Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Bakken Expected to Set More Production Records into 2020s

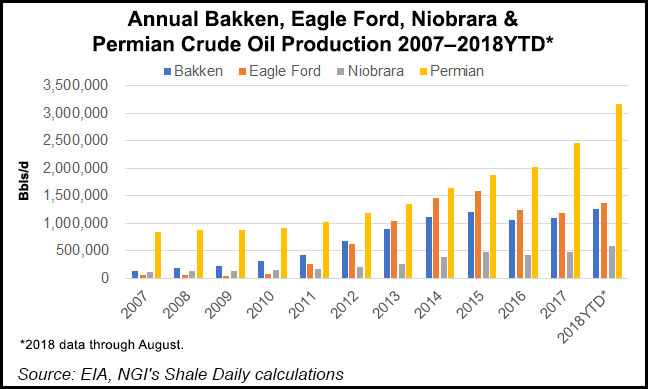

Even with some inherent geographical and financial disadvantages, the Bakken/Three Forks Shale play in North Dakota should see continued production growth of up to 1.5 million b/d by 2024 and another $40 billion in investments between now and then, according to an analysis released by Wood Mackenzie.

Report author Pablo Prudencio, who focuses on U.S. unconventional plays, described the Bakken in the Williston Basin as having made a “comeback,” with the recent announcement that it set a new all-time daily production level in July of 1.27 million b/d.

“Our view is that today’s record-setting production will continue to grow and peak around 1.5 million b/d in 2024, and that is of course driven by our view on oil prices,” Prudencio told NGI’s Shale Daily, adding that the production will then plateau for a number of years before going into decline.

Three main factors have contributed to the Bakken’s rebound, according to the analysis: higher oil prices, improved transportation, and the “absolutely more productive wells” that are now “drilled much faster, and all of that contributes to keeping down costs.”

The Wood Mackenzie report was released as local news media reports from the North Dakota Petroleum Council’s annual conference said Bakken reserves are now estimated at 30-40 billion boe. Continental Resources President Jack Stark called the new estimates “technically sound.”

The report highlighted five takeaways.

What Prudencio described as a “comeback” has been driven by operators investing nearly $5 billion in the Bakken this year with lower acquisition costs than the Permian and fewer risks.

“Activity levels in this mature basin — by both legacy independent and private-equity-backed operators — have increased in recent months,” he said.

The outlook is optimistic, but not as bullish as those of state energy officials who in the past have talked about eventually getting to 2 million b/d of oil production and three-quarters of the Bakken’s overall reserve potential still being ahead. “There certainly are many more years of production coming,” Prudencio said. “Production will not stop in 2024, but it will peak and then keep going for a long time.

“However, the way we model it, at the point of peaking, a lot of what is defined as core acreage of the most productive wells will start to be depleted and operators will have to begin moving to tier two-type acreage that is typically less productive, and more wells will be needed to fight that production decline.”

In terms of gas capture and flaring, the Wood Mackenzie study “doesn’t see any big issues,” Prudencio said. There are sufficient gas processing plants in line to be built, and if they come online as expected, state gas capture goals should eventually be met.

As a global commercial intelligence firm in the natural resources sector, Wood Mackenzie factors innovation and efficiency improvements into its analytical work, and Prudencio indicated that the firm sees that factors as an important element in the Bakken’s continued development. “We model the average well performance in the different parts of the play, and refresh those models very frequently,” he said. “Over the past few years, for sure, we have noticed the productivity improvements.”

New wells today are much more productive than they were a few years ago. Prudencio said a major contributor is the improved completion designs that operators “have been perfecting by using more water and more proppant and other technologies.”

Prudencio also discussed two other issues affecting the Bakken — financial attractiveness and competition for capital, along with North Dakota’s geographic location, far from the country’s heavily-populated areas and, in particular, the refineries and export operations of the Gulf Coast.

Acknowledging that the Permian Basin is currently the premier play drawing a lot of capital investment, Prudencio said that may have an effect on future Bakken development. But he noted that two private equity (PE) operators entered the Bakken last year, Rim Rock Oil and Gas and Bruin E&P Partners LLC. “Typically the PE operators are focused on a single basin, so internally those companies don’t have to make a decision between the Bakken and another basin,” he said.

But more generally, Wood Mackenzie sees competition for capital being an issue, particularly with the Permian’s huge draw, Prudencio said.

In terms of North Dakota’s remote location, he said historically the Bakken has been disadvantaged because of the transportation situation favoring rail over pipelines. “Today there have been expansions and there is plenty of pipeline takeaway and that has helped the basin’s economics a lot by lowering transportation costs,” Prudencio said.

But he also acknowledged that one of the reasons Wood Mackenzie forecasts a Bakken peak at 1.5 million b/d is the fact that there are ultimate limits on transportation from the isolated region. “Once you exceed the 1.5 million b/d rate, a lot of the additional production would need to be moved by rail, and that obviously becomes a disadvantage at that point.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |