NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

Bulls in Control as October Natural Gas Nets Double-Digit Gain for Shoulder Season

While the term “rally” has been tossed around to describe rather small price movements in natural gas prices in recent months, forward prices did just that from Sept. 13-19 as Nymex futures skyrocketed more than a dime on a single day and other pricing hubs notched gains of as much as 30 cents for the week, according to NGI’s Forward Look.

At the heart of the week’s blowouts were weather forecasts showing widespread warmth for the remainder of September, with highs across the southern United States continuing to reach the 90s. Strong cash prices provided an extra boost, as did tight power burns and news about lower-than-expected Chinese tariffs on U.S. liquefied natural gas (LNG) imports.

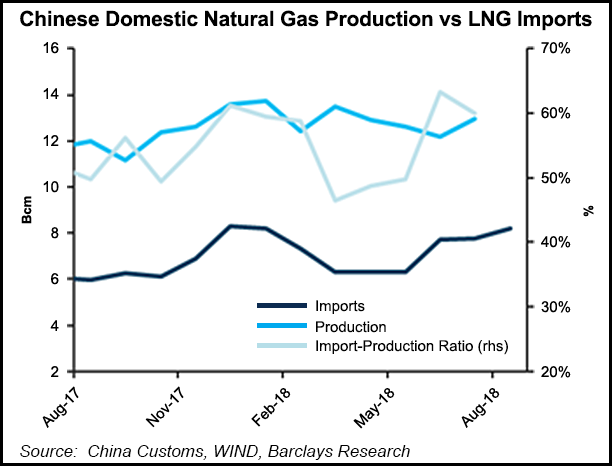

“China initially set potential tariffs as high as 25% on LNG and other products,” Barclays Capital Inc. analysts said. “The lower 10% figure was seen with relief by the market,” and China accounts for a modest — and shrinking — share of U.S. LNG exports.

Meanwhile, Mobius Risk Group said while the Chinese tariffs were indeed supportive of prices, a more tangible impact on the Nymex natural gas curve likely came from news that Cheniere Energy Inc. secured a 15-year LNG purchase agreement with Vitol Inc. that begins this year. “It is reasonable to assume Vitol may have de-risked a portion” of the 70,000 metric tons per year (0.1 Bcf/d) for which it contracted, analysts said.

Whether it was bid for near-term natural gas or not, “both this deal and the previously announced Trafigura deal (2019 start) serve to remind the market that natural gas demand is doing much more than nipping at the heels of production growth,” Mobius said.

That sentiment may be catching on as gas prices retreated only a couple of cents on Wednesday, but still retained the lion’s share of the increases from earlier in the week. “The ability of the October contract to hold on to nearly all of its gains after its startling run-up on Monday and Tuesday indicates that this week’s rebound cannot be dismissed as an anomaly,” EBW Analytics said. “Instead, if the 15-day forecast remains bullish, further gains are possible.”

Indeed, the latest weather data again warmed slightly, with long-range forecasts showing widespread warmth into Week 3 that should increase cooling demand across the South and depress heating demand by the second week of October, according to Bespoke Weather Services.

Models continue to strengthen a shorter-term cold shot next week, but there will be enough heat lingering in parts of the Southeast to keep cooling demand elevated too, Bespoke said. “From there, we do see cold move across the country and gradually fade into the long range, and better agreement across all models and atmospheric indicators gives us high confidence that heating demand will be limited into week 3,” Bespoke chief meteorologist Jacob Meisel said.

The generally bullish weather picture was enough to drive additional support for the Nymex October contract, which rose another 6.8 cents on Thursday to settle at $2.976. November climbed 8.2 cents to $2.964, and December picked up 8 cents to reach $3.031.

Not even a somewhat bearish storage report was enough to steal bulls’ hold on the market. The Energy Information Administration reported an 86 Bcf injection into storage inventories for the week ending Sept. 14. The print was slightly larger than consensus that had clustered in the low 80 Bcf range, and compared to a 96 Bcf injection recorded in the year-ago period and a five-year average injection of 76 Bcf.

Stocks as of Sept. 14 were at 2,722 Bcf, 672 Bcf less than last year at this time and 586 Bcf below the five-year average of 3,308 Bcf. The deficit to the year-ago level grew by 10 Bcf while the deficit to the five-year average shrunk by 10 Bcf.

As the market got word of the final number at 10:30 a.m. ET on Thursday, the October Nymex futures contract briefly dipped as low as $2.886 before quickly recovering to around $2.910. “We do not see the print as significantly changing market expectations; the market is primarily focused on next week’s print,” which is expected to show “power burns that will have rapidly tightened,” Bespoke said.

Despite the 86 Bcf build, Mobius said the market should not expect average weekly injections of more than 85 Bcf over the next four EIA reporting periods, with deficits likely holding above the 600 Bcf as we enter the first full week of October. “Thereafter, market bears will be on shaky ground with only four weeks of traditional injection season remaining, and a need for weather forecasts to deliver a perfect storm of a warm north and a cool south.”

Withdrawal season may begin with 3.2 Tcf in storage, or more than 400 Bcf less than market expectations late in the first quarter, Mobius said. “At some point, the rationale of ”it’s just weather’ will no longer be defensible, and at the very least, the market will have to consider price risks in a colder-than-normal winter scenario.”

Permian Hubs Languishing

While nearly all pricing hubs across the United States posted gains at the front of the curve of anywhere from 7 cents to as much as 30 cents (hello, New England), Permian Basin points remained on their firm downward trajectory amid persistent pipeline constraints that were exacerbated by unplanned maintenance on one of the pipelines leaving the basin and heading north to the Midcontinent, which led to sharp sell-offs in the spot market.

Natural Gas Pipeline Company of America (NGPL) declared a force majeure that was to be in effect from Sept. 18-24 restricting operational capacity through compressor station (CS) 104 on Segment 11 in Kansas to 500 MMcf/d from its current capacity of 1,100 MMcf/d, according to Genscape Inc.

Scheduled nominations through Segment 11 fell as low as 515 MMcf/d for Tuesday’s gas day because of a separate force majeure in effect on Segment 13 in Iowa, but it had begun to recover by Wednesday, Genscape natural gas analyst Vanessa Witte said.

“Segment 11 has averaged 1.05 Bcf/d since the beginning of September,” she said.

Meanwhile, the force majeure on Segment 13 was restricting around 550 MMcf/d of operational capacity through CS 108 in Warren County, IA. This event also started Sept. 18 and is expected to last until Saturday (Sept. 22), Genscape said.

“While Kansas is far from the Permian, the compressor outage will limit combined outflows on NGPL from the Permian and Midcon markets by as much as 60% through early next week,” RBN Energy analyst Jason Ferguson said. “The capacity reduction means Permian and Midcon gas will be fighting for share of the remaining space on NGPL to Midwestern markets.”

If the unplanned maintenance wasn’t bad enough, Permian producers were also hit with news that Southern California Gas Co. (SoCalGas), one of the largest recipients of Permian gas, has nearly filled its gas storage caverns and would soon need far less gas hitting its borders.

“That’s particularly bad news for the Permian, which has few other options if it needs to reduce the supply that is currently flowing west out of the basin to California,” Ferguson said.

On Tuesday (Sept. 18) at 12:23 p.m. PT, the electronic bulletin board of SoCalGas posted an update to its maintenance schedule for the Aliso Canyon storage facility indicating that it would be filled to its currently authorized maximum inventory of 34 Bcf by Monday (Sept. 24).

“This is big news, for not only the SoCalGas gas market, but also the supply basins that send natural gas to Southern California, including the Rockies, San Juan and Permian,” Ferguson said.

With Aliso Canyon reaching capacity early next week, the SoCalGas system will see a storage injection reduction of 400 MMcf/d, according to the utility’s website.

“This is a bummer for the Permian, given the huge volumes of gas that leave the basin and head west to California,” Ferguson said. “The posting came out after gas markets had closed, so market participants had to wait until trading started on Wednesday morning to gauge the impact of the news.”

On Wednesday, Waha spot gas plunged more than $1 to average just 61 cents, setting a new all-time low in the process. El Paso Permian tumbled 56 cents to $1.17, and NGPL Midcontinent tumbled 76 cents to $1.19.

Wednesday’s average price at Waha easily undercuts the lowest trade on record at the point going back to 1995, a low of 95 cents reported in December 1998, Daily GPI historical data show.

The dramatic sell-off spilled over into forward markets as well, with Waha October shedding 9 cents from Sept. 13-19 to reach $1.17 ($1.74 below Henry Hub), according to Forward Look. Interestingly, November was down just a penny to $1.26 ($1.62 below Henry), and the winter 2018-2019 was flat at $1.46 ($1.49 below Henry). The summer 2019, however, fell 6 cents to $1.30, a $1.32 discount to Henry.

At El Paso-Permian, October dropped 11 cents to $1.194, November fell 4 cents to $1.259 and the winter 2018-2019 held firm at $1.46. Summer 2019 prices, meanwhile, slid a nickel to $1.32.

NGPL-Midcontinent posted similar declines as October eased a dime to $1.93, November dropped a nickel to $1.954, winter 2018-2019 slipped 3 cents to $2.22 and summer 2019 fell a nickel to $1.90.

“While the futures market has proven to not always be the best predictor of, well, the future, it does indicate that market participants have rather a gloomy outlook on Permian gas at present,” Ferguson said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |