Infrastructure | NGI All News Access

Natural Gas Called ‘Viable’ Alternative Truck Fuel

Diesel will continue to be the leading fuel for commercial vehicles over at least the next 20 years, but natural gas vehicles (NGV) will see their market share grow, according to a multi-client study by consultant IHS Markit.

The study issued Tuesday, “Reinventing the Truck,” looks at the impact of new technologies and powertrain shifts on the logistics, trucking and energy industries. Researchers concluded that 66% of new medium duty and heavy commercial vehicles sold in the United States will be fueled by diesel, versus 80% now.

Still, co-author Matt Trentacosta, an IHS Markit automotive adviser, told NGI that natural gas infrastructure is “well positioned in the United States compared to other alternatives analyzed in this study.”

The study found that the range and load capacity requirements for long-haul, on-highway trucking “will keep diesel relevant in the short- and long-term,” while additional propulsion types including NGVs, “will grow in popularity as technology continues to advance.”

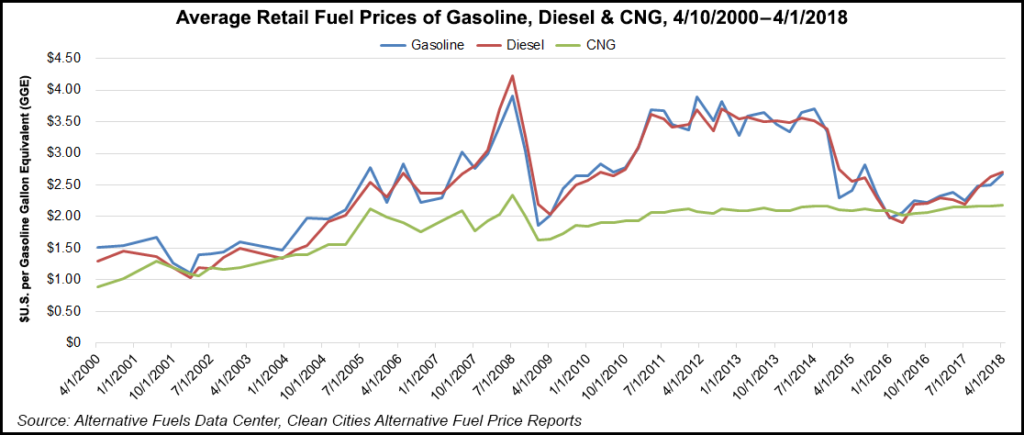

Over the study period of 2020-2040, battery electric vehicles (BEV) are forecast to grow at a 15% compound annual growth rate. However, when total cost ownership (TCO) modeling is applied, BEVs have difficulty competing with diesel or compressed natural gas (CNG) and liquefied natural gas (LNG).

“Exact growth numbers are dependent on the market and scenario covered, but the TCO analysis was quite favorable for CNG/LNG when compared to other alternatives in class-8 heavy-duty trucks,” Trentacosta said.

“We found that NGVs have the potential to be a viable alternative powertrain option in the U.S. market. Diesel will still be playing the largest role moving forward, but natural gas alternatives will see their share increase.”

Natural gas, he said, “fared well in both regulatory scenarios from a total cost of ownership standpoint. Our modeling showed favorable TOC against alternatives in certain instances, like heavy-duty trucks in the United States.”

Overall, the study concluded that there is “a mix of different alternatives to diesel moving to 2040 as each technology has its advantages and disadvantages.”

Regarding regulations, the study looked at two scenarios, and NGVs stacked up favorably.

“The regulatory environment will have a large impact on the pace of change in the industry between now and 2040,” Trentacosta said.

One scenario might feature a ban on diesel use in central cities and the other a move away from fossil fuels, such as the move underway in California.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |