Natural Gas Futures Rally Further as Storage Deficits Persist; West Texas Woes Continue

Natural gas futures showed some follow-through Thursday after rallying earlier in the week, with recent demand giving the market something to think about as the end of injection season nears. Constrained West Texas points continued to suffer in the physical market Thursday, while prices moderated in the Midwest and East; the NGI National Spot Gas Average fell 8 cents to $2.60/MMBtu.

October Nymex futures added 6.8 cents to settle at $2.976, trading as high as $2.991 after briefly dropping as low as $2.886 on government storage data that showed a plump injection for the week ended Sept. 14. Gains were higher further along the strip. November climbed 8.2 cents to settle at $2.964, while January settled at $3.117, up 7.6 cents on the day.

With the winter strip leading Thursday’s rally, the implications of recent strong power burns on storage seemed to be getting the market’s attention, according to Bespoke Weather Services.

Even as the Energy Information Administration’s (EIA) weekly storage report counted as a slight bearish miss, the market rallied as “power burns continued to dramatically tighten and production sits off record highs, presenting one of the tightest balance pictures in a while,” Bespoke said.

“Estimates for the EIA print next week have accordingly fallen off rapidly,” and widening October/November and October/January spreads “indicate that the market has taken note. The question is now how long this tightness can remain; if the market does not loosen soon the rally can continue, especially as we see cold in Week 2 that should translate into our first significant shot of heating demand.”

Guidance suggests the upcoming cold blast — while having the potential to spook the market — could be short-lived, the firm said, adding that “we expect any further continuation of this rally to quickly fail once evidence of loosening appears again.”

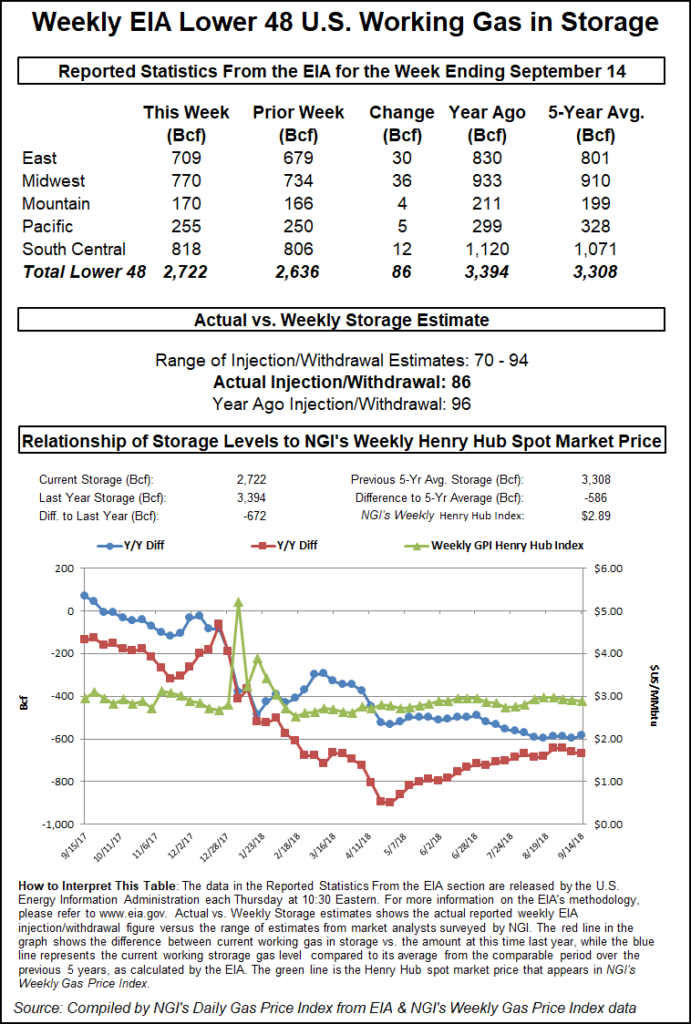

EIA reported an 86 Bcf weekly injection into working U.S. natural gas stocks Thursday, on the high side of most estimates.

The 86 Bcf build recorded for the week ended Sept. 14 compares to a five-year average injection of 76 Bcf and a 96 Bcf injection recorded in the year-ago period. The number topped consensus estimates that had settled in the low-80s Bcf range but was close to Wednesday’s 85 Bcf Intercontinental Exchange EIA financial weekly index futures settlement.

As the market got word of the final number at 10:30 a.m. ET, the October Nymex futures contract briefly dipped as low as $2.886 before quickly recovering to around $2.910, holding onto the lion’s share of gains from Tuesday’s breakout rally.

Total Lower 48 working gas in underground storage stood at 2,722 Bcf as of Sept. 14, about 20% below year-ago stocks of 3,394 Bcf and around 18% lower than the 3,308 Bcf five-year average, according to EIA.

By region, the Midwest posted the largest net injection at 36 Bcf, followed by a 30 Bcf build in the East. The Pacific region saw a 5 Bcf injection, while 4 Bcf was refilled in the Mountain region.

In the South Central, EIA reported an 11 Bcf injection into nonsalt. Meanwhile, the South Central’s salt inventories, after being steadily drawn down since mid-June, saw a rare 2 Bcf build for the week.

Even with the year-on-five-year-average inventory deficit still well above 500 Bcf as the end of injection season approaches, year/year (y/y) production growth has eased a lot of the market’s fears over such lean stockpiles.

“With only six weeks remaining in the refill season, we expect to enter November at around 3.3 Tcf (about 440 Bcf, or 12%, below average),” analysts with Jefferies LLC said Thursday. “Given the rapid supply growth that has occurred this summer, we believe that the storage deficit can easily be reduced further in the winter.

“Assuming five-year average winter withdrawals, we estimate that production would need to average just around 7.0 Bcf/d higher y/y for storage to reach the five-year average (roughly 1.7 Tcf) by the end of March. This level of production would imply a winter average of just 84 Bcf/d, only slightly higher than the September average.”

Turning to the physical market, this week’s West Texas spot price doldrums continued Thursday. Waha bounced back from Wednesday’s all-time low, but on average trades couldn’t climb above the $1.00/MMBtu mark, ending the day 34 cents higher at 95 cents. El Paso Permian, meanwhile, fell 21 cents to average just 96 cents on the day.

“It’s no secret by now that” natural gas takeaway pipelines out of the Permian Basin “have been running near full the last few months, jam-packed like Southern California traffic while trying to whisk away copious volumes of mostly associated natural gas to markets north, south, west and east of the basin,” RBN Energy LLC analyst Jason Ferguson told clients Thursday.

“Despite every major artery running near capacity this summer, Permian prices had so far managed to avoid falling below the dreaded $1.00/MMBtu threshold, a precipice that historically defines a gas producing region as definitively oversupplied. That all changed” Wednesday “as word came in that Southern California Gas Co. (SoCalGas), one of the largest recipients of Permian gas, has nearly filled its gas storage caverns and will soon need far less gas hitting its borders.”

This is particularly bad news for Permian producers, according to Ferguson, who said the basin has limited options for reducing flows attempting move west out of the region.

The constraints to the west also coincided with forces majeure on Kinder Morgan Inc.’s NGPL system restricting flows downstream of the basin in the Midcontinent and Midwest, Ferguson noted.

“The SoCalGas and Kinder Morgan announcements combined to create an extremely chaotic day of trading” at the Waha hub Wednesday, “where prices were already under pressure,” the analyst said. “…Given the speed and severity of Wednesday’s price movements, we expect the Permian gas market to remain volatile in the days ahead as production remains healthy and demand is falling seasonally.”

Recent events “are just one of the many maintenance-related impacts that could roil the Permian markets over at least the next year” until Kinder Morgan’s Gulf Coast Express Pipeline Project enters service, Ferguson said.

Genscape Inc. analyst Joseph Bernardi painted a similar picture of the Permian’s recent depressed pricing, pointing to various coinciding constraints inside and outside the basin that could be putting the squeeze on producers.

“Reported production numbers within the Permian have been unusually volatile over the last three days, particularly on” El Paso Natural Gas (EPNG), Bernardi said Thursday. “One possible contributor is maintenance at EPNG’s ”KEYST ST’ meter, affecting flows out of the Keystone Hub, which began on Tuesday and has led to numerous re-routes within the Permian to accommodate the reduced operating capacity.”

Bernardi said maintenance was expected to extend through Friday’s gas day, noting that production receipts initially dropped consistent with the Keystone restriction before rebounding in later cycles Tuesday and Wednesday.

Typically maintenance at the Keystone point “does not correspond with noteworthy Waha price movements, indicating that there may be other factors influencing” the record low spot prices this week, according to the analyst. “Another contributor to Waha prices from outside the region could be lowered demand in the Desert Southwest resulting from mild weather. EPNG demand has shown the largest decreases, posting a new month-to-date demand low for Wednesday’s gas day.”

SoCal Border Average spot prices fell Wednesday, possibly related to “the additional flexibility for receipt capacity at the California/Arizona border that became available at Topock. EPNG’s deliveries to SoCalGas at Ehrenberg have dropped precipitously, by over 300 MMcf/d, as a result of unplanned maintenance on” the Southern Zone for imports into the SoCalGas system.

Spot prices in California reversed Wednesday’s trends, with the import-constrained SoCal Citygate shedding some of its premium as surrounding trading locations gained back some of the prior day’s losses.

SoCal Border Average picked up 23 cents to $2.24, while SoCal Citygate tumbled 63 cents to $3.95 amid moderate demand of about 2.1 million Dth/d expected on the SoCalGas system over the next two days. Genscape’s Bernardi also recently noted that unplanned maintenance could cut up to 250 MMcf/d of import flows into SoCalGas over the next two weeks.

Along the East Coast, prices at Transco Zone 5 moderated further Thursday after surging to start the week on a combination of nuclear outages and hot temperatures in the Southeast.

Duke Energy’s Brunswick nuclear plant in North Carolina was showing signs of returning some of its capacity to service Thursday. According to EIA, the Brunswick plant — completely offline for days following the landfall of former Hurricane Florence last week — was operating with about 7.5% of its 1.87 GW of capacity back online.

Transco Zone 5 finished at $3.06, down 10 cents on the day.

“It remains hot across the southern U.S., with highs again into the upper 80s to lower 90s for strong late summer demand,” NatGasWeather said. “It will also be warmer than normal over most of the northern U.S., but with light demand as highs reach the comfortable 70s and 80s besides the Northwest and northern Rockies.

“High pressure will weaken across the southern U.S. this weekend with temperatures easing several degrees from current hot conditions, weakening national demand slightly,” the firm said. “However, the upper ridge will spring back across the Southeast Monday to Wednesday with highs of upper 80s to near 90 degrees, but not quite as impressive in recent runs.”

In the Midwest, prices dropped by double digits as Radiant Solutions was calling for recently above-normal temperatures in the region to ease heading into the weekend. Chicago was expected to see highs drop from around 90 degrees Thursday down to the mid 60s and low 70s by Saturday and Sunday, according to the Gaithersburg, MD-based forecaster.

Chicago Citygate tumbled 17 cents to $2.83, while Joliet shed 12 cents to $2.79.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |