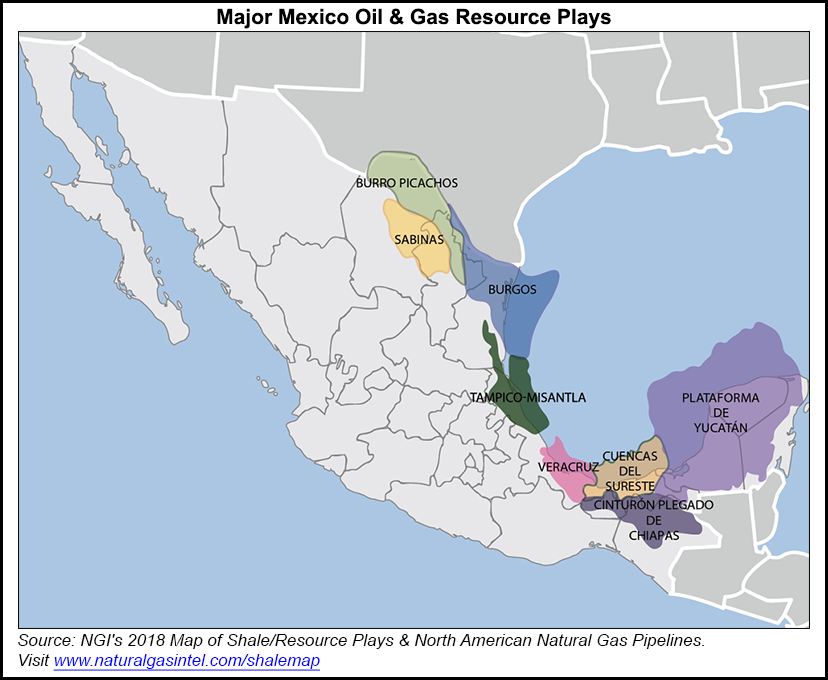

Renaissance won the Mundo Nuevo, Topén and Malva onshore blocks in Chiapas state through the Round One bid process in December 2015, and the Pontón block in Veracruz state through a mature fields auction in August 2016.

The three Chiapas blocks supply all of Renaissance’s hydrocarbon output, which rose sequentially to 1,656 boe/d in 2Q2018 from 1,249 boe/d.

The crown jewel in Renaissance’s portfolio, though, is the Amatitlán block in the prolific Tampico-Misantla Basin, through which Renaissance and its partners are targeting an upper Jurassic shale formation with “characteristics superior to Eagle Ford,” in South Texas, per a September investor presentation. The Jurassic shale at Amatitlán is more than three times thicker than the Eagle Ford Shale in South Texas, and is “potentially the world’s next premier shale play,” the Renaissance presentation said.

The consortium plans to drill its first appraisal well this year at the block, which contains an estimated 5.3 billion bbl of crude oil and 3.6 Tcf of natural gas originally in place.

A 189-page policy document published last month by Mexico’s Comisión Nacional de Hidrocarburos (CNH) stressed the importance of developing the country’s unconventional gas resources in order to reduce dependence on gas imported from the US.

Jaguar-Vista JV Approved

In related news, the CNH approved the acquisition by Vista Oil & Gas of a 50% interest in the CS-01, B-10 and TM-01 blocks from Jaguar Exploración y Producción. Jaguar acquired the onshore assets through the Round 2.2 and Round 2.3 tenders in 2017.

Vista, the first E&P to be listed on the Mexican stock exchange, is helmed by Miguel Galuccio, the former CEO of Argentina’s 51% state-owned oil company, YPF SA. While at YPF, Galuccio oversaw the initial development of the emerging Vaca Muerta formation in Argentina’s Neuquén Basin.

The Jaguar-Vista alliance was first announced in May, and is the first of its kind between two private operators under the terms of the energy reform. Under the agreement, Vista will operate CS-01 and B-10, while Jaguar will operate TM-01.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 |