Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Alaska LNG Gains Momentum with ExxonMobil Agreements

Alaska officials on Monday clinched an agreement to purchase ExxonMobil Corp.’s share of 30 Tcf of natural gas from the Prudhoe Bay and Point Thomson units, giving more validation to the 2 Bcf/d-plus export project.

The binding sales agreement, including key terms including price and volumes, between ExxonMobil Alaska Production Inc. and Alaska Gasline Development Corp. (AGDC), is momentum for the proposed gasline and liquefied natural gas (LNG) export facility, Alaska LNG.

ExxonMobil operates Point Thomson with a 62.5% share; BP plc is the minority partner. ExxonMobil also has a 36.4% share of Prudhoe Bay field, considered the largest oil and gas field in North America.

BP in May already came to terms with AGDC for a gas sales precedent agreement to purchase its share of gas from the Prudhoe Bay and Point Thomson units.

“This precedent agreement is good for Alaska and ExxonMobil and represents a significant milestone to help advance the state-led gasline project,” said ExxonMobil Alaska President Darlene Gates. “As the largest holder of discovered gas resources on the North Slope, ExxonMobil has been working for decades to tackle the challenges of bringing Alaska’s gas to market.”

ADGC filed an application in April with FERC to commercialize North Slope gas for overseas exports, with the project tentatively starting up by 2025.

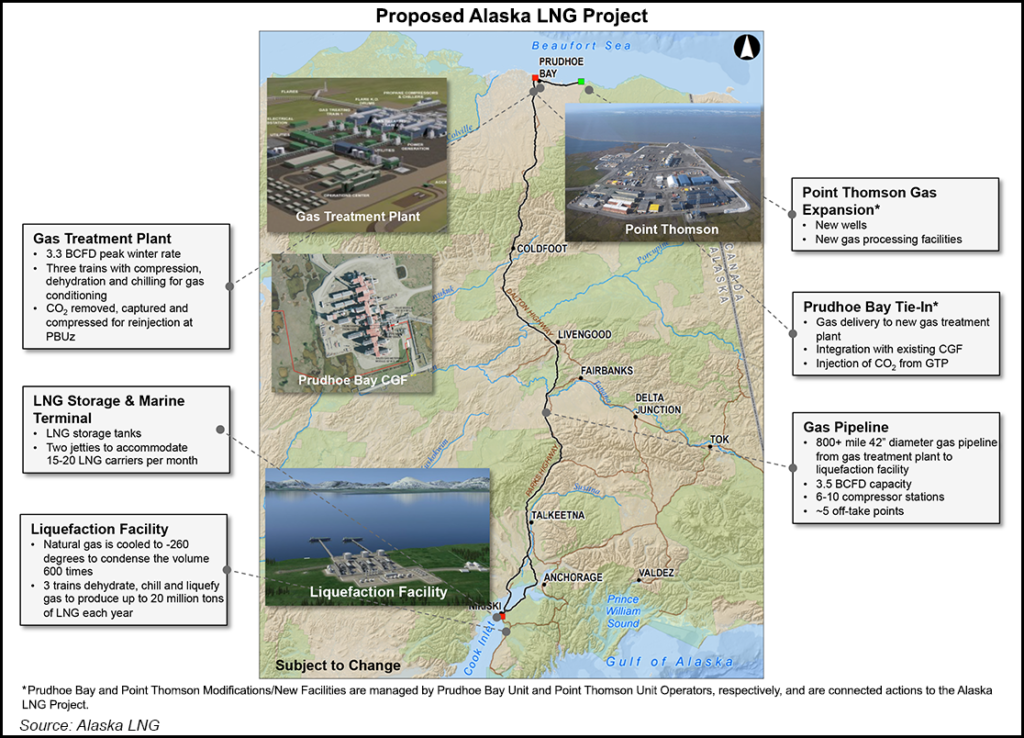

As designed, the project would export up to 20 million metric tons/year, or around 2.63 Bcf/d, with a three-train liquefaction plant in Southcentral Alaska at Nikiski, an 800-mile, 1.1 meter diameter gas pipeline; a gas treatment plant and interconnecting facilities to the Prudhoe Bay gas complex.

The Federal Energy Regulatory Commission earlier this month issued environmental schedules for a dozen LNG export projects, including Alaska LNG.

Gas-thirsty China is high on the radar for Alaska’s gas, and last November U.S. and Chinese officials signed a joint development agreement to help advance the project.

“The Alaska LNG project has made meaningful progress over the past year,” said AGDC President Keith Meyer. “We have secured the customers, we have advanced the project with regulators, and now we have ExxonMobil’s gas sales precedent agreement executed.”

Gov. Bill Walker said the agreement “means Alaska is one step closer to monetizing the North Slope’s vast and proven natural gas resources.”

In conjunction with the gas sales agreement, Alaska also reached agreement Monday with Point Thomson’s working interest owners (WIO), ExxonMobil and BP, to align work commitments and timelines established in a 2012 settlement agreement, which established timelines for production to begin. Production began in 2016, but the settlement also required the WIOs to commit by the end of 2019 to increase production.

Through a letter of understanding, the Alaska Department of Natural Resources (DNR), ExxonMobil and BP agreed to better align the settlement with the Alaska LNG project. The agreement effectively stays the year-end 2019 deadline as long as the project continues to progress.

The extension would end when the Alaska LNG project reaches final investment decision (FID), or when DNR notifies the parties that the project is no longer progressing. If the extension ends, the companies would have 30 months to reach FID on either of two development options at Point Thomson, or else lose acreage.

“This agreement continues to demand that our resources at Point Thomson are developed to the maximum benefit of all Alaskans, and also aligns the state and industry in a new way as the Alaska LNG Project advances,” DNR Commissioner Andy Mack said. “We are committed to development of this critical resource, and this agreement keeps us on track.”

Development of Point Thomson is considered key to bring North Slope gas to market, as it contains 25% of the North Slope’s discovered natural gas.

AGDC joined the Alaska LNG Project in 2014 and then assumed control in 2017, with two pipeline options. In June AGDC received environmental approval from the U.S. Army Corps of Engineers for one of the two proposed pipelines.

Tudor, Pickering, Holt & Co. (TPH), in commenting on the AGDC and ExxonMobil agreements, noted that the Alaska Oil and Gas Conservation Commission estimates that collectively, Prudhoe Bay and Point Thompson could produce more than 9 Bcf/d on a producing day basis or 7.6 Bcf/d on a calendar day basis.

Accounting for the WIO percent “but before any re-injection needs, which would be significant, volumes could nominally be between 2.7-3.2 Bcf/d,” TPH analysts estimated. “If true, the contract would cover the majority of volumes needed” for Alaska’s LNG exports.

“The project has neither been approved by FERC…nor been FID’d, but commentary by AGDC, its state backing, and favorable location (to Asia) position the project positively.”

However, the estimated in-service date of year-end 2024 “does little to fill the air pocket” as Cheniere Energy Inc.’s Corpus Christi LNG export project in South Texas expects to complete the third train by late 2021.

Even if Alaska LNG were to come online earlier, “we’d expect a limited impact on the overall U.S. natural gas market given its isolated location,” TPH analysts said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |