Markets | NGI All News Access | NGI The Weekly Gas Market Report

NatGas Forwards Sept. 20-25 Rally Begins to Show Signs of Cracks

There was a growing number of $3 handles for October natural gas during the Sept. 20-25 period as temperatures remained well above seasonal averages in markets that aren’t used to running air conditioners in the fall, delaying substantial improvements in an already dire storage situation. Meanwhile, weather outlooks for early October showed signs of early heating demand, although forecasts have since moderated.

October forward prices rose an average 9 cents during that time, but gains of 15 cents or more were not uncommon, according to NGI’s Forward Look. Appalachian pricing hubs ended the week in the red, however, as federal regulators have yet to approve the in-service of two long-awaited natural gas pipeline projects. The market expects approval for those startups any day now.

Nymex futures led the charge as the October contract has been on a tear since last week. The prompt month ratcheted up another 10 cents-plus during the four days leading up to Tuesday’s settle at $3.082. November was up 9 cents to $3.058, and December was up 10 cents to $3.129.

Much of that increase occurred on Monday as traders responded to relatively small storage injections over the Sept. 22-23 weekend, as well as early strength in the spot market, according to Mobius Risk Group. Upward momentum was sustained as mid-day weather model runs reintroduced the idea of cooler-than-normal temperatures in the northern tier of the country.

The latest weather outlooks, however, have since moderated and heating demand looks to run more consistently below average through the next couple of weeks with weaker cold shots being confined to the Upper Midwest, Bespoke Weather Services said. The Nymex October contract went on to expire Wednesday at $3.021, down 6.1 cents on the day. November dropped 7.8 cents to $2.98.

Moving through the beginning of October, it becomes increasingly difficult to get more than five to six population-weighted cooling degree days per day, and with limited heating demand, that tends to cap gas-weighted degree days (GWDD) overall, the forecaster said. This fits with expectations well, and atmospheric conditions and upstream tropical forcing favor more sustained ridging across the East into Week 3 that will keep the bias warmer.

“Though over the coming week, it helps GWDDs actually run a bit above average still” and by Week 2, it quickly becomes rather bearish, “and turns even more so into Week 3,” Bespoke chief meteorologist Jacob Meisel said.

Still, the price surge during the last two weeks has caught some in the market off guard, despite persistent warning signs of a deteriorating storage picture throughout the summer in the face of strong power demand. Henry Hub has remained range-bound below $3 for most of the year due to excess production capacity in the Marcellus Shale and other plays.

But as power consumption has grown to become a bigger slice of the daily natural gas demand pie, summer is showing greater excitement for the market, Morningstar Commodities Research said. Although natural gas traders traditionally have viewed winter as the “exciting season” due to added heating demand, power demand now is having a similar effect in the summer cooling season. And that summer power footprint is growing, according to Morningstar power and natural gas associate Dan Grunwald.

“The current summer is on pace to set a new natural gas power demand record. The average of the previous five years was 27 Bcf/d with the maximum just over 30 Bcf/d. This summer, we are on pace to beat 30.5 Bcf/d,” he said.

In fact, weekly storage withdrawals were seen during the summer of 2016, but higher demand now raises the possibility of increased withdrawals in the summer months going forward. If this trend of two demand seasons in winter and summer continues, then the shoulder seasons in the spring and fall will need to become heavier and more concentrated storage injection periods to make up the deficit, Grunwald said.

As for Thursday’s Energy Information Administration (EIA) report, most estimates were wide ranging in the 50 to 60 Bcf range, although one high-ball estimate extended into the 70 Bcf range. Kyle Cooper of IAF Advisors projected a 52 Bcf injection, Bespoke expected a 60 Bcf build and EBW expected a 62 Bcf build.

Last week, the EIA reported an 86 Bcf injection into storage inventories for the week ending Sept. 14, lifting stocks to 2,722 Bcf, about 20% below year-ago stocks of 3,394 Bcf and around 18% lower than the 3,308 Bcf five-year average.

Longer term, Morningstar researchers see a clear signal that production is growing and should be able to meet demand. “If reserve numbers hold, natural gas production will keep prices low and the forward curve backwardated for years out for the time being,” Grunwald said.

Indeed, some market observers see a pullback in pricing occurring relatively soon. EBW Analytics said that while additional price strengthening is possible, the more likely scenario suggests that as a price ceiling forms, “shorts” establish positions, production rises and the market may face consolidation by as soon as next week.

The “market has proven sensitive to rising production thus far” in the 2018 injection season, EBW CEO Andy Weissman said. Recent data has Lower 48 production fluctuating on either side of 80 Bcf/d.

Still, the winter contracts may be in for a period of heightened volatility. “If a winter storage squeeze appears more likely — as the past week of colder outlooks and delayed pipelines indicates — prices can jump sharply,” Weissman said.

Last year, a brief period of very cold weather pushed up the February 2018 contract to roll off the board at $3.63/MMBtu, a full $1 above the March 2018 contract price once storage adequacy concerns faded.

Surging production has loosened the supply/demand balance over the past year, but current projections point to the lowest early-November storage level since 2005. “Although end-of-season storage is at a new low, the weather-normalized supply/demand balance has shifted 3.5 Bcf/d looser” for the upcoming winter relative to the winter 2017-18, Weissman said.

After normalizing for price and weather, the winter gas market averages out to 3.5 Bcf/d looser year-over-year in the most-likely production scenario. Over the course of the winter, this equates to an incremental 525 Bcf available to market relative to year-ago levels, according to EBW.

Therefore, on paper, the anticipated early-November storage deficit of 500 Bcf is almost exactly offset by anticipated looser supply/demand balance for the upcoming winter. Still, the “quality” of supply available to the market is lower as relying on production growth is riskier than having gas waiting in storage, according to Weissman.

“The risk of potential supply disruptions — for example, from freeze-offs if temperatures get cold enough — may compound supply concerns and is likely reflected in higher prices,” he said.

Appalachia Pricing Depressed

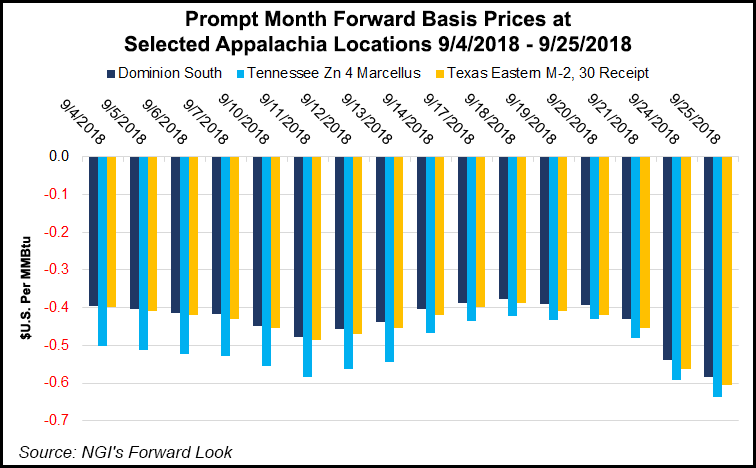

While the majority of pricing hubs across North America posted gains similar to that of Nymex futures, Appalachia points dropped anywhere from 5 to 10 cents as regional supply waits for new takeaway to hit the market.

Specifically, Transcontinental Gas Pipe Line’s (Transco) 1.7 Bcf/d Atlantic Sunrise expansion project and the 1.5 Bcf/d Nexus Gas Transmission continue to await final FERC approval to begin service.

Earlier this month, the U.S. Court of Appeals for the Third Circuit rejected a challenge filed by environmental groups against Atlantic Sunrise’s Section 401 Water Quality Certification (WQC) issued under the Clean Water Act by Pennsylvania. The challenge was the latest in a string of legal challenges the project has endured since FERC issued a certificate for the project in February 2017.

About 550 MMcf/d of capacity on the project has already been placed into service. Atlantic Sunrise would create an additional path for constrained gas in northeast Pennsylvania to reach markets in the Mid-Atlantic and Southeast via the Transco mainline that runs along the Atlantic seaboard.

Until final approval from the Federal Energy Regulatory Commission, however, “new supply continues to be kept off the market, supporting the recent run-up in futures” but dampening the local pricing hubs in the producing region.

“We anticipate both pipelines will be given official approval to commence service as of Oct. 1st, potentially driving a large increase in production for October,” EBW said.

Dominion October tumbled 9 cents from Sept. 20-25 to reach $2.45, while November slipped 3 cents to $2.525. The winter 2018-2019 strip was flat at $2.60, while summer 2019 fell 3 cents to $2.08, according to Forward Look.

Tennessee Zone 4 Marcellus October was down a dime to $2.446, but November shed only a penny to $2.576 and the winter 2018-2019 strip rose 2 cents to $2.62. Summer 2019, meanwhile, was down 3 cents to $1.94.

Maintenance on the Millennium Pipeline led to decreases there. Between Sept. 27 and Oct. 19, Millennium was set to to perform the MPC Huguenot loop tie-ins. For the first two days of the event, capacity through the Wagoner East (Orange County, NYC) throughput meter was to be limited to a capacity of 546 MMcf/d; capacity would be reduced to 585 MMcf/d for the remainder of the event.

This represents cuts of 157 MMcf/d and 118 MMcf/d, respectively, according to Genscape Inc.

While the work sent prices lower at Millennium East Pool, it had a bullish effect on Algonquin Citygate prices, as Algonquin Gas Transmission has already begun their Stony Point to Oxford maintenance event, cutting 0.5 Bcf/d of mainline flows, according to Genscape natural gas analyst Josh Garcia.

Algonquin Citygate October rose 7 cents from Sept. 20-25 to reach $3.544, November climbed 5 cents to $3.779 and winter 2018-2019 jumped 11 cents to $8.31, Forward Look data show. Other Northeast points were only marginally higher for October.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |