Shale Daily | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Rigs Exit Texas as BHGE U.S. Count Falls to 1,052

The United States dropped two rigs to 1,052 for the week ended Friday (Oct. 5) on a slowdown in oil drilling activity, including declines in Texas, according to data from Baker Hughes, a GE Company (BHGE).

Total U.S. natural gas rigs held steady at 189 for the week, while domestic rigs in search of oil fell by two to 861. Three directional and three horizontal units exited the patch, offsetting the addition of four vertical units. In total, the domestic rig count ended the week outpacing its year-ago tally of 936 by more than 100 units.

The Gulf of Mexico added four rigs to its tally for the week, finishing at 22. That helped offset the loss of three rigs on land and two from inland waters, BHGE data show.

Canada added four rigs for the week to 182 but remained down from 209 rigs running in the year-ago period. The combined North American rig count finished the week at 1,234, versus 1,145 a year ago.

Among states, Texas posted the largest weekly move, dropping five rigs from its total to finish at 524 (448 a year ago). Meanwhile, Oklahoma and New Mexico each added two rigs for the week. Kansas and Pennsylvania each added one rig, while Alaska, Colorado and North Dakota each saw one rig depart.

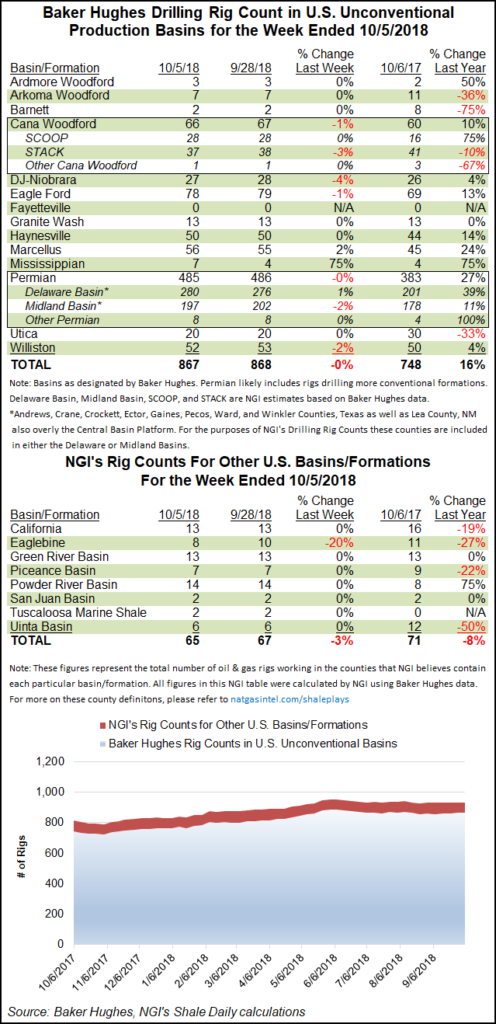

Among plays, the Mississippian Lime nearly doubled its tally by adding three units to end at seven for the week from four a year ago. Other major plays saw small adjustments. The Marcellus Shale saw one rig return to action for the week to end at 56, while the Cana Woodford, the Denver Julesburg-Niobrara, the Eagle Ford Shale and the Permian and Williston basins each dropped a rig.

Also Friday, BHGE released its international rig count for September, which saw the oilfield services company’s tally of active rigs across Latin America, Europe, Africa, the Middle East and Asia Pacific fall by four month/month to 1,004.

The average U.S. rig count for September 2018 was 1,053, up from 1,050 in August, BHGE said. The average Canadian rig count was 201 in September, down from 220 in August.

The worldwide rig count was 2,258 for September 2018, down from 2,278 the month prior but up 177 from 2,081 rigs counted in September 2017.

The slowdown in Texas for the week comes as Permian producers continue to face takeaway constraints amid a ramp-up in output from the U.S. onshore’s most active play. Midstreamers continue to make moves to alleviate those constraints.

Because of “high customer demand” from Permianproducers, Epic Crude Oil Pipeline is expanding the size of its system and moving up the start date, with expectations to begin transport to South Texas by 3Q2019, at least three months sooner than originally anticipated.

The Epic Midstream Holdings LP subsidiary, through a lease agreement, would use a portion of a parallel natural gas liquids (NGL) system now underway by Epic NGL Pipeline.

“Given our recent commercial success and subsequent upsizing of the pipeline, we remain responsive to growing demand for crude oil transportation from the Permian Basin.” said Epic CEO Phillip Mezey. “We are proud to be able to offer an interim solution for our customers, while we continue to build out the EPIC Crude Oil Pipeline to service this region.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |