NatGas Futures Shoot Higher on Bullish Storage Surprise; Spot Prices Fall on Softer Demand

A major bullish surprise from the Energy Information Administration’s (EIA) weekly storage report helped spark a natural gas futures rally that saw the bulls regain the momentum they’d lost a day earlier. In the physical market, a drop-off in cooling load hammered prices in the Northeast and Appalachia; the NGI National Spot Gas Average fell 21 cents to $2.53/MMBtu.

The November Nymex futures contract added 7.6 cents to settle at $3.056 Thursday, reversing a 7.8 cent sell-off from the day before. The prompt month traded as high as $3.111 as it rode a wave of momentum following the 10:30 a.m. ET release of a leaner-than-expected storage build.

As EIA’s latest inventory report pushed the year-on-five-year-average deficit to well over 600 Bcf, the market busied itself pricing in a little more upside risk along the winter strip. December added 7.3 cents to $3.135, while January settled at $3.214, up 6.9 cents on the day. Gains were more muted for February (up 2.8 cents) and March (up 1.0 cent).

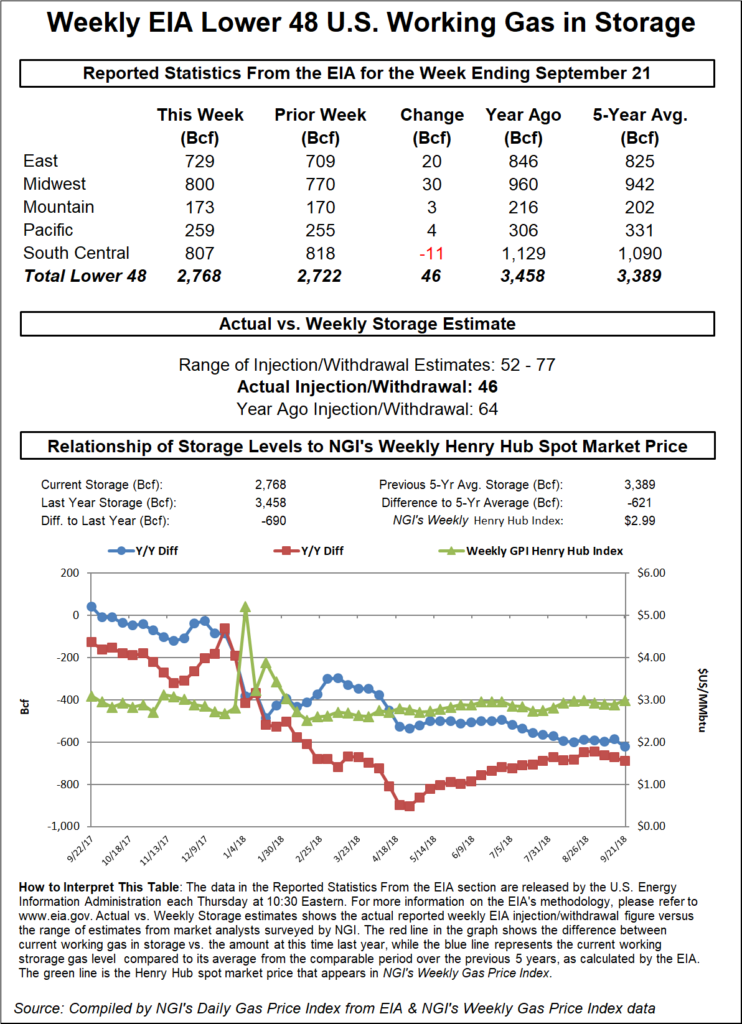

The EIA reported a 46 Bcf build into Lower 48 gas stocks for the week ended Sept. 21, compared to a five-year average build of 81 Bcf and a 64 Bcf build recorded a year ago.

Prior to the report, the median from a Bloomberg survey of traders and analysts had keyed in on a build of 61 Bcf. Intercontinental Exchange (ICE) EIA financial weekly index futures had settled Wednesday at an injection of 52 Bcf.

The bullish miss featured an 11 Bcf pull from salt stockpiles in the South Central region. The report period saw strong spot prices in the Gulf Coast and Southeast coinciding with hot temperatures and reports of above-average nuclear outages in the aftermath of Hurricane Florence.

Last week the average day-ahead price at Transco Zone 5 climbed as high as $3.38, while Henry Hub crested the $3 mark by mid-week (Sept. 19 trade date), Daily GPI historical data show.

“We had seen very impressive power burns last week that rallied the market, and clearly the market had not” priced in the full extent of the tighter burns, Bespoke Weather Services said. “Nuclear outages helped spike burns, and demand destruction from Hurricane Florence was far less than expected. We view the tightening in this print as a relatively one-off event; next week’s print is expected to be solidly looser as we have seen burns ease off,” along with a decline in liquefied natural gas exports and higher Canadian imports.

“Still, this print is bullish enough to emphasize storage shortages and keep a bid under prices; a reversal off $3.07-$3.10 seems most likely.”

Total working gas in underground storage as of Sept. 21 stood at 2,768 Bcf, putting inventories 621 Bcf (18.3%) below the five-year average with only a few weeks left in injection season. Year-ago inventories stood at 3,458 Bcf, according to EIA.

The Midwest recorded the largest weekly net injection among regions at 30 Bcf, followed by the East at 20 Bcf. The Pacific injected 4 Bcf, while the Mountain region injected 3 Bcf for the week, according to EIA.

Meanwhile, as the start of winter heating season looms, the market’s expectation for end-October inventories declined again Wednesday, according to ICE end of storage index futures, which dropped 15 Bcf day/day to settle at 3,268 Bcf. That’s down nearly 30 Bcf from the Sept. 20 settlement.

Such a large natural gas stockpile deficit entering the heating season will mean very different things to physical versus financial market participants, according to global consulting firm Energy Aspects.

“The theme for this upcoming heating season’s cash market will be deliverability versus availability,” analysts with Energy Aspects said in a winter outlook published this week. “The market has long been complacent about the forecast shale-era low storage carryout for end-October given record-high production and expectations of another deluge of supply this winter.

“However, cash value will be determined by getting gas to where it is needed at the time it is needed…As we have previously underscored, a 3.3 Tcf-type end-October carryout may not be of concern to financial market participants, which view our expected 7.0 Bcf/d plus year/year supply gains as a type of ”latent’ storage, but it certainly will be concerning for physical players.”

Starting winter at below 3.3 Tcf would mean end-March inventories at just under 1.5 Tcf, assuming 10-year normal weather and no wellhead disruptions such as those observed in recent winters, according to the firm.

“Superimposing a 5% colder-than-normal scenario underscores the weather-risk that comes with such a carryout,” Energy Aspects said. Adjusting for residential/commercial “and industrial heating increases, power load increases and price-related givebacks in the power sector as well as winter wellhead disruptions and an uptick in net trade with Canada, such a scenario puts end-March storage near 1.0 Tcf and would spur winter prices toward $3.20-3.40.

“However, a 5% milder-than-normal scenario would start to make balances feel loose, pushing inventories toward 1.8 Tcf, with price reverberations through the winter and into injection season 2019.”

Turning to the spot market, locations throughout the Northeast and Appalachia posted heavy losses Thursday coinciding with a falloff in cooling demand along the East Coast and various maintenance events in the region. Radiant Solutions was calling for mild temperatures to close out the week along the Interstate 95 corridor, with highs from Washington, DC, to Boston only reaching the 60s and 70s.

Transco Zone 6 New York dropped $1.05 to average $1.80, while Algonquin Citygate shed 34 cents to $2.89.

Further upstream in Appalachia, Dominion South plunged 77 cents to $1.39, its lowest average day-ahead price in almost a year. Millennium East Pool fell 92 cents to 86 cents amid reports of maintenance affecting flows through Millennium Pipeline Co.’s Wagoner East throughput meter.

“There is still some ongoing maintenance in Appalachia that is bearish on producers, but the biggest” driver of spot price declines Thursday appeared to be a “massive drop in weather driven demand,” Genscape Inc. analyst Josh Garcia told NGI. Cooling degree days “fell by around 8 degrees day/day across the Northeast. Even in New England, current mainline restrictions on Algonquin Gas Transmission are the biggest driver in basis support, but power demand is very low.”

In West Texas, prices eased as Permian Basin producers could be impacted by another maintenance-related constraint on northbound flows through NGPL. El Paso Permian fell 14 cents to $1.30.

“NGPL issued a force majeure restricting 27 MMcf/d of flow through Compressor Station 168 located on NGPL’s ”STATION 167 TO STATION 112’ segment near Bailey County, TX,” Genscape analyst Matthew McDowell told clients Thursday. The event began Wednesday and was expected to last through Friday.

“NGPL’s critical notice stated northbound flows could be reduced to 75% of scheduled maximum daily quantity,” McDowell said. “Last week, a force majeure at the same location restricted operating capacity to 273 MMcf/d, while flows outside of the force majeure averaged 300 MMcf/d.”

In the West, prices eased throughout California and the Rockies as storage restrictions could prove bearish for gas demand. SoCal Citygate gave up 5 cents to $3.65, while SoCal Border Average tumbled 37 cents to $2.18.

Earlier this week, Southern California Gas (SoCalGas) announced that it’s approaching maximum inventories and will stop allowing injection nominations on its system starting next month.

SoCalGas inventories sit at just under 81 Bcf, the highest level since the 2015 leak at the Aliso Canyon storage field and just shy of current working maximum inventories, according to Genscape analyst Joe Bernardi.

“The current maximum has been achieved in large part due to the increased working capacity at Aliso Canyon that took effect this past July,” Bernardi said. “In addition, decreased demand has contributed to increased injections as the region has experienced a milder September month-to-date than in recent years.

“Demand has averaged 2.08 Bcf/d month-to-date in September 2018, compared to 2.39 Bcf/d last year and 2.48 Bcf/d across the past three years. Meanwhile, average injections are within 5 MMcf/d of last September’s average. The lack of September heat has also allowed prices to remain less volatile” at SoCal Citygate than they’ve been in recent months amid storage and import restrictions on the SoCalGas system.

Points throughout the Rockies dropped by double digits Thursday, including Northwest Wyoming Pool, which fell 28 cents to $2.04.

Northwest Pipeline (NWPL) is scheduled to start annual maintenance Monday at the Jackson Prairie storage facility that could limit its balancing flexibility over the next two weeks, according to Bernardi.

“Jackson Prairie will be shut in for annual reservoir testing and maintenance” starting Monday and continuing through Oct. 12, Bernardi said. “NWPL normally performs this work each year when net transactions are beginning to switch from injections to withdrawals. Current inventory is around 23 Bcf, which is only about 1.5 Bcf below the maximum working capacity, and is more than 0.5 Bcf higher than the five-year average for this date.

“Considerably mild weather is forecasted for the Pacific Northwest for the first part of this maintenance,” which over the last several years has not corresponded with any notable price movements “even when it occurs during times of colder-than-average weather,” according to the analyst.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |