Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report

U.S. LNG Exports a Geopolitical Tool, Senate Committee Told

Increased U.S. natural gas exports, particularly to the European Union (EU), can provide extensive economic and geopolitical advantages, according to experts testifying Thursday before a Senate committee.

While a consumer advocate warned that more liquefied natural gas (LNG) exports could drive up domestic prices, most testifying before the Senate Energy and Natural Resources Committee generally agreed that more needs to be done to increase exports to European nations.

“These are extraordinary opportunities for our country right now, and we are in a position to wield some power for good,” said Senate Committee Chairman Lisa Murkowski (R-AK). “This is an important time for the United States when it comes to recognizing the power of our energy abundance and how that can be used for the good of this country and our friends and allies around the world.”

Ranking Sen. Maria Cantwell (D-WA) agreed that Europe needs to diversify energy resources from Russia, but if more exports are part of the solution, she wants to make sure there are more protections for the American consumers and the environment from the increased production.

GOP Sens. Steve Daines of Montana, Bill Cassidy of Louisiana and John Barrasso of Wyoming said the country should expand its role in the global energy markets through increased LNG exports, which are slated to grow from the current 3.5 Bcf/d level to more than 11 Bcf/d after 2020.

More U.S. gas supplies on the global market will mean more competition and added security and reliability for U.S. allies, according to the Department of Energy’s Steven Winberg, assistant secretary for fossil energy. “This gives our allies energy supplies that are governed by market forces and not political whim,” he told the committee.

He said that was the message that DOE Secretary Rick Perry is delivering to Russian counterparts on a trip now underway.

“With the U.S. and Russia as two of the world’s largest energy producers, Perry is re-opening a dialogue with the Russians to ensure increased competition in the energy markets, and to stand firm on U.S. sanctions that prohibit any U.S. participation in energy production and exploration projects in Russia’s deepwater, Arctic offshore or shale.”

Argonne National Laboratory associate Agnia Grigas, who authored “The New Geopolitics of Natural Gas,” criticized Russia for what she alleged past and current attempts to use its energy resources as a geopolitical weapon.

“LNG exports to Europe have significant positive national security, economic, political, and geopolitical implications for the United States and its allies, Grigas said. “We all know that Russia and its national gas company Gazprom use gas exports as a means of political influence, coercion and as an energy weapon, directly threatening the national security of important European nations.”

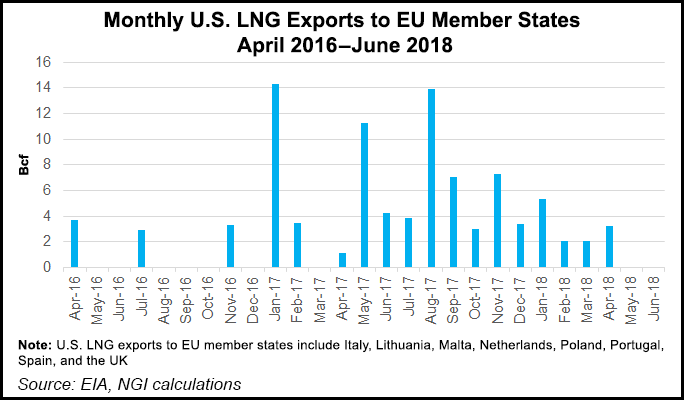

ClearView Energy Partners LLC’s Kevin Book, managing director, and Mark Mills, senior fellow at the Manhattan Institute, supported the U.S. case for pursuing the global “energy dominance” strategy of the Trump administration given the abundant and economic gas supplies. Book called LNG “the star of the story,” noting that exports were up by 58% in June year/year.

Supporters and skeptics of more LNG exports to Europe acknowledged that the EU is using only about 20% of its current LNG receiving capacity, as nearly 40% of its gas supplies come via pipeline from Russia. However, Mills seized on that as an opportunity for U.S. gas producers.

“This is all about U.S. ”self-interest’ as some European critics like to point out, but it is also in Europe’s self-interest,” said Mills, noting several examples of “mutual self-interest” for both sides.

“The existing LNG import capacity is operating at about 27% capacity, but putting those import terminals to work at nearly full capacity will require three-fold more gas than a second major pipeline into Europe will bring.”

The higher prices compared to more Russian pipeline gas could be below 10%, said Mills, noting that it would be “cheap” considering the added security and diversity the U.S. LNG would bring.

Public Citizen’s Tyson Slocum, energy program director, countered the arguments. He said more exports would drive up domestic gas prices for Americans. He cited problems Australia is experiencing with domestic prices spikes since it became the second largest global LNG exporter after Qatar.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |