E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Worldwide Natural Gas Consumption to Overtake Oil by 2026, Says DNV GL

Global natural gas demand, boosted by expanding use of exports, should overtake oil consumption by 2026, escalate until 2034 and account for one-quarter of the world’s energy mix by mid-century, DNV GL said Monday.

Oil consumption worldwide is likely to peak in 2023 before gas takes the lead three years later, DNV GL said in its Energy Transition Outlook (ETO) to 2050. The global quality assurance and risk management company is a technical adviser to the oil and gas industry.

“The energy transition will be made up of many sub-transitions,” said DNV GL’s Liv A. Hovem, CEO of the oil and gas division. “Our outlook affirms that the switch in demand from oil to gas has already begun. Significant levels of investment will be needed in the coming decades to support the transition to the least carbon-intensive of the fossil fuels.

“Gas will fuel the energy transition in the lead-up to mid-century. It sets a pathway for the increasing uptake of renewable energy, while safeguarding the secure supply of affordable energy that the world will need during the energy transition.”

Liquefied natural gas (LNG) capacity is forecast to double by the late 2040s, connecting shifting sources of gas with changing demand centers, according to the report compiled by lead author Neil James Slater. DNV GL’s LNG outlook is similar to other major annual outlooks, including by the U.S. Energy Information Administration, International Energy Agency, BP plc and ExxonMobil Corp.

According to DNV GL, more gas use would mean more capital expenditures (capex) and operational expenditures (opex) are going to be needed. Researchers estimated upstream gas capex should peak in 2025 at $1.13 trillion from $960 billion in 2015, while upstream gas opex should reach a peak of $582 billion in 2035 from $448 billion in 2015.

Conventional onshore and offshore gas production should begin to skid around 2030, while unconventional onshore gas is forecast to peak in 2040. DNV GL expects this trend to lead to “leaner, more agile gas developments with shorter lifespans.”

According to the forecast, North America will continue to dominate unconventional gas production to 2050, while most of the onshore conventional gas production likely will be supplied by northeastern Eurasia, including Russia, as well as the Middle East and North Africa.

“In the offshore sector, the Middle East and North Africa will see the highest annual rate of new gas production capacity from now until at least 2050,” according to the DNV GL team. LNG capacity is to increase as production prices, doubling by the late 2040s as the midstream sector connects shifting sources of gas with changing demand centers.

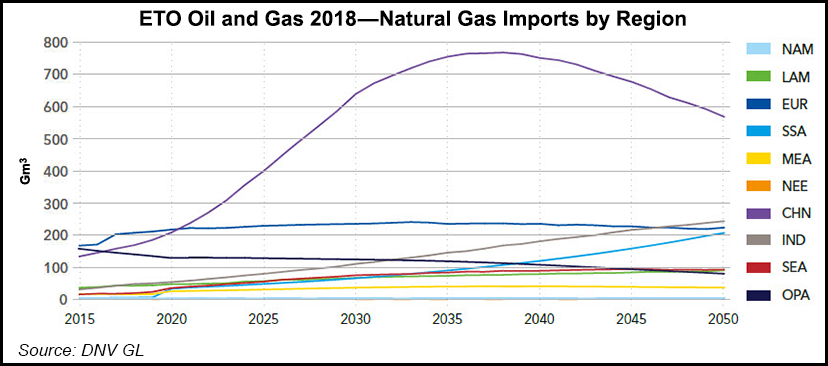

“Seaborne gas trade is forecast to treble from North America to China by 2050,” said Slater and his team. “An increase in trade from Sub-Saharan Africa to the Indian subcontinent and Southeast Asia is also expected.”

DNV GL forecasts further transition for the sector in the lead-up to 2050, as “greener” gases — including biogas, syngas and hydrogen — enter transmission and distribution systems.

Long after the peak forecast, new oil and gas resources would be required to replenish depleting reserves, said the researchers. The ETO covers the transition of the entire energy mix to 2050, with three supplements forecasting implications for the oil and gas, power and maritime industries.

“Our forecast points to a faster, leaner and cleaner oil and gas industry in the future,” Hovem said. “It’s time for our sector to enhance focus on developing the digital technologies that will enable quicker and more agile exploration and production, and the smooth integration of less carbon-intensive gases into the energy system.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |