NGI Mexico GPI | Daily GPI | Markets | Mexico | NGI All News Access

OFS Company’s Bankruptcy a Cautionary Tale for Mexico E&P

Following a hearing in Singapore, Mexican-based oilfield services (OFS) company Servicios Petroleros Oro Negro SAPI de CV has been cleared to negotiate with creditors a year after it sought the protection of the law under a bankruptcy procedure, known as concurso mercantil, similar to Chapter 11 in the United States.

The Singapore court ruled that the case, which involves debts of about $900 million, was outside of its jurisdiction, Damian Fraser, head of Mexico City-based Miranda Partners told NGI’s Mexico GPI.

Fraser’s company represents the 173 creditors in the case.

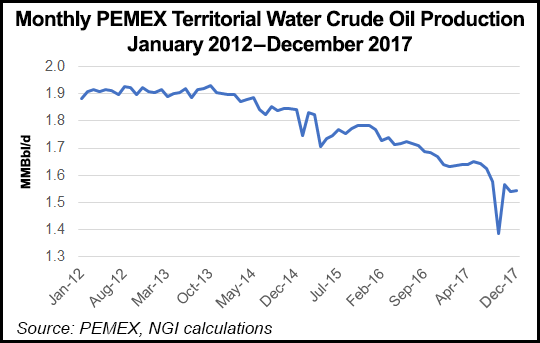

The issue of jurisdiction is one of several complexities involved. Mexico’s state oil company Petroleos Mexicanos (Pemex) was the sole client of Oro Negro’s drilling subsidiary, Perforadora Oro Negro.

In one public exchange, Pemex accused Perforadora officials of offering bribes to resolve the case. But there was no evidence to substantiate the accusation.

“Pemex said there were voice recordings to prove the charge. But it never produced them,” said Fraser. “Clearly, there was no proof.”

Oro Negro was founded in 2012 ahead of the 2013-14 energy reform, and never had any private-sector clients. Indeed, it is one of hundreds of OFS operators that have worked for the state monopoly over the years, though clearly one of the largest.

On the company’s website, Oro Negro said it owned five jack-up rigs that were under contract with Pemex for drilling operations in the Gulf of Mexico.

Many of these OFS companies were represented at a recent meeting in Villahermosa, Tabasco, addressed by President-elect Andrés Manuel López Obrador, who promised a new series of drilling contracts after years without almost any work.

López Obrador’s promises were clearly music to the ears of his audience, as it almost certainly would be the declaration of Oro Negro’s concurso mercantil proceedings and the company’s possible return to operations were to its creditors.

“There is time now to reach a solution to the company’s problems but setting a series of deadlines,” said Fraser. “Of course there is no solution, and that is certainly one likely outcome. The assets of the company, its rigs and other equipment, will have to be handed over to the creditors.”

First a conciliador, or moderator, has to be appointed by the Federal Institute of Specialists in Concursos Mercantiles in order to assess the relative importance and justice of the arguments of both the company and its creditors.

“The case is an example of the huge problems that can arise for both Pemex and the service companies that support it in the type of scheme that López Obrador is now proposing in order to boost crude output,” said Mexico Energy Intelligence Director George Baker.

“Billions of dollars were spent by Pemex on services to develop the Chicontepec Basin during the [2006-12] administration of Felipe Calderon. Pemex officials claimed that Chicontepec would produce 400,000 b/d of crude, or more. But all the money was spent and the end result was close to zero,” Baker said.

A free market can provide the risk absorbers that the industry needs both for operators and service providers, he added.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 |