EIA Reports Larger-than-Expected 98 Bcf Storage Injection; November NatGas Drops

After a substantially bullish storage report last week, the Energy Information Administration (EIA) flipped the script as it reported a 98 Bcf build into storage inventories for the week ending Sept. 28, beating some low-ball estimates by more than 20 Bcf but still coming in within the larger range of expectations.

The Nymex November natural gas futures contract was already trading about 4 cents lower just ahead of the EIA’s 10:30 a.m. ET release, but then fell another couple of cents to around $3.17 as the print hit the screen. By around 11 a.m., the prompt month had bounced back a bit to trade at $3.181, down about a nickel on the day.

The EIA’s reported 98 Bcf injection was a full 10 Bcf above Bespoke Weather Services’ projection. “This comes after a 14 Bcf smaller injection last week, and in this regard, we see what may be an implicit revision following last week’s very tight print.”

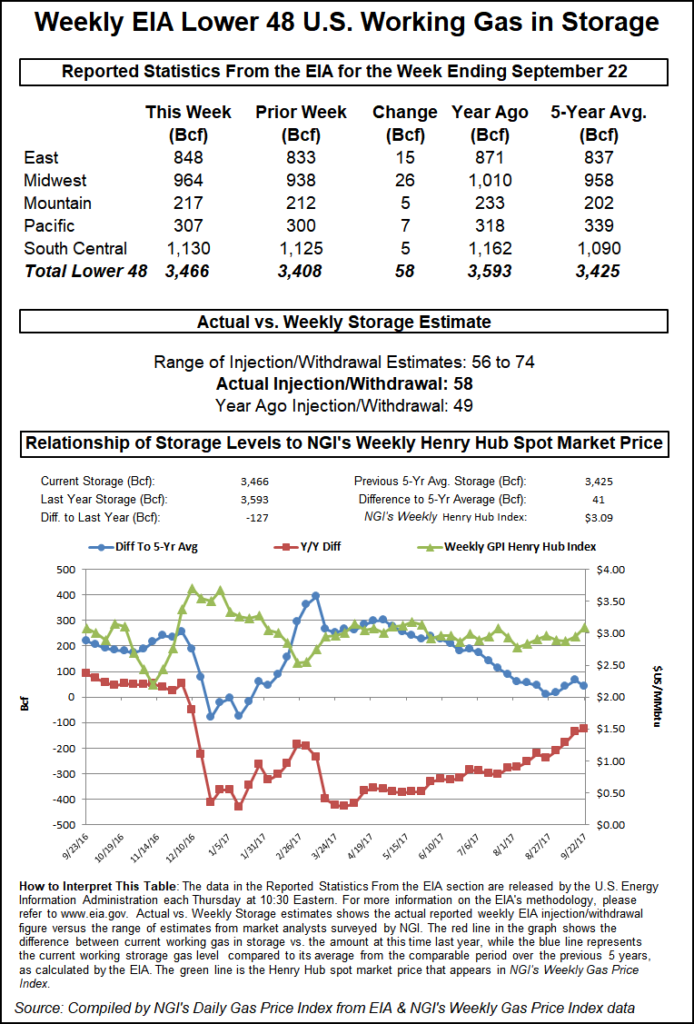

With the 98 Bcf build, inventories stood at 2,866 Bcf, 636 Bcf below year-ago levels and 607 Bcf below the five-year average. Broken down by region, the EIA reported a 36 Bcf injection in the Midwest, a 34 Bcf build in the East and a 22 build in the South Central. Some 8 Bcf was injected into salt dome storage, while 14 Bcf was injected into non-salt facilities.

“This eases some of the storage concerns that played a role in the recent run-up in price, especially with a larger salt build,” Bespoke said.

Even with Thursday’s build, however, salt dome storage remains at a 120 Bcf deficit to year-ago levels and a 107 Bcf deficit to the five-year average. But Wood Mackenzie natural gas analyst Gabe Harris questioned whether it was necessary for inventories to recover to historical highs given the rampant production growth in the United States.

“The long-haul pipes from these high deliverable facilities” to the Northeast and Midwest “are not crucial anymore with production going through the roof,” he said.

Another market observer agreed, saying that salts play less of a role in balancing winter demand today as Northeast production has the ability to ramp up and down daily to match price/demand. “I’ve see production in 2017 jump by almost 1.2 Bcf/d in a matter of three days … as demand and cash prices rocketed higher.”

Instead, salts are needed just to balance supply/demand in the Southeast quarter of the country as little wind there and plenty of coal retirements have left the Southeast “as one of the best places” for natural gas demand growth, Harris said.

Meanwhile, bearish pressure was building in the market as the Federal Energy Regulatory Commission approved service on the Atlantic Sunrise project Thursday, and weather outlooks turned slightly less supportive.

“However, cash prices above $3.25 keep us skeptical prices move down in a straight line. Rather, the loosening and bearish risks we see are getting realized, and bounces above $3.20 are stronger shorting opportunities,” Bespoke said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |