Waha Hits All-Time Low Amid Constraints as NatGas Futures Retreat

Natural gas futures retreated Wednesday, with bulls hesitating after a swift and decisive double-digit rally a day earlier amid expectations for a slightly above average storage build this week. Lingering heat and pipeline constraints contributed to a day of dynamic price moves in the spot market, including a new record-low in West Texas; the NGI National Spot Gas Average dropped 7 cents to $2.68.

The October Nymex contract gave back 2.5 cents to settle at $2.908 after trading as high as $2.948 and as low as $2.898. November settled 1.4 cents lower at $2.882, while the January contract slid 0.9 cents to $3.041.

Bespoke Weather Services said supply/demand balance continued to look “very tight” Wednesday, with weather-adjusted power burns some of the tightest of the summer and production easing off recent highs.

“However,” liquefied natural gas “exports ticked lower the last couple of days, easing the impact of extraordinarily tight burns,” Bespoke said. “We see this current tightness as providing strong support for the front of the strip; it will be difficult to break below $2.85 support without clear signs of loosening” given that end-of-season storage estimates continue to decline.

A bearish number from the Energy Information Administration’s (EIA) weekly natural gas storage report Thursday “could briefly move prices below that level, and we do see some slight bearish risks” associated with the report, the firm said.

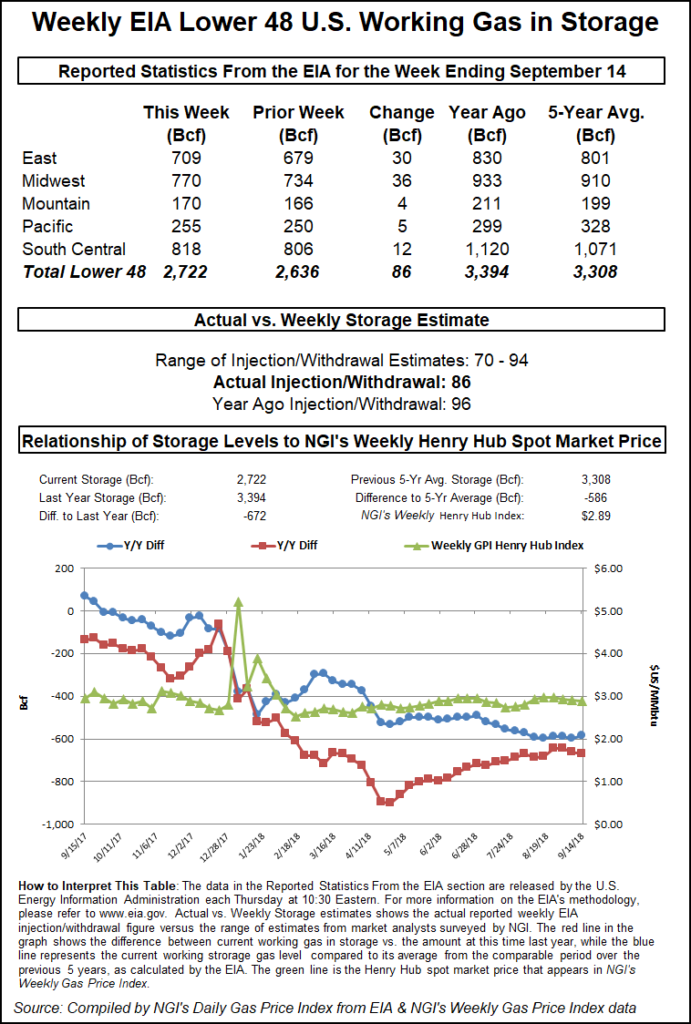

Estimates so far for the upcoming EIA storage data point to a build slightly above the five-year average. A Reuters survey of traders and analysts on average showed respondents expecting EIA to report an 84 Bcf build for the week ending Sept. 14, with a range of 76-94 Bcf. A Bloomberg survey produced a median 81 Bcf injection, with a range of 70-94 Bcf.

Last year, EIA recorded a 96 Bcf injection for the period, while the five-year average is a build of 76 Bcf.

IAF Advisors analyst Kyle Cooper called for an 80 Bcf build, while Bespoke predicted an 83 Bcf injection. Intercontinental Exchange (ICE) EIA weekly financial index futures settled Tuesday at a build of 83 Bcf.

“Next week’s print is now looking far tighter as we have continued to see impressive burns, and should these burns hold Thursday we would be looking at another cash-driven rally in the morning that could put a re-test” of resistance at $2.95 in play, Bespoke said. “Increasingly, though, any rallies are likely to fail as we look for forecasts that warmed slightly in the 11-15 day time period” Wednesday afternoon to trend warmer.

Meanwhile, ICE EIA end of storage index futures fell 13 Bcf Tuesday to settle at 3,308 Bcf, which would comfortably set a new five-year minimum for inventories at the start of the heating season.

In a phone interview Tuesday, INTL FC Stone Financial Inc. Senior Vice President Tom Saal pointed to the recent backwardation as evidence of the market’s lack of urgency regarding storage.

Indeed, even as futures pulled back Wednesday, day-ahead prices at Henry Hub added 9 cents to average $3.06, trading at a roughly 15 cent premium to front month futures, and even trading slightly above the January contract.

“Current spot market prices will have to converge with October futures in the next few days, and recent heat is helping keep cash prices at a premium,” said Patrick Rau, NGI’s director of strategy & research. “But of course, cash prices are day-ahead, and the October futures contract is for that entire month.

“Gone in October will be the hotter temperatures, but not gone will be robust production,” he said. “Yes, current storage levels are below where they were last year, but production is higher as well, so the overall supply picture is better than what the storage figure implies. For example, marketed gas production in the U.S. was up more than 9 Bcf/d in June versus a year ago. That’s a nearly 12% increase.”

Turning to the spot market, pipeline constraints to the north and limited demand-pull to the west helped to clobber West Texas basis differentials Wednesday, as Waha collapsed $1.06 to average just 61 cents, setting a new all-time low in the process. Other regional points also got crushed but not to the same extent, with El Paso Permian tumbling 56 cents to $1.17.

Wednesday’s average price at Waha easily undercuts the lowest trade on record at the point going back to 1995, a low of 95 cents reported in December 1998, Daily GPI historical data show.

In terms of physical basis, Waha finished a whopping $2.45 cents back of Henry Hub on the day. That’s not the widest negative basis differential on record for Waha due to higher price levels at Henry in the 1990s and early 2000s. However, since 2015 after the collapse in oil prices and the massive focus on the Permian Basin due to its best-in-class breakevens, the region’s basis differentials have seen a sharp downward trend.

The takeaway constraints driving depressed pricing for the Permian have been well-documented, and on a good day these constraints have seen West Texas points routinely trade more than $1 back of Henry Hub.

But now for the next few days Permian supply will have to navigate past additional restrictions on NGPL affecting northbound flows into the Midcontinent and Midwest, according to Genscape Inc.

“Effective from Sept. 18-24 [Tuesday through Monday], NGPL declared a force majeure restricting operational capacity through CS 104 on Segment 11 in Kansas to 500 MMcf/d from its current capacity of 1,100 MMcf/d,” Genscape analyst Vanessa Witte said. “Scheduled nominations through Segment 11…initially experienced a day/day drop of around 300 MMcf/d, from 1,087 MMcf/d to 788 MMcf/d on Sept. 18 due to” a separate force majeure in effect on Segment 13 in Iowa.

“As of the intraday 2 cycle for Tuesday’s gas day, nominations were revised down even further to 515 MMcf/d,” Witte said. “However, nominations for Wednesday are sitting at 794 MMcf/d, 294 MMcf/d above operating capacity. Segment 11 has averaged 1.05 Bcf/d since the beginning of September.”

Meanwhile, the force majeure on Segment 13 is restricting around 550 MMcf/d of operational capacity through CS 108 in Warren County, IA. This event also started Tuesday and is expected to last until Saturday, according to Witte.

“Scheduling nominations on Segment 13…initially decreased to around 1.0 Bcf/d from its average of 1.35 Bcf/d, but were revised down to 724 MMcf/d for Sept. 18. Nominations have since increased to 993 MMcf/d for Wednesday’s gas day,” Witte said. “Genscape meteorologists forecast a slight heat wave to hit the Midwest region, most notably on Thursday when” cooling demand is expected to spike, potentially putting pressure on NGPL’s Gulf Coast Mainline.

NGPL Midcontinent tumbled 76 cents to $1.19 Wednesday, while further upstream in the Midwest, prices were steady. Chicago Citygate added 3 cents to $3.00.

In the West, SoCal Citygate jumped 64 cents to $4.58 as other locations in California and the Desert Southwest posted heavy losses.

Unplanned maintenance on the already constrained Southern California Gas (SoCalGas) system could cut up to 250 MMcf/d of import flows over the next two weeks, according to Genscape analyst Joseph Bernardi.

“Remediation on SoCalGas’s L2001, announced Tuesday and taking effect Wednesday, limits firm operating capacity for the Southern Zone to 455 MMcf/d with an expected end date of Oct. 3,” Bernardi told clients. “This zone consists of the El Paso-Ehrenberg, North Baja-Blythe and TGN-Otay Mesa receipt points. Reported receipts here also indicate the presence of non-firm molecules in this zone nearly every day in the last month. Firm operating capacity had been set at 708 MMcf/d prior to this event but receipts had averaged 745 MMcf/d, and maxed out at 815 MMcf/d.”

Mild temperatures in the forecast for the region should help to mitigate price spikes at the volatile trading hub, according to the analyst.

“However, with import capacity already tight and the existing restrictions on withdrawals from Aliso Canyon, any combination of new restrictions like this one plus high future demand has the potential to lead to significant price volatility,” Bernardi said.

SoCalGas was anticipating comfortable system-weighted temperatures in the mid 70s over the next few days, with demand expected to total around 2.1-2.2 million Dth/d for the rest of the work week. But given the constraints on imports, even this relatively modest demand level would be enough to force a withdrawal from storage Thursday, according to the utility’s projections.

Over on the East Coast, prices in Transco’s Zones 5 and 6 moderated Wednesday after recent gains. Transco Zone 5 fell 22 cents to $3.16 after surging to start the week.

According to Genscape analyst Josh Garcia, the recent gains at Transco Zone 5 have coincided with the recovery of Mid-Atlantic natural gas demand following the landfall last week of former Hurricane Florence.

Aggregate demand in Virginia and the Carolinas set a new month-to-date high at just above 5 Bcf/d Tuesday after falling to a low of 3.48 Bcf/d on Saturday, which compares to demand averaging 4.4 Bcf/d month-to-date prior to the storm, according to Garcia.

“Several nuclear plants remained offline due to weather or coinciding maintenance, which was one of the bullish factors that caused Transco Zone 5 basis to strengthen,” Garcia said.

Nuclear outages in the Southeast remained a factor for the market Wednesday, as Duke Energy’s 1,870 MW Brunswick plant in North Carolina was still completely offline, according to data compiled by EIA. Combined U.S. nuclear capacity outages totaled 14,349.1 MW Wednesday, 14.4%of total capacity and well above the five-year range for this time of year.

Meanwhile, the heavy rains Florence delivered to parts of Appalachia and the Mid-Atlantic could pose some risks for pipeline infrastructure, Garcia said.

Genscape’s infrastructure team observed during the week of Sept. 8-14 that Nexus Gas Transmission “had up to 4.9 inches of rain from the remnants of Gordon, with Florence coming through just a week later,” the analyst said. “This could pose risks to infrastructure timelines in the Northeast, but it is too early to definitively tell if specific projects will be delayed due to the rain.”

The recent rainfall might have slowed down Transco’s efforts to put the finishing touches on its Atlantic Sunrise expansion, but the operator has managed to power through, as the 1.7 Bcf/d eastern Marcellus takeaway line is now mechanically complete, parent company Williams announced Wednesday.

Transco filed a request with FERC Wednesday to place the remaining facilities into service, including the greenfield portions of the project critical to opening up an additional path for northeastern Pennsylvania production to reach the Transco mainline.

Spot prices in Appalachia were mixed Wednesday. Transco-Leidy Line dropped 2 cents to $2.65.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |