Markets | NGI All News Access | NGI Data

Weekly Natural Gas Spot Market Weakens as Shoulder Season Sets In

Even with some lingering hot weather, natural gas spot prices generally moved lower for the week ended Sept. 14 as markets watched for impacts from the latest round of tropical weather. The NGI Weekly National Spot Gas Average fell 11 cents to $2.60/MMBtu.

The headline-grabber in the natural gas markets for the week was Hurricane Florence, which made landfall with the Carolinas Friday, threatening catastrophic flooding, prolonged power outages and demand destruction. Daily Southeast and Mid-Atlantic prices dropped late in the week as Florence arrived, leaving weekly prices at a number of locations in the region modestly lower. Transco Zone 5 fell a dime to $2.94.

Further up the East Coast, Algonquin Citygate shed 24 cents to $2.77 as forecasts showed above normal — but generally comfortable — conditions in Boston during the week. Upstream in Appalachia, Dominion South sold off 21 cents to $2.28, while Texas Eastern M-2, 30 Receipt tumbled 23 cents to $2.25.

In the Rockies, Kingsgate gained 14 cents on the week as Gas Transmission Northwest lifted a force majeure that had been impacting flows through the location. Prices throughout the rest of the region generally fell as forecasts showed cooler temperatures in the Pacific Northwest. Opal gave up 12 cents to average $2.25.

In Western Canada, with temperatures starting to reach almost winter-like levels of chilly during the week, prices at NOVA/AECO C gained C37 cents to average C$1.21/GJ.

Meanwhile, the prospect of demand destruction from Hurricane Florence as it hammered the Carolinas helped send natural gas futures lower Friday, although not enough to break below the recent trading range. The October Nymex futures contract sold off early in the day before settling a nickel lower Friday at $2.767.

“Despite volatility through the week the October contract settled just a cent lower from last Friday, fitting our neutral weekly sentiment well as resistance from $2.85-2.88 held and $2.75 support was only tested Monday,” Bespoke Weather Services said. “We continue to like this trading range short-term, though note that if anything today’s price action seems to indicate a bit more short-term downside towards at least $2.75 early next week on any Florence demand destruction and lingering cash weakness like we saw” Friday.

“Should burns really loosen over the weekend from Florence, we could even see a test of $2.70-2.71, but we see that as relatively unsustainable given current low stockpiles and burns that before the hurricane were increasingly tightening,” Bespoke said.

As of 5 p.m. ET Friday, Florence had weakened into a tropical storm as it churned about 50 miles west-southwest of Wilmington, NC, dropping catastrophic amounts of rainfall and carrying maximum sustained winds of 70 mph, according to the National Hurricane Center (NHC).

Florence was “moving toward the west near 3 mph,” NHC said Friday afternoon. “A slow westward to west-southwestward motion” was expected through Saturday, and on the forecast track, the storm’s center was likely to move farther inland across extreme southeastern North Carolina and across extreme eastern South Carolina through Saturday. The storm then was likely to “move generally northward across the western Carolinas and the central Appalachian mountains” after the weekend.

As of Friday afternoon, Duke Energy was reporting more than 400,000 customers affected by power outages in its Carolinas service territory, with coastal areas of North Carolina the hardest hit. The Charlotte, NC-based utility had warned earlier in the week of anywhere from one to three million customer outages due to the storm, predicting that restoration work could potentially last weeks.

Early signs of Florence’s natural gas impact were already emerging as the storm made landfall Friday.

“Sample demand for North Carolina is down to 1,238 MMcf/d, a drop of about 439 MMcf/d from Thursday,” Genscape Inc. senior natural gas analyst Rick Margolin told clients Friday morning. “The drop is almost entirely concentrated on Duke Energy Carolinas power plants on Transco (Duke has eight gas-fired power plants throughout the state).”

Margolin also noted that Duke had shut down its 1,980 MW Brunswick nuclear plant in advance of the storm’s arrival.

“South Carolina nominated demand appears relatively unaffected as the storm is coming in a bit to the north,” he said. “However, cooler temperatures and storm preparations are contributing to Virginia sample demand dropping about 300 MMcf/d day/day to fall to 1,701 MMcf/d.”

Meanwhile, even as Florence’s looming presence seemed to overshadow the usual discussions of weekly inventory data, an on-target storage report from the Energy Information Administration (EIA) Thursday left the market with more to ponder as the injection season rapidly draws to a close.

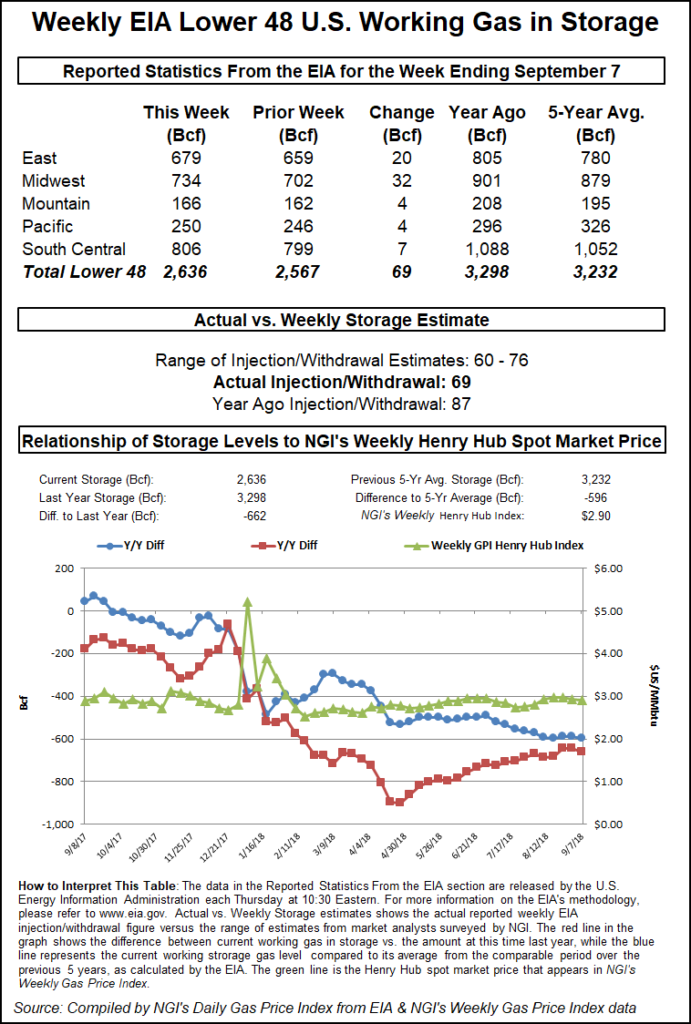

EIA reported a 69 Bcf injection into Lower 48 underground storage for the week ended Sept. 7, lower than both the 74 Bcf five-year average and the 87 Bcf recorded in the year-ago period.

Prior to the report, a Bloomberg survey had produced a range of 59-76 Bcf, with a median of 65 Bcf. A Reuters survey ranged from 60-76 Bcf with a median of 68 Bcf. Intercontinental Exchange futures had settled Wednesday at a 65 Bcf injection.

Total working gas in underground storage stood at 2,636 Bcf as of Sept. 7, 596 Bcf (18.4%) below the five-year average and 662 Bcf (20.1%) lower than year-ago inventories, according to EIA. Inventories also currently sit below the five-year historical range, EIA noted.

By region, the Midwest posted the largest net build for the week at 32 Bcf, followed by the East, which injected 20 Bcf. The Mountain and Pacific regions injected 4 Bcf each during the period. In the South Central, a 9 Bcf build for nonsalt offset a 1 Bcf withdrawal from salt, according to EIA.

This week’s report is the first to publish estimates based on a new sample selected for EIA’s weekly storage report. On Monday, EIA released revised estimates for the eight weeks covering July 13-Aug. 31 to gradually phase in the new sample.

The established sampling and estimation methodologies for the report have not changed, EIA said. Estimates produced from the sample are to reflect the most recent version of the EIA-912 form, which requires storage operators in the South Central region to separately report the volume of working natural gas held in salt facilities and nonsalt facilities, according to the agency.

“Weather-adjusted, the market is about 2.0 Bcf/d oversupplied, marking the third straight week the market is oversupplied,” analysts with Tudor, Pickering, Holt & Co. said Friday. “U.S. production is now at 83.3 Bcf/d with Northeast production rising about 300 MMcf/d week/week (w/w). Since the end of June, Northeast production has increased around 2.0 Bcf/d.”

Genscape analyst Margaret Jones viewed the 69 Bcf build as “about 2.1 Bcf/d loose versus the five-year average. This includes an estimated 9 Bcf demand impact from the Labor Day holiday.

“Relative to the previous week, total power generation was down almost 12 average GWh,” Jones said. “Collectively, nuclear and renewable gen were down about 13 average GWh w/w as wind gen was down almost 12 average GWh and hydro generation was also down 1 average GWh w/w. Coal was up around 4 average GWh w/w, and gas generation was down around 4 average GWh for an estimated 0.7 Bcf/d less gas burn w/w.”

Turning to the spot market, as Florence plotted its slow path of destruction through the Carolinas Friday, points across the Southeast and Mid-Atlantic fell. The NGI National Spot Gas Averagedropped 7 cents to $2.54.

Transco Zone 5shed 10 cents to $2.83, while Dominion Energy Cove Pointtumbled 12 cents to $2.85.

Friday’s discount saw Transco Zone 5 trade 2 cents back of Henry Hub, a relatively uncommon flip to negative basis for the point after Henry Hubshed 8 cents to $2.85.

For most of the summer, Transco Zone 5 — extending from the Georgia/South Carolina border to the Virginia/Maryland border — has traded at a premium to Henry. Prior to Friday, spot prices at Zone 5 had averaged a negative basis on only three different trade dates since June, trading a mere penny back of the Hub twice in June and once in August, Daily GPIdata show.

Meanwhile, just last month, Zone 5 prices accrued as much as a 95-cent basis premium on the Aug. 7 trade date, according to Daily GPI.

Further upstream in Appalachia, Columbia Gasdropped 22 cents to $2.47, while Texas Eastern M2, 30 Receiptdropped 12 cents to $2.17.

As of Friday, NatGasWeather predicted mostly bearish impacts from Florence as it was expected to make its way inland in the Southeast, bringing rain, cooler temperatures and knocking out power.

“Texas and the South will see areas of showers as a weak tropical system stalls, while a cooler system impacts the Northwest,” NatGasWeather said in its one- to seven-day outlook Friday. “It remains hot over the Southwest with 90s and 100s, while also hot over the Southeast with lower 90s. Warm high pressure will strengthen over the northern half of the country” in the week ahead “with 80s becoming widespread besides the Northwest.”

In South Texas, Tennessee Zone 0 Southdropped 9 cents to $2.65.

In the Rockies, prices sold off heading into the weekend as Radiant Solutions was predicting cooler-than-normal temperatures across much of the Pacific Northwest over the next several days. Radiant was calling for highs in Seattle to hover in the mid to low 60s over the weekend and into the week ahead.

Opalgave up 11 cents to $2.12.

Further north, NOVA/AECO Cadded C13 cents to C$1.38/GJ as Radiant was predicting temperatures in Western Canada to plunge into heating degree day territory over the weekend. The forecaster predicted temperatures averaging around 15 degrees colder than normal in Calgary, including a low of 30 degrees Monday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |