As Florence Lashes U.S. Southeast, NatGas Futures Slide

With the market left to process the short-term impacts of a raging hurricane and the long-term implications of the latest government storage data, natural gas futures traded both sides of even Thursday before finishing slightly lower on the day. Spot prices were mixed as gains in the Midwest offset modest declines along a Southeast coast bracing for impact; the NGI National Spot Gas Average gave up 2 cents to $2.61/MMBtu.

The October contract settled 1.2 cents lower Thursday at $2.817 after trading as high as $2.856 and as low as $2.805. The November, December and January contracts each fell 2.0 cents on the day, with January settling at $2.981.

As of 5 p.m. ET Thursday, Hurricane Florence was about 100 miles east-southeast of Wilmington, NC, and about 155 miles east of Myrtle Beach, SC, traveling west-northwest at 5 mph, according to the National Hurricane Center (NHC).

Florence was expected to approach the coasts of North and South Carolina later Thursday night, “then move near or over the coast of southern North Carolina and northeastern South Carolina” on Friday. “A slow motion across portions of eastern and central South Carolina is forecast Friday night through Saturday night,” NHC said.

NHC was predicting up to 20-30 inches of rainfall for some coastal areas of the Carolinas, with isolated amounts of up to 40 inches, enough to “produce catastrophic flash flooding and prolonged significant river flooding.”

Charlotte, NC-based Duke Energy, whose territory includes millions of electric retail customers across North Carolina and northern South Carolina, said it was bracing for one to three million power outages in its Carolinas territory because of Florence. The utility said it had more than 20,000 people in place for the anticipated restoration work, its “largest resource mobilization ever.”

Duke’s incident commander Howard Fowler said the magnitude of Florence “is beyond what we have seen in years.” He emphasized that “with the storm expected to linger, power restoration work could take weeks instead of days.”

While widespread and extended power outages would destroy demand, not all of the theoretical Florence impacts examined in the lead-up to the storm would be bearish for natural gas, with some predictions pointing to possible production shut-ins or prolonged downtime for nuclear plants.

Florence could have production impacts depending on its path as it pushes inland, Genscape Inc. analyst Nicole McMurrer told clients Thursday.

“Depending on Florence’s speed and track there could be major flooding in Ohio, West Virginia and western Pennsylvania, which could cause short-term shut-ins, or possibly longer term damage,” McMurrer said. “However, we do not have a preliminary estimate of potential production impacts because there have not been any other analogous storms in recent years to compare to. The nearest analog would be Hurricane Matthew, but that storm was weaker as a Category 1, hit much farther south, and stayed primarily offshore.”

The prospect of supply impacts should Florence cause severe flooding in Appalachia may help explain the “otherwise inexplicable surge in prices Wednesday morning,” according to EBW Analytics Group CEO Andy Weissman, who said based on updates to the storm’s projected track this week he does not expect Florence to force any production curtailments.

On Wednesday, the October contract reached its intraday high of $2.869 in the morning before selling off over the rest of the session, and Thursday’s trading also saw the front month rallied to an intraday high ($2.856) in the morning hours only for prices to slide as the day progressed.

Predictions that flooding could damage a number of nuclear plants in the storm’s path “are also far off the mark,” according to Weissman. “While nuclear plants directly in the eye of Florence will be temporarily shut down two hours before the storm hits due to post-Fukushima requirements, operation is likely to return to normal soon after the hurricane passes.”

Considering Florence’s magnitude, “widespread, prolonged outages may be inevitable,” he said. “Given the expected torrential rains, repairs are not likely to begin until next week and could take months in some areas. Further, once nuclear plants come back online, the need to operate gas-fired generating units could be minimal for an extended period.”

The Energy Information Administration (EIA) reported that as of Thursday morning two of 11 nuclear plants in Georgia, North Carolina, South Carolina and Virginia were operating at slightly reduced levels, both in North Carolina. The four states combined received 36% of their electricity from nuclear power in 2017, according to the agency.

In terms of gauging Florence’s impact on the electric grid, EIA noted that “last September, Hurricane Irma resulted in electricity demand in Florida falling to 64% lower than typical levels for that time of year because of widespread outages.”

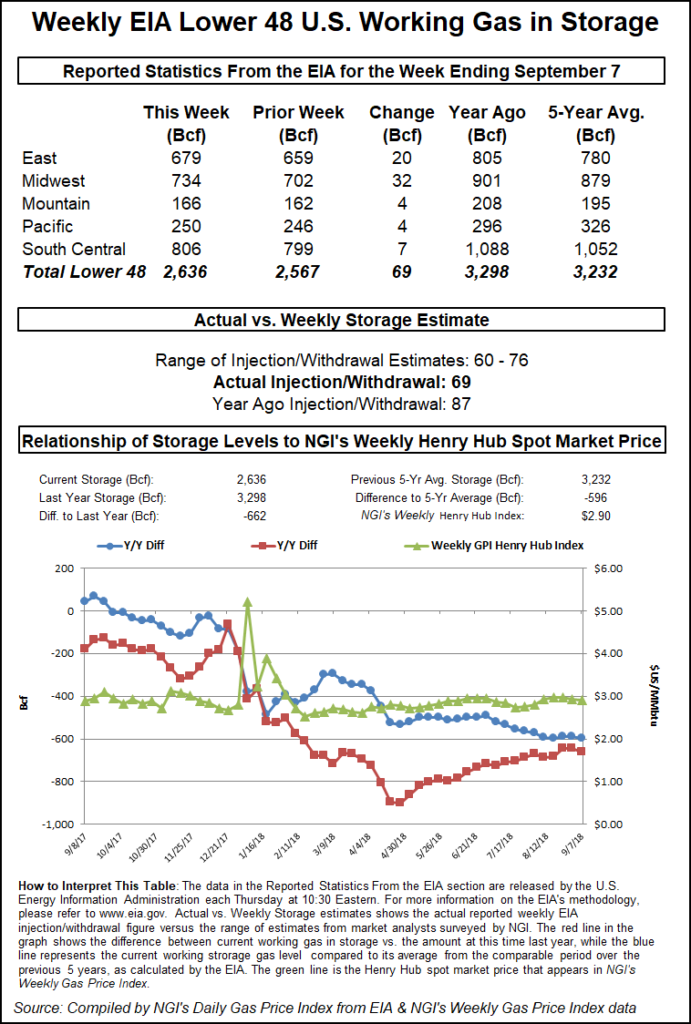

As the destructive potential of Hurricane Florence commanded the natural gas market’s attention Thursday, the Energy Information Administration (EIA) reported a 69 Bcf build for the week ended Sept. 7 that barely moved the needle.

After probing above $2.850 earlier in the morning, the October Nymex futures contract pulled back slightly on the news, dropping about a penny as the number crossed trading desks at 10:30 a.m. ET. By 11 a.m. ET, the October contract was back up to around $2.844 but fell steadily over the rest of the session.

The 69 Bcf build, reflecting the impact of the Labor Day holiday, came in lower than both the 74 Bcf five-year average and the 87 Bcf injection recorded in the year-ago period.

Prior to the report, a Bloomberg survey had produced a range of 59-76 Bcf, with a median of 65 Bcf. A Reuters survey ranged from 60-76 Bcf with a median of 68 Bcf. Intercontinental Exchange futures had settled Wednesday at a 65 Bcf injection.

“This print is, of course, artificially loose due to the Labor Day holiday, where we saw the loosest weather-adjusted burns of the summer,” said Bespoke Weather Services, which had called for a 68 Bcf build. “We accordingly expect a tighter print next week,” but the market is still on track for end-of-season inventories “north of 3.35 Tcf.

“This print confirms recent production growth too, essentially indicating prices are relatively fairly priced,” the firm added. EIA’s report should firm up resistance around $2.88, “with $2.75 in play on any major Florence demand destruction.”

Total working gas in underground storage stood at 2,636 Bcf as of Sept. 7, 596 Bcf (18.4%) below the five-year average and 662 Bcf (20.1%) lower than year-ago inventories, according to EIA. Inventories also currently sit below the five-year historical range, EIA noted.

By region, the Midwest posted the largest net build for the week at 32 Bcf, followed by the East, which injected 20 Bcf. The Mountain and Pacific regions injected 4 Bcf each during the period. In the South Central, a 9 Bcf build for nonsalt offset a 1 Bcf withdrawal from salt, according to EIA.

As Florence figures to impact natural gas in the short term, longer-term seasonal factors could help prices start to grind higher from here, especially after heavy selling over the last week of August and first week of September, according to Powerhouse Vice President David Thompson.

“We’ll see how bad the flooding is. The market will very quickly figure out how much power is lost, how much demand destruction there is from that, and then it will price that in accordingly,” Thompson told NGI Thursday.

September is the time of year that market participants start to look ahead to the heating season, and “if the winter strip stays above $2.85 and can’t break below that low, then I start to get incrementally bullish each day that rolls off the calendar,” he said. “All of this is against that backdrop that we’ve had all summer, where we’ve wondered when the market will start to concern itself with that storage deficit.”

The year-on-five-year deficit remains close to 600 Bcf, and “we’re getting close to the point where we’ll have to start taking gas out for heating demand,” Thompson said.

Turning to the spot market, Southeast locations posted small declines Thursday as Florence approached. Transco Zone 5 dropped 6 cents to $2.93, while Transco Zone 4 shed 3 cents to $2.87.

After tracking inland in the coming days, Florence should move “over the Southeast this weekend,” NatGasWeather said in its one- to seven-day outlook Thursday. “Texas and the South will see areas of showers, while a cooler system impacts the Northwest. It remains hot over the Southwest with 90s and 100s, while also hot over the Southeast with lower 90s.

“Warm high pressure will strengthen over the northern half of the country to close out the week with 80s becoming widespread besides the Northwest.”

Radiant Solutions in its six-to-10-day outlook Thursday noted “significant warmer changes” for the eastern half of the country. “This comes as the European ensemble and operational models continue to show more limited intrusion of Canadian high pressure into the northern tier. As a result, belows are no longer in the forecast for any day in the upper Midwest or Northeast while areas of the lower Midwest/Mid-South carry much aboves for much of the period.

“However, there is notable model disagreement with the” Global Forecast System “coming in much cooler. Florence remains an issue with its remnants tracking into the East early, and we’ll also have to keep an eye on Isaac.”

Midwest spot prices worked higher Thursday as Radiant was calling for highs in Chicago to warm slightly into the mid-80s over the weekend into early next week. Chicago Citygate climbed 4 cents to $2.76, while Northern Natural Ventura added 7 cents to $2.73.

Elsewhere, prices in constrained West Texas continued to swing lower Thursday, with Waha tumbling 22 cents to $1.78.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |