First Cold Shot of Season Sends Most Weekly NatGas Prices Lower; Heat Lifts Northeast

A reprieve from the unrelenting heat that drove strong natural gas demand for most of the summer pushed weekly gas prices lower across most of the country from Aug. 27-30, with some of the most substantial losses seen in the West, from the Rockies, Arizona, Nevada and California. There were exceptions, however, as hot high pressure on the East Coast sent temperatures close to 100 degrees in some locales, lifting weekly prices by double digits. Overall, the NGI Weekly National Avg. for September gas for the week through Thursday fell 3 cents to $2.76.

Most of the United States got their first taste of fall as a decent cold shot of the season moved into the country’s midsection early in the week. The weather system brought showers and thunderstorms across the northern Plains and gradually advanced through the Midwest and Ohio Valley for several days, according to NatGasWeather.

The milder conditions led to significant weekly declines in the Rockies, where Northwest Sumas plummeted 18 cents from Aug. 27-30 to reach $2.29 and Kern River dropped 17 cents to $2.32. CIG was down 12 cents to $2.26.

Prices in California also moved lower despite increasing heat in the region during the second half of the week. AccuWeather showed highs in Los Angeles moving from the low 80s on Monday (Aug. 27) to the low 90s by Friday (Aug. 31). Given the hotter weather on tap, SoCal Citygate posted one of the smallest declines in the region, shedding just 11 cents to reach $4.73. Malin dropped 18 cents to $2.37, and PG&E Citygate fell 17 cents to $3.16.

Weekly prices in Arizona/Nevada posted the most significant decreases across the country as El Paso S. Mainline/Baja and Kern Delivery each plunged more than 50 cents from Aug. 27-20 to reach $2.50 and $2.83, respectively.

The picture could not be more different in the Northeast, where yet another heat wave moved into the region and drove temperatures far above seasonal norms, prompting local electric grid operators to issue hot weather alerts and utilities to ask for power conservation. In addition to the heat, Genscape Inc. reported that after the close of trading Monday (Aug. 27), New England’s 688 MW Pilgrim nuclear plant ramped down to 40% of nameplate capacity as excessive heat warnings were declared in the region.

Aggregate nominations for Tuesday’s power burn across New England were summing up to 2,066 MMcf/d, which — barring revisions — would establish a new record high, topping the previous burn record of 1,788 set in 2010, according to Genscape senior natural gas analyst Rick Margolin.

“This is the major component in total regional demand from all sources topping the 3 Bcf/d mark, which has never been done in a May-October time period,” Margolin said.

Given the strong demand in the region, Algonquin Citygate shot up 59 cents from Aug. 27-20 to reach $3.52, while Tennessee zone 6 200L jumped 54 cents to $3.46.

The Summer That Won’t End

On the futures front, the past week saw the Nymex September contract post back-to-back losses on Monday and Tuesday before a flip in Wednesday’s medium-range weather outlooks sent the then-prompt month off the board more than 4 cents higher at $2.895. For the Aug. 27-30 period, September contract edged up roughly 2 cents to expire at $2.895. The October contract, meanwhile, continued to strengthen throughout the rest of the week, ending the Aug. 27-31 period up 4.7 cents at $2.916.

Weather forecasts overnight Thursday continued moving hotter yet again, “as we are approaching some of the hottest output possible for the time of year,” Bespoke Weather Services said. As expected, American guidance moved much closer to the heat European guidance was showing, “with heat peaking next week but lingering with strength through much of the medium range and into the long range as eastern ridging fails to break down,” chief meteorologist Jacob Meisel said.

Bespoke still expects this eastern ridge to eventually propagate westward around mid-September, which should begin to cool the eastern third of the country and limit the extent of heat. “However, that is not yet shown on guidance, which really shows max heat at this stage,” Meisel said.

That being said, the forecaster said he is unsure that hotter trends may arrive, “but current forecasts are quite supportive and medium-range heat has significant upstream support, so it should remain.”

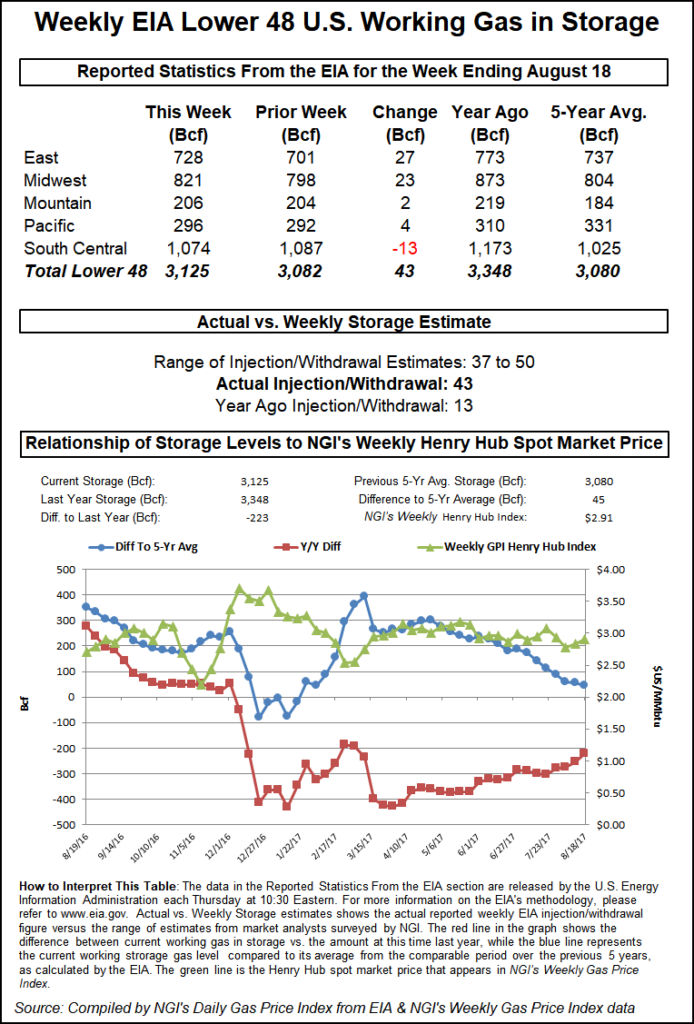

The lingering heat is expected to drive strong demand through the middle of September, which throws a wrench into many market observers’ theories of record production chipping away at hefty storage deficits, at least temporarily. The Energy Information Administration delivered a shocker of a weekly storage inventory report on Thursday (Aug. 30), reporting a 70 Bcf injection into gas stocks for the week ending Aug. 24.

On the surface, the bearish storage build could have been viewed as a sign of more stout injections to come as market consensus had clustered around a build in the mid-60 Bcf range. The 70 Bcf print was also significantly larger than both last year’s 32 Bcf build for the week and the five-year average injection of 59 Bcf.

But NatGasWeather said EIA’s storage report offered no change in the bigger picture “as deficits dropped to 588 Bcf…but should increase back toward 600 Bcf after next week’s EIA report accounts for hot conditions over the southern and eastern U.S. this week.”

Deficits also could expand because of “tough comparisons” to last year’s bearish hurricane season, EBW Analytics said. By September, however, liquefied natural gas maintenance, bearish weather and a likely ramp-up in Appalachian gas production “could meaningfully loosen the supply/demand balance in the coming months, driving a year-over-year deficit reduction of 4.8 Bcf/d from mid-September through the end of the injection season,” EBW CEO Andy Weissman said.

Hot Holiday Weekend Lifts Spot Gas

Despite the extended holiday weekend, spot gas prices were mixed in Friday trading as a heat wave was expected to start building late in the weekend and then get the first week of September off to a hot start.

National demand eased Friday as a cool front advanced across the Mid-Atlantic and Northeast, easing highs back into the 70s and 80s. A swing back to stronger-than-normal national demand, however, was expected to occur later in the weekend through next week as hot high pressure returned over most of the United States, except over portions of the West, according to NatGasWeather.

The result is daytime temperatures in the mid-80s and 90s again becoming widespread across the Great Lakes, Mid-Atlantic and Northeast, with hot and humid conditions remaining across the southern part of the country, the forecaster said.

“The data continues to be slower in how fast the upper ridge weakens Sept. 7-11 and where the GFS and European models have been hotter trending the past couple days, stalling the fizzling of late summer heat across the eastern, central and southern U.S.,” NatGasWeather said.

Trading action on Friday for gas delivery through the holiday weekend was a direct reflection of where the most intense heat was forecast to be concentrated. California markets were a sea of red as the volatile SoCal Citygate tumbled more than 50 cents to $4.25, while Malin slipped less than a nickel to $2.36.

Moderate declines were also seen in the Rockies, where El Paso-Bondad dropped a dime to $2.10, and Northwest S. of Green River fell 6 cents to $2.20.

Interestingly, most Appalachia points also declined despite the hot weather heading into the region. Dominion South fell 6 cents to $2.52, while Transco-Leidy Line dropped 13 cents to $2.41. Tennessee zone 4 Marcellus plunged 25 cents to $2.13.

Meanwhile, other points on the Tennessee Gas Pipeline posted sharp increases as the pipeline on Friday issued an operational flow order “Daily Critical Day 1” for Tuesday (Sept. 4) for all balancing parties downstream of Station 245 on the 200 Line and downstream of Station 325 on the 300 Line.

All delivery point operators downstream of Station 245 on the 200 Line and downstream of Station 325 on the 300 Line were required to keep actual daily takes out of the system equal to or less than scheduled quantities regardless of their cumulative imbalance position, the company stated. All receipt point operators downstream of Station 245 on the 200 and downstream of Station 325 on the 300 Line also were required to keep actual daily receipts into the system equal to or greater than scheduled quantities regardless of their cumulative imbalance position.

Tennessee zone 4 200L spot gas rose 14 cents to $2.77, while Tennessee zone 6 200L spot gas jumped more than 30 cents to $3.09.

Meanwhile, Columbia Gas spot gas prices also nudged out a small 3-cent gain to $2.71 as maintenance beginning Saturday (Sept. 1) on the pipeline’s WB system was to restrict operational capacity through the Lost River compressor station (CS) to various levels through Sept. 10: 1,050 MMcf/d Sept. 1-2; 1,000 MMcf/d Sept. 3-5; 845 MMcf/d Sept. 6-7; and 945 MMcf/d Sept. 8-10.

Flow through the Lost River CS has mirrored operating capacity closely, with a 30-day average utilization of 93%, average nominations of 960 MMcf/d and a max of 1.17 Bcf/d, according to Genscape Inc. “The operational capacity restrictions during the maintenance are likely to reduce scheduled nominations correspondingly,” Genscape natural gas analyst Vanessa Witte said.

In addition, the pipeline’s VB system is set to undergo maintenance beginning Monday through Friday, which would reduce operational capacity to the Loudoun LNG interconnect with Dominion Cove Point to 350 MMcf/d from Monday through Wednesday, and to 225 MMcf/d on Thursday and Friday.

Average nominations to Cove Point at Loudoun were around 400 MMcf/d, excluding prior maintenance from Aug. 7-21, when the Loudoun LNG interconnect was completely shut-in, Genscape said. During this event, Transcontinental Gas Pipe Line picked up the remainder of flows to Cove Point at the Pleasant Valley location, “and it is likely the current maintenance will produce a similar outcome,” Witte said.

Elsewhere across the country, Southeast pricing location put up gains of more than a dime in some areas, while Louisiana and East Texas posted smaller gains.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |