Volatility Returns; November NatGas Forwards Soar to Highest Levels in Year

Natural gas traders didn’t have to look hard for reasons to drive up forward prices as stubbornly low natural gas storage inventories, delays in service for key pipelines, erratic weather outlooks and a higher-than-usual level of nuclear generation outages caused plenty of jitters mere weeks before the start of winter. November natural gas forward prices rocketed an average 22 cents higher from Sept. 27-Oct. 3, according to NGI’s Forward Look.

Some price points in the West pushed out gains of more than 40 cents during that time as much colder weather was on tap beginning next week, but ongoing pipeline constraints in the Permian Basin kept pricing hubs there at a steep discount to other markets across the country, with Waha and El Paso Permian sporting $1 handles through next summer.

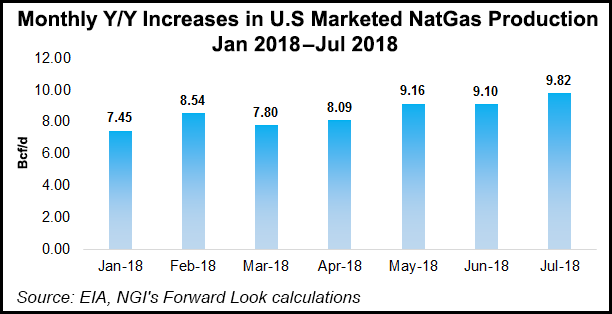

While many market observers had written off natural gas price volatility thanks to robust production growth, which is climbing at a record-breaking pace of about 9 Bcf/d year/year, this week proved wild swings do still exist. Lingering heat in the Southeast and hints of a cold snap by mid-October helped send the Nymex November contract up more than 17 cents from Sept. 27-Oct. 3. The entire winter strip posted similarly strong gains, with the November-March package settling Wednesday at $3.24, a gain of 15 cents on the week.

Storage inventories have been persistently low throughout the injection season, with little improvement just weeks ahead of the peak winter season. But this trend is nothing new, and Barclays Commodities analysts see other “temporary” factors driving the recent rally in the futures market. It is these fundamentals, which include high nuclear outages and warmer-than-normal weather that drove September power burns to a record high, that “have forced the market to come to terms with the storage situation” and brought about a return of volatility to futures.

“While end-October storage forecasts have shifted incrementally lower over the past month, we believe the real impetus behind the Nymex surge is the strength of cash prices in the face of record production growth,” Barclays said.

Because a number of factors supporting the recent strength in the cash market are transitory, analysts think futures have rallied “too much, too soon.” Both cash and futures prices are likely to decline once these fundamentals wear off, but the 10-year storage low ahead of the winter “leaves the market with very little cushion to withstand weather demand swings,” Barclays said.

The market will balance on a knife’s edge in almost any weather scenario this winter, and volatility is likely to increase markedly, according to analysts. In fact, price risks are heavily skewed to the upside based on five weather scenarios the firm ran. It estimates a 30-cent downside risk in a 10% warmer-than-normal winter versus a 61-cent potential upside in a 10% colder-than-normal winter.

“The demise of volatility has been greatly overstated,” Barclays said.

Even though the firm remains bearish versus Nymex futures, it raised its 4Q2018 and 2019 price forecasts to $2.95 and $2.72, respectively, to reflect lower storage inventories. It projects end-of-October gas stocks to sit at 3.25 Tcf.

On Thursday, the Energy Information Administration (EIA) helped calm some fears about supply this winter. The EIA reported a 98 Bcf injection into storage inventories for the week ending Sept. 28, lifting stocks to 2,866 Bcf, which is still 636 Bcf below year-ago levels and 607 Bcf below the five-year average. Broken down by region, the EIA reported a 36 Bcf injection in the Midwest, a 34 Bcf build in the East and a 22 build in the South Central. Some 8 Bcf was injected into salt dome storage, while 14 Bcf was injected into non-salt facilities.

“This eases some of the storage concerns that played a role in the recent run-up in price, especially with a larger salt build,” Bespoke said.

Meanwhile, the recent strength was likely also predicated on continuing silence from FERC regarding approval to flow gas on both the Atlantic Sunrise and Nexus Gas Transmission pipelines, which was increasing perception of market risk for the winter, according to EBW Analytics.

“The market appears increasingly concerned with low early October flow data and FERC’s delay in approving in-service of Atlantic Sunrise and Nexus pipelines. Together, the questions about the supply side have helped bolster the case for increased winter risk premiums,” EBW CEO Andy Weissman said.

However, the Federal Energy Regulatory Commission on Thursday issued an in-service authorization for the 1.7 Bcf/d Atlantic Sunrise project, clearing the way for the critical 186-mile greenfield segment of the pipeline to uncork additional Appalachian volumes by opening another avenue for producers to reach East Coast markets by way of the Transcontinental Gas Pipe Line (Transco) mainline.

Transco previously added interim service associated with the completion of brownfield portions of Atlantic Sunrise, including an incremental 400,000 Dth/d that came online last August, and another 150,000 Dth/d approved to enter service in May. Transco parent company Williams indicated Atlantic Sunrise would begin flowing Oct. 6.

Nexus Gas Transmission still awaits federal approval for in-service.

While the pipeline additions will certainly ease some supply-side concerns, there are other non-storage factors that could wreak havoc on the market this winter, Barclays said. Power demand is expected to increase by 0.8 Bcf/d, while economic growth and new gas-intensive projects bolster industrial demand by a similar amount.

New connections to power plants in Mexico are forecast to push net exports to that country by 0.8 Bcf/d. Liquefied natural gas exports are set to expand 1 Bcf/d as exports are scheduled to start up at Corpus Christi, Sabine Pass Train 5 and Elba Island in 4Q2018/1Q2019. In total, demand is forecast to grow by about 1.5 Bcf/d this winter, according to Barclays.

On the other hand, gas production is climbing at a record-breaking pace of about 9 Bcf/d year/year, and further gains are expected in the coming months. The firm expects production growth to total nearly 7 Bcf/d year/year.

It cautioned, however, that if production growth falls short of its forecast by 2 Bcf/d, for example, the resulting higher call on storage withdrawals would trim its end-March storage forecast to 1.2 Tcf, “which would put considerable upward pressure on prices.”

Production growth expectations, however, are not the same as gas in storage, Barclays said. Low temperatures can cause production freeze-offs, which can drastically reduce output — and jack up prices — in the immediate term. Associated gas wells, with their higher liquid content, are particularly prone to freeze-offs, the firm said. That’s where the volatility comes in.

Western Pricing Strong as Heating Demand Rises

Forward curves across the western United States posted some of the largest increases during the Sept. 28-Oct. 3 period as a slew of pipeline maintenance events and lingering heat drove demand to unseasonably strong levels. And while weather outlooks show milder weather on tap for the remainder of the week, much cooler conditions were beginning to build for the second week of October.

“The West continues to cool as weather systems arrive, including showers into California as a weather system arrives off the Pacific, with a colder one over the Rockies. Colder systems are expected into the West next week for stronger heating needs as lows drop below freezing over many states with areas of higher elevation snowfall,” NatGasWeather said.

Indeed, a storm is set to tap into a plunge of fresh cold air and unleash the first widespread snowstorm of the season from parts of Utah and Colorado to Montana, Wyoming and the Dakotas spanning Sunday to Tuesday, according to AccuWeather.

Small-scale storms have brought accumulating snow in recent weeks to parts of the northern High Plains and Rockies, including the Black Hills of South Dakota and the Bighorn Mountains of Wyoming and Montana. This storm, however, has the potential to span more than 500 miles, the forecaster said.

“While the exact orientation of the swath of heaviest snow will depend on the track of the storm, there is the potential for some of the high country in the region to receive a foot of snow. At this time, the most likely swath of heavy snow is forecast from the Wasatch Range and parts of the central and northern Rockies to the northern High Plains,” AccuWeather senior meteorologist Alex Sosnowski said.

It is possible the storm comes together farther south, which may bring heavy snow to the Rockies in central Colorado, including the chance of snow in Denver. A more southward shift with the storm may cause less or no snow to fall on parts of Montana, northern Wyoming and the Dakotas, he said.

Given the early cold snap, strong gains were seen across the region. Northwest Sumas November shot up 39 cents from Sept. 28-Oct. 3 to reach $2.765, while the November-March strip jumped 23 cents to $2.94. The summer 2019 package was up 11 cents to $1.75, according to Forward Look.

CIG November climbed 33 cents to $2.504, the winter strip (November-March) rose 21 cents to $2.62 and the summer 2019 tacked on 11 cents to $1.92. In California, ongoing pipeline restrictions and storage limitations lifted SoCal Citygate November prices up 62 cents to $4.325, while the winter strip jumped 28 cents to $5.22 and summer 2019 edged up 9 cents to $3.37.

Prices in the country’s midsection also strengthened considerably during the week, although for that region, it was cooling demand that sent prices higher as daytime temperatures continued to hit the upper 80s and lower 90s. Panhandle Eastern November was up 33 cents from Sept. 28-Oct. 3 to reach $2.566, winter was up 25 cents to $2.67 and summer 2019 was up 11 cents to $2.02.

At NGPL Midcontinent, November moved up 38 cents to $2.551, the winter strip rose 29 cents to $2.64 and summer 2019 increased by a dime to hit $2.03, Forward Look data show.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |