Natural Gas Futures Down Again as Forecasters Spot Cooler Short-Term Trends; Waha Basis Strengthens

Natural gas futures continued to slide Wednesday, with the market anticipating the start of the shoulder season as lingering summer heat looked less impressive in recent guidance. In the spot market, West Texas basis strengthened for the second straight day as East Coast points pulled back; the NGI National Spot Gas Average fell 3 cents to $2.78/MMBtu.

After steep losses over the Labor Day weekend, the October Nymex futures contract fell further in trading Wednesday, giving up 2.8 cents to settle at $2.795, near its intraday low of $2.786. November dropped 2.9 cents to $2.813, while January dipped below the $3 mark, giving up 3.2 cents to settle at $2.995.

“The October natural gas contract rallied” Wednesday morning “on cash price strength as expected, moving just 7 ticks away from our $2.85 resistance level before a very weak winter strip pulled prices lower through the day,” Bespoke Weather Services told clients following Wednesday’s settle.

The firm pointed to “afternoon model guidance that continued cool short-term trends,” along with “a balance picture that is quite loose and expectations for a bearish” Energy Information Administration (EIA) storage report Thursday as factors driving Wednesday’s selling.

“With storage so low there is not much of a need to tighten demand much further than where it is already, even with production still soaring, making us think that the market will try and put in a more firm floor around the $2.75 level” with any “bullish weather developments” potentially leading to rallies, Bespoke said. “However, afternoon guidance only continued to show less cooling demand in the short term and a long-term pattern that is not conducive for any early season heating demand either.”

The technical picture isn’t particularly encouraging for bulls either, based on a breakdown of historical seasonal trends from ICAP Technical Analysis analyst Brian LaRose.

For all years going back to 1990, “natural gas is in the window for a seasonal cycle low. The epicenter of that window is Aug. 26,” LaRose said. But “based on the last five years of data the bottoming window has migrated from August out to mid-October, Oct. 17 to be exact. So there is still time for further downside, according to the five-year average.”

Meanwhile, data for all years going back to 1990 shows an average fall-to-winter seasonal advance for the spot contract of just over 100%, according to LaRose. But this has also changed in recent years.

“Based on the last five years of data, the average gain is just 57%” for a fall-to-winter rally, he said. “Recent history suggests the historical preseason rally could become nothing more than a brief seasonal anomaly in the future. However, with working gas in storage on the low end of the both the five- and 10-year averages, we would not ignore the historical gains associated with a typical fall-to-winter advance.”

LaRose pegged three support levels that could hold ahead of a potential seasonal rally going into the winter, the first at $2.781-2.777-2.766, then $2.644-2.642, and then down to around $2.523-$2.568.

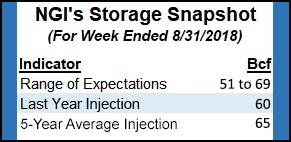

Major surveys show the market expecting EIA to report a storage build in the low 60s Bcf Thursday when it releases its weekly inventory data covering the week ending Aug. 31.

A Reuters survey of traders and analysts on average predicted a 62 Bcf build, between the five-year average 65 Bcf injection and the 60 Bcf build recorded in the year-ago period. Responses ranged from 51 Bcf to 69 Bcf. As of Wednesday afternoon, a Bloomberg survey showed a median 61 Bcf injection based on 12 estimates, with a range of 52 Bcf to 69 Bcf.

Last week, EIA reported a 70 Bcf build that surprised to the bearish side of consensus.

In the spot market Wednesday, West Texas prices rose sharply for the second straight trading day, gaining significant ground on benchmark Henry Hub in the process. After jumping 55 cents on Tuesday, Waha tacked on another 18 cents Wednesday to average $2.02, closing the gap on Henry Hub (which fell to $2.94 Wednesday) by around 70 cents over the last two trading days.

El Paso Permian similarly gained 14 cents Wednesday to average $1.95, following up on a 38-cent gain posted the previous day.

The strong start to post-Labor Day trading for Waha has seen the West Texas point rebound from some of the widest negative basis differentials it’s seen in years. Just one week earlier, Waha spot prices averaged a measly $1.27 in trading on Aug. 29, $1.69 back of Henry Hub. You’d have to go back to November 2008 to find the last time Waha traded at such a steep discount to Henry, and that was during a stretch when the Louisiana hub was routinely averaging above $6/MMBtu, Daily GPI historical data show.

The cash gains should also give Waha bidweek gas buyers reason to feel good, at least for now. Fixed price trading at Waha averaged $1.29 during September bidweek, a significant discount of more than 70 cents to Wednesday’s spot average, especially when considered in terms of percentage given the region’s depressed pricing due to import constraints.

The force majeure El Paso Natural Gas (EPNG) declared Tuesday due to an equipment failure at its Puckett Compressor Station in West Texas remained in effect Wednesday, reducing flows to zero through its “PUC WAHA” location.

Genscape Inc. analyst Joseph Bernardi said the event cuts about 90 MMcf/d of intra-Permian Basin flows based on the recent 30-day average.

“This meter was also restricted at the beginning of June due to a force majeure equipment failure, with that event cutting a comparable amount of gas to this event,” Bernardi said. “Waha basis price strengthened over the course of that six-day outage in June, although there were also additional forces majeure in place on EPNG’s system at that time.”

On Wednesday, EPNG declared an operational flow order due to concerns “that the unavailability of the Washington Ranch storage facility” in New Mexico starting Thursday “and the continued drafting of the system” at certain locations in the Arizona and New Mexico “will undermine our ability to meet scheduled deliveries.” The operator notified shippers that “immediate action is required to ensure that system pressure remain at a level capable of meeting scheduled deliveries off the system.”

Last month, EPNG notified customers that it planned to conduct bottom hole surveys at the Washington Ranch facility from Thursday until Sept. 13.

Meanwhile, the strengthening basis for West Texas also comes amid recent indications of slower drilling and completions activity in the Permian, according to Patrick Rau, NGI‘s Director of Strategy & Research.

“Halliburton noted it is seeing more white spaces in its fracking calendar in the region, and Keane Group took down its 3Q18 guidance more than expected,” Rau noted.

Shares of HAL and FRAC were down 6% and 9% in late Wednesday afternoon trading, respectively.

Another potential factor, according to Rau, is now that the calendar has turned to September, utilities and the like should start injecting more gas in the South Central region, which could open the door for more Permian production to find a home. As of Aug. 24, storage in the South Central region stood at 800 Bcf, down 262 Bcf from last year and a full 229 Bcf below the previous five-year average.

NGI provides a detailed breakout of South Central storage each week in its daily Mexico Gas Price Index publication.

Downstream of West Texas production, prices gained in California and the Desert Southwest as forecasts were showing temperatures at regional population centers hovering in cooling degree day territory and likely to warm into the weekend. Gaithersburg, MD-based forecaster Radiant Solutions was calling for highs in Burbank, CA, to reach close to 100 degrees by Saturday, up from a high of 82 Wednesday.

SoCal Citygate climbed 15 cents to $4.26, while SoCal Border Average added 21 cents to $2.78. In Arizona/Nevada, Kern Delivery surged 55 cents to $3.39.

Elsewhere in the spot market, East Coast points backed off from recent heat-driven gains. Radiant Solutions was calling for highs in New York, Boston, Philadelphia and Washington, D.C. to cool down into the 70s and 80s Friday from highs in the mid to low 90s on Thursday.

Algonquin Citygate tumbled 50 cents to average $3.11, while further south Transco Zone 5 shed 11 cents to $3.10.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |