Natural Gas Futures Find Further Momentum as Summer’s Remnants Boost Cash

With the leaves turning and the natural gas futures market starting to look ahead to winter, Monday’s breakout run found further upside momentum Tuesday even as forecasts haven’t seemed particularly inspiring for the bulls. In the spot market, lingering above-normal cooling demand helped lift prices along the East Coast; the NGI National Spot Gas Average added 9 cents to $2.74/MMBtu.

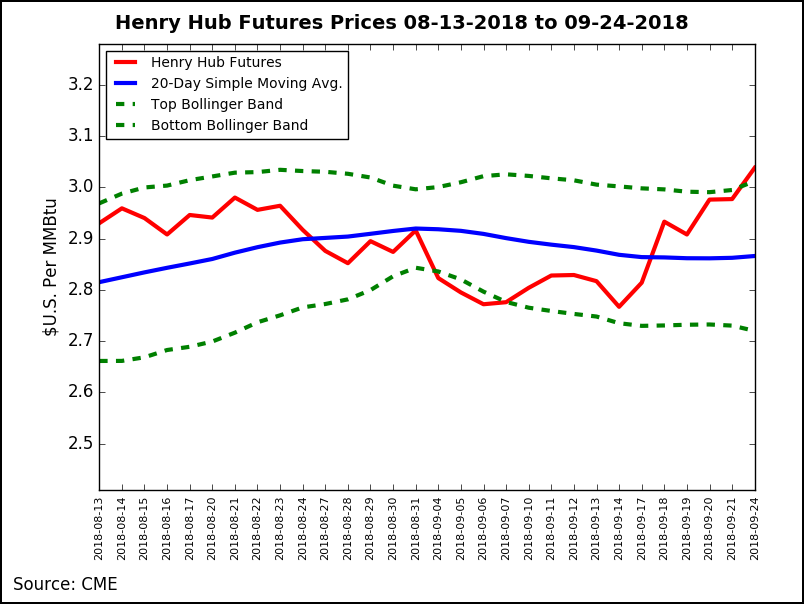

The October contract, set to expire Wednesday, added 4.4 cents to settle at $3.082 after trading as high as $3.087. Gains were more muted further along the strip. The November contract added 2.9 cents to settle at $3.058. January settled at $3.209, up 3.0 cents on the day.

Tuesday’s gains brought the November contract closer to a band of resistance from $3.096-3.119 pegged by ICAP Technical Analysis analyst Brian LaRose “as the highest levels consistent with any corrective structure off the lows.”

From a technical standpoint, “it is reverse or else for the bears,” LaRose said late Monday. “…If the bears can somehow carve out a top (right now that does not look promising) there is still a chance natural gas slides back down to the $2.704 neighborhood. No reversal, no top. Looking for a run to $3.220-3.227-3.258 next in this case.”

The midday Global Forecast System (GFS) data Tuesday added some demand for the upcoming weekend but maintained milder trends to drop demand expectations for next week, according to NatGasWeather.

“The GFS was also quite a bit milder across the northern U.S.,” with the period from Oct. 5-8 likely to lose numerous heating degree days (HDD), the firm said. “The GFS still sees cool blasts into the northern U.S., just more over the Rockies and Plains instead of the Midwest and further eastward.” The latest GFS is now “closer to the milder” European model that had been more bearish for the period heading into Tuesday’s session.

To help explain the continued buying in the futures Tuesday, Bespoke Weather Services pointed to “extraordinarily strong cash prices…as cooling demand remained very strong for the time of year and nuclear outages continue to sit far above the five-year range.

“The market is still rather tight, as rapidly tightening demand last week helped precipitate a rally along the entire front the strip,” Bespoke said. “However, we are increasingly confident that prices will set a short-term high this week, as the first signs of demand-side loosening became more apparent today and production continued to set record highs…

“Weather-adjusted burns were revised slightly looser” on Monday “and did not appear particularly impressive” Tuesday, “indicating we should really see demand fall off into the end of the week as heat temporarily fades.”

Recent guidance showing limited heating demand over the next two weeks, combined higher Canadian imports and weaker liquefied natural gas exports because of Dominion Cove Point maintenance, could limit upside for prices, according to the firm.

In the spot market, next-day physical deliveries at Henry Hub climbed 9 cents to $3.13, leapfrogging the expiring October contract and setting the tone for gains throughout much of the Gulf Coast and Texas.

“Lower 48 power burns are poised to make what may be their last push of the summer strip this week, drawing near to a close on a record-setting summer,” Genscape Inc. senior natural gas analyst Rick Margolin told clients Tuesday. Even though Lower 48 cooling degree days (CDD) “are decreasing, they are forecast to remain well above normal through the weekend.”

Tuesday’s forecast was showing CDDs running close to 63% above normal for Wednesday, “driven primarily by heat in the Northeast, Southeast and Southwest,” according to Margolin. Genscape’s supply and demand estimates showed Tuesday’s power burns at around 31.5 Bcf/d, with burns expected to stay up around 30 Bcf/d through next Tuesday (Oct. 2).

That’s comparable to year-ago burns, but both 2017 and 2018 totals exceed the prior three-year average by almost 3 Bcf/d, Margolin said.

“Burns may receive additional support from nuclear outages. Outages have climbed to about 16 GW with about 13 plants throttled down (including the recently retired Oyster Creek facility),” Margolin said. “Actual outages are coming in about 5 GW higher than had been scheduled back in August, though planned outages are expected to continue climbing into October and peak around 19.3 GW on Oct. 21.

“Looking a bit farther out, though, burns enter their typical seasonal decline, and net HDDs have started to appear at the tail end of the forecast, starting Oct. 8.”

Along the East Coast, a number of points strengthened Tuesday as forecasts were calling for above normal temperatures to move in along the Atlantic seaboard. Radiant Solutions called for highs to reach the 80s Wednesday in major cities including Atlanta, Boston, New York and Washington, DC.

Transco Zone 6 New York added 10 cents to $3.02, while further south Transco Zone 5 picked up 6 cents to average $3.19.

Further upstream in Appalachia, prices were mixed as Dominion South fell 16 cents to $2.07. Going back to last week, Dominion South cash basis has weakened close to 60 cents over the past three trading days, with day-ahead prices averaging more than $1 back of Henry Hub as of Tuesday. That’s the weakest Dominion South basis has been since Jan. 16, when Henry Hub averaged $5.09, $1.42 higher than the Appalachian point, Daily GPI historical data show.

The recent weakening at Dominion South splits the difference between woeful basis differentials in the negative $1.50-2.00 range there last September and what has generally been much-improved pricing for Appalachian producers in 2018.

“For the first time in five years, takeaway expansions are outpacing Northeast production growth,” RBN Energy LLC analyst Sheetal Nasta said earlier this week. “Major natural gas takeaway capacity additions on large-diameter pipes…over the last couple of years are allowing Marcellus/Utica shale producers to send record amounts of gas supply to the Midwest and, indirectly, to the Gulf Coast.

“At the same time, there are some small pockets of unused takeaway capacity appearing on some of the legacy routes out of the region,” helping the region realize the strongest basis differentials it’s seen since 2013.

Meanwhile, as the growth in Appalachian takeaway has helped strengthen the region’s basis differentials in 2018, it has also coincided with generally weaker basis further downstream in Midwest markets like Chicago and the Dawn Hub, Nasta said.

Looking just at the Rover Pipeline, even while flowing at only partial capacity for a good chunk of the year, the pipeline has on average flowed 2.2 Bcf/d into the Midwest year-to-date, according to the analyst. Of that total, “we estimate that about half has targeted Gulf Coast destinations, either physically or by displacement, while the other half has ended up in the Midwest market.

“There is about 300 MMcf/d or so being pushed back to Chicago on other interconnects off Rover, while 800 MMcf/d has moved to Dawn” through capacity on the Vector Pipeline, Nasta said. “That has effectively displaced 500 MMcf/d or so of Dawn’s supply” to DTE’s Michigan Consolidated utility (aka, MichCon), “where the bulk of it seems to have gone into storage, save for a small portion — about 10 MMcf/d — that’s also been displaced all the way back to Chicago.”

With more westbound capacity expected on Rover, and with the 1.5 Bcf/d Nexus Gas Transmission pipeline expected to start up soon targeting the same market, Midwest points are likely to face further downward pressure, a trend that could be particularly noticeable by the end of the upcoming heating season, according to Nasta.

In day-ahead trading Tuesday, Chicago Citygate added a nickel to $2.90, while Dawn climbed 4 cents to $3.04. Radiant Solutions was calling for temperatures in Chicago to dip into HDD territory later this week, with lows in the upper 40s.

In the Midcontinent, Panhandle Eastern jumped 21 cents to $2.27.

From Wednesday to Friday, “Southern Star will commence maintenance on the Black West and Blackwell compressor stations (CS) in Kay County, OK,” according to Genscape analyst Dominic Eggerman. The work was expected to “reduce operational capacity on Black West by 30% and Blackwell CS by 25%. Blackwell CS past 30-day flows have averaged around 603 MMcf/d.

“This event is expected to restrict gas flowing eastwards (onto segment 117) through the compressor station by around 126 MMcf/d. Blackwell West acts as a connection to Blackwell CS, so total eastward flow reductions will be dictated by the Blackwell CS restriction.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |