Infrastructure | E&P | NGI All News Access

Permian Up, Cana Woodford Down as U.S. Rig Count Pulls Back

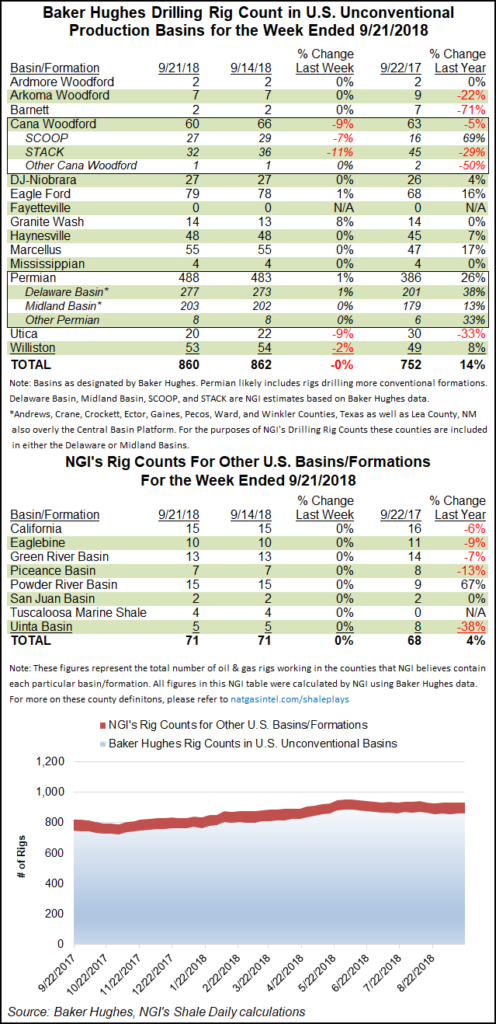

The U.S. rig count pulled back slightly to 1,053 for the week ended Friday (Sept. 21) as gains in the Permian Basin countered a drop in activity in the Cana Woodford, according to data from Baker Hughes, a GE Company (BHGE).

The United States saw one oil-directed rig and one miscellaneous rig exit the patch, while natural gas rigs finished flat at 186. The domestic count for the week outpaced its year-ago tally by 118 rigs.

Two directional units and two horizontal units packed up shop, while two vertical units returned to action. Offshore drilling activity held steady as the Gulf of Mexico rig count finished flat at 18, according to BHGE.

Canada, meanwhile, dropped 29 rigs for the week — 13 oil-directed and 16 gas-directed — to finish at 197, down from 220 a year ago. The combined North American rig count stood at 1,250, versus 1,155 active units at this time last year.

Collapsed natural gas basis differentials didn’t stop the oil-focused Permian Basin from adding five rigs to finish at 488, up more than 100 rigs year/year. The Cana Woodford, meanwhile, saw its tally drop by six units. According to a more detailed breakout of BHGE data by NGI’s Shale Daily, two rigs exited the SCOOP (aka, South Central Oklahoma Oil Province) as four packed up in the STACK (aka, the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties).

In other changes, the Utica Shale dropped two rigs to fall to 20 active units, 10 behind its year-ago count. The Eagle Ford Shale and Granite Wash each added onr rig, while one rig packed up in the Williston Basin.

Among states, Texas, host to a sizeable chunk of the Permian, unsurprisingly proved the biggest mover for the week, adding six units to grow its tally to 531 from 453 a year ago. Oklahoma on net dropped three rigs for the week. Ohio and Alaska each saw two rigs exit the patch, while one rig departed in North Dakota.

Constraints to the north and to the west combined to clobber West Texas spot prices during the week, including a new all-time low at the Waha hub, and analysts see more volatility on the way as Permian producers wait on additional takeaway capacity.

Day-ahead prices plummeted in West Texas last Wednesday, as Waha collapsed $1.06 to average just 61 cents/MMBtu on the day, easily undercutting the previous all-time low of 95 cents reported in December 1998, NGI historical data show.

Waha finished a whopping $2.45 cents back of Henry Hub on Wednesday. That’s not the widest negative basis differential on record for Waha because of higher price levels at Henry Hub in the 1990s and early 2000s. However, since 2015 after the collapse in oil prices and the massive focus on the Permian because of its best-in-class breakevens, the region’s basis differentials have seen a sharp downward trend.

Meanwhile, the midstream sector has been responding with project proposals to address the booming Permian’s constraints.

Oryx Midstream Services said last Tuesday it successfully completed an open season for a regional crude oil gathering and transportation system to serve the Permian’s liquids-rich Delaware formation. The 700,000 b/d system would include more than 500 miles of gathering and transportation pipeline in addition to more than 1.5 million bbl of storage capacity. With the expansion, Oryx said it would serve production from every active county in the Delaware, including New Mexico’s Lea and Eddy counties, and the West Texas counties of Loving, Reeves, Ward, Pecos, Winkler and Culberson.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |