NGI Data | Markets | Natural Gas Prices | NGI All News Access

Natural Gas Futures Not Rattled as EIA’s Storage Number Surpasses Consensus

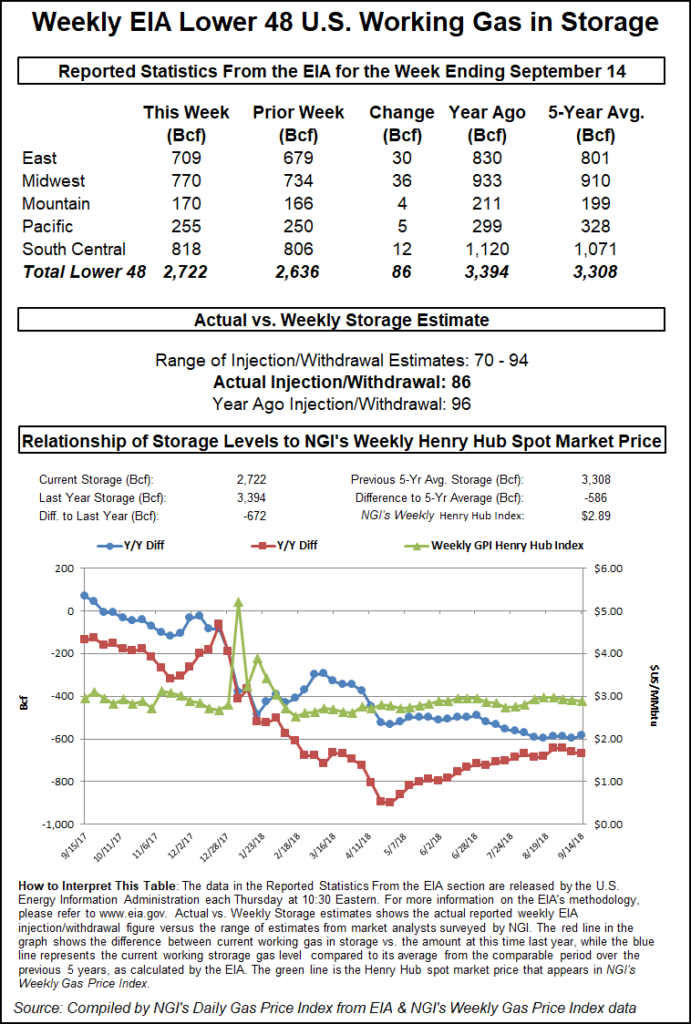

The Energy Information Administration (EIA) reported an 86 Bcf weekly injection into working U.S. natural gas stocks Thursday that was on the high side of most estimates, but futures held steady following the news at just above $2.90/MMBtu.

The 86 Bcf build recorded for the week ended Sept. 14 compares to a five-year average injection of 76 Bcf and a 96 Bcf injection recorded in the year-ago period. The number topped consensus estimates that had settled in the low-80s Bcf range but was close to Wednesday’s 85 Bcf Intercontinental Exchange EIA financial weekly index futures settlement.

As the market got word of the final number at 10:30 a.m. ET, the October Nymex futures contract briefly dipped as low as $2.886 before quickly recovering to around $2.910, holding onto the lion’s share of gains from Tuesday’s breakout rally. By 11 a.m. ET, the October contract was trading around $2.922, up about 1.4 cents from Wednesday’s settle. Further along the strip, November was trading about 2.9 cents higher at around $2.911 as of 11 a.m. ET, and January was similarly up about 2.7 cents to around $3.068.

Bespoke Weather Services, which had been looking for an 83 Bcf build, attributed the larger injection to “power burns that were a touch less impressive than estimated, which is not particularly surprising given the cooler weather across Texas” during the period.

“We do not see the print as significantly changing market expectations; the market is primarily focused on next week’s print,” which is expected to show “power burns that will have rapidly tightened,” the firm said. “The market is bouncing off this slightly bearish number thanks to that, with the winter strip leading the way higher. We see room toward $2.95 on this tightening short-term, though once forecasts warm we would expect a quick reversal still.”

Total Lower 48 working gas in underground storage stood at 2,722 Bcf as of Sept. 14, about 20% below year-ago stocks of 3,394 Bcf and around 18% lower than the 3,308 Bcf five-year average, according to EIA.

By region, the Midwest region posted the largest net injection at 36 Bcf, followed by a 30 Bcf build in the East. The Pacific region saw a 5 Bcf injection, while 4 Bcf was refilled in the Mountain region.

In the South Central region, EIA reported an 11 Bcf injection into nonsalt. Meanwhile, the South Central’s salt inventories, after being steadily drawn down since mid-June, saw a rare 2 Bcf build for the week.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |