Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Permian Highway Project Advancing to Move 2 Bcf/d to Gulf Coast and Beyond

The 2 Bcf/d Permian Highway (PHP) Pipeline Project, designed to move natural gas south across Texas via a 42-inch diameter pipeline, was given the all-clear sign late Wednesday by Kinder Morgan Texas Pipeline LLC (KMTP) and EagleClaw Midstream Ventures LLC.

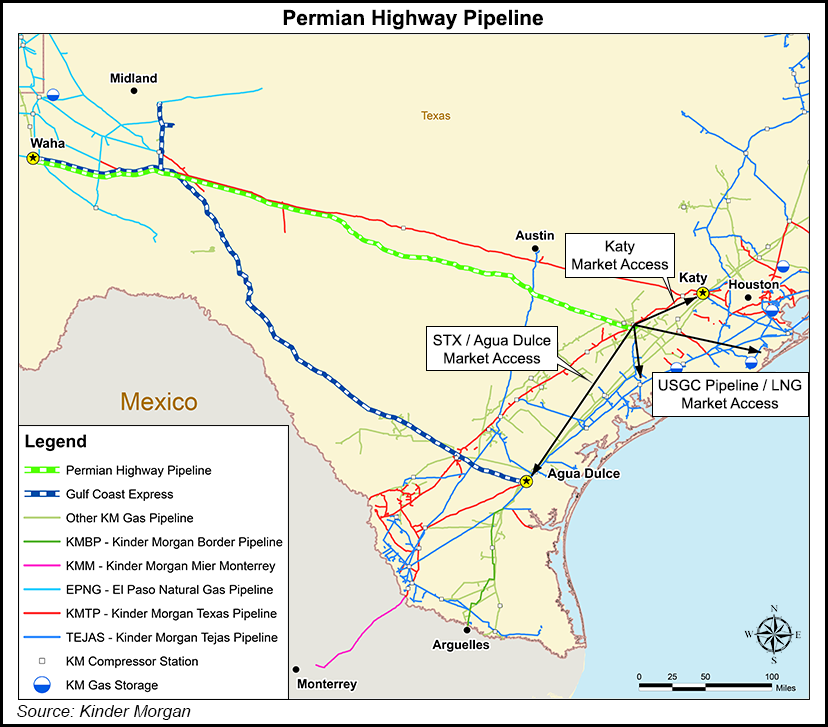

The final investment decision (FID) to advance PHP, unveiled in June, could put the pipeline in service by late 2020. PHP would move gas through a 430-mile pipeline from Waha in West Texas to Katy, outside of Houston, with connections to the Gulf Coast and Mexico markets.

“With a route identified and the project nearly fully subscribed, we expect to begin stakeholder outreach, environmental surveys and right-of-way activities in the coming months,” KMPT President Sital Mody said.

This is the second Permian-to-Gulf Coast gas project to advance that is led in part by the Kinder Morgan Inc. subsidiary. Gulf Coast Express, a 1.92 Bcf/d gas line, was given the green light in late 2017 by KMPT, DCP Midstream LP and an affiliate of Targa Resources Corp.

KMPT and EagleClaw, a portfolio company of private equity giant Blackstone Energy Partners, initially are splitting ownership in PHP 50-50.

Enough firm transportation agreements with shippers were in place to issue the positive FID. Nearly all capacity available on the system is subscribed and committed under long-term, binding transportation agreements and remaining capacity is expected to be awarded “shortly,” said the partners.

Shippers already committed to the project besides EagleClaw are Apache Corp. and XTO Energy Inc., a subsidiary of ExxonMobil Corp.

Apache, which has an option to acquire up to 33% equity in PHP, is assigning the option to Altus Midstream LP, which it formed in August with Kayne Anderson Acquisition Corp. to assist in moving Alpine High gas volumes from the Permian’s Delaware sub-basin.

“We are excited to see the Permian Highway Pipeline move forward,” said Apache’s Brian Freed, senior vice president of midstream and marketing. “This is a tremendous project with strong partners that will provide us with additional access to key natural gas markets.”

Ultimate ownership interests between KMPT and EagleClaw could vary from 27-50%, depending on the outcome of the options held by the anchor shippers.

“With the continued growth in drilling activity in the Permian Basin, this project will help to provide key infrastructure for producers to move natural gas to the best premium markets along the Gulf Coast and South Texas,” EagleClaw CFO Jamie Welch said.

EagleClaw on Wednesday said it plans to take over another Permian Delaware-focused midstreamer, Caprock Midstream Holdings, in a transaction worth an estimated $950 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |