Hotter Medium-Range Outlooks Send October Natural Gas Higher Despite Bearish Storage Data; Spot Gas Slides

Just when the idea of record production and a surprise bearish storage injection may have sent natural gas prices tumbling, weather forecasts turned hotter for the first week of September. The Nymex October gas futures contract, in its first day in the prompt-month position, nudged out a 1.1-cent gain to settle Thursday at $2.874. November also climbed 1.1 cents to hit $2.901.

Spot gas prices, however, moved lower for the second day as cooler conditions had already begun moving into parts of the country before becoming more widespread by Friday. The NGI National Spot Gas Avg. fell 12 cents to $2.64.

Nymex futures were stronger from the start of trading, rising more than a penny at the open but then softening later in the morning following the Energy Information Administration’s (EIA) weekly storage inventory report. The EIA reported a 70 Bcf injection into inventories for the week ending Aug. 24. The reported build was well outside of market consensus that had clustered around a build in the mid-60 Bcf range.

By 11 a.m. ET, however, the October contract had edged up to trade on par with Wednesday’s settle and then gained modest ground throughout the day.

Regarding the EIA report, Bespoke Weather Services said the net of the last two weeks yielded a better reading of balance. The firm, which had projected a 66 Bcf build, said that given the miss, however, the print indicated “weekly noise” in EIA data may be playing a role in these misses.

“This print confirms much of the demand-side loosening we observed last week that appears to have carried into this week, and also reflects the recent surge in production,” Bespoke chief meteorologist Jacob Meisel said.

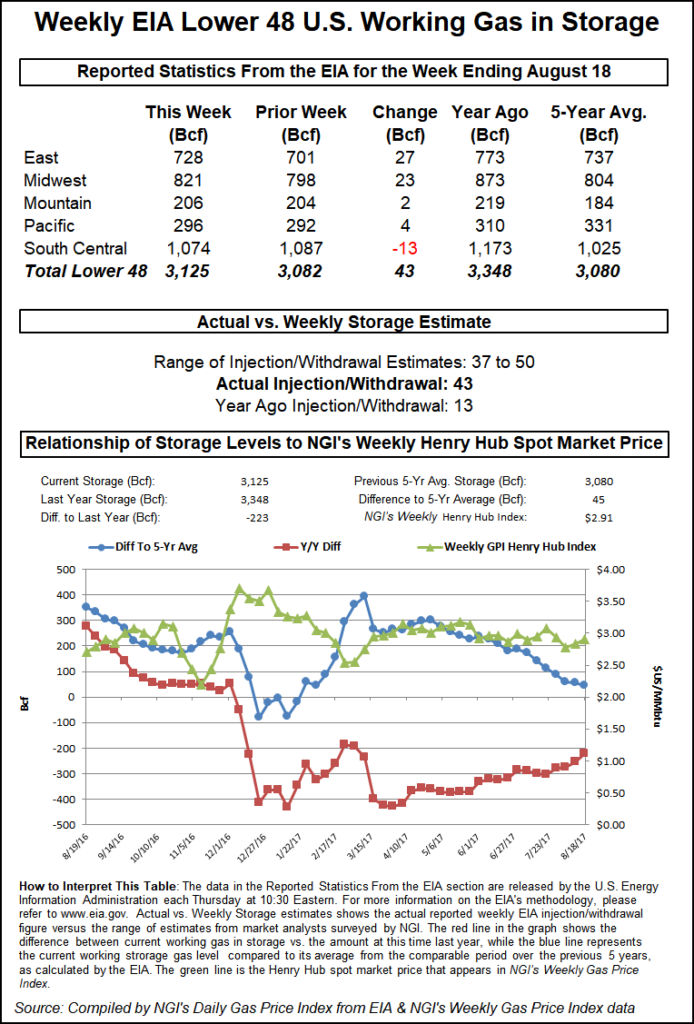

The 70 Bcf build was significantly larger than both last year’s 32 Bcf build for the week and the five-year average injection of 59 Bcf.

Traders scoured the EIA data to find the missing link that caused the discrepancy between the estimated storage injection and the actual print. The Midwest region appeared to be culprit as mild temperatures and low humidity led to a 6 Bcf increase in injections week/week.

“Weather impacts start to get a little goofy though in the fall when you start getting moderate weather,” Weather Decision Technologies forecaster Stephen Strum said. “We had the windows open with temperatures in the mid-80s. We would have had the A/C on with the same weather in May.”

Broken down by region, the EIA reported a build of 35 Bcf in the Midwest, 27 Bcf in the East, 4 Bcf in the Mountain, and 2 Bcf each in the Pacific and South Central regions. Inventories as of Aug. 24 stood at 2,505 Bcf, 646 Bcf below last year and 588 Bcf below the five-year average.

Despite the bearish report, NatGasWeather said EIA’s storage report offered no change in the bigger picture “as deficits dropped to 588 Bcf…but should increase back toward 600 Bcf after next week’s EIA report accounts for hot conditions over the southern and eastern U.S. this week.”

Furthermore, the latest weather outlooks are pointing to another heat wave during the first week of September that’s likely to stick around longer than initially forecast. The European and Global Forecasting System (GFS) models were hotter trending with the pattern Sept. 5-10, according to NatGasWeather. Each slowed the weakening of hot high pressure that sets up to dominate most of the eastern and southern United States next week.

Despite a minor change in midday data, models overall were a little hotter trending to add several cooling degree days, the forecaster said. Still, most data favor a more comfortable pattern setting up for much of the United States after Sept. 7-8.

Production Filling Storage, Supporting Region Prices

With the shoulder season looming, market observers will be looking to production to quickly fill storage inventories before winter. Genscape Inc.’s SpringRock group said production on Monday (Aug. 27) set another record high of 82.25 Bcf/d. In the 10 days leading up to Thursday, production has averaged about 81.6 Bcf/d, about 0.6 Bcf/d above the August month-to-date average, according to senior natural gas analyst Rick Margolin.

Meanwhile, production is expected to climb even higher as additional takeaway capacity goes online later this year. Transcontinental Gas Pipe Line Co. LLC (Transco) has asked the Federal Energy Regulatory Commission for authorization to begin full service on its 1.7 million Dth/d Atlantic Sunrise expansion by Sept. 10.

Between Atlantic Sunrise and other recent expansions, including the start-up of two additional supply laterals on the Rover Pipeline Project, Marcellus and Utica shale producers will have more options to get their gas to market this winter.

Already, August has seen an additional 7 Bcf of takeaway capacity versus August 2017, according to Genscape. The increased takeaway capacity has had a positive effect on gas prices in Appalachia. In each of the last four summers (2014-2017), the firm has seen significant basis blowouts toward the end of the summer, with August cash prices averaging $1.45 below Henry Hub and October cash averaging $1.76 below the benchmark. The blowouts reflected capacity constraints in moving gas out of the supply region and into demand markets.

“These capacity constraints were the result of increased export requirements out of the region (driven by production growth) that continually outpaced available pipeline export capacity,” Genscape senior natural gas analyst Eric Fell said.

As of Thursday, however, Dominion cash prices sat just 32 cents behind Henry Hub, and Dominion’s September forward contract settled 42 cents below the Nymex contract. The continuing strength in Dominion prices is an indication that this additional takeaway is easing the constraints seen in previous years, Genscape said.

“This summer, year on year (y/y) changes in local Mid-Atlantic demand (up an estimated 1.1 Bcf/d y/y) and an increase in exports from the region” via liquefied natural gas (LNG) (up 0.7 Bcf/d versus last summer) have also lent some strength to local basis, Fell said.

Although capacity expansions finally outpacing production growth is the primary reason for stronger basis this summer, the coldest April in more than 30 years contributed significantly to the storage deficit and lent some strength to summer basis, he said.

Brief Slide In Temps Softens Spot Gas

Spot gas prices continued to slide Thursday despite lingering heat in parts of the country. Daytime temperatures were once again forecast to reach the 90s on the far East Coast, while hot and humid conditions remain in the southern United States, according to NatGasWeather.

National demand, however, was expected to be lighter Thursday through Saturday as a cool front advances across the Mid-Atlantic and East, easing high temperatures from the 90s to the 70s and 80s. A swing back to stronger-than-normal national demand was expected to occur late this weekend through next week as hot high pressure returns over all but portions of the West. Highs were then forecast to climb back into the mid-80s and 90 across the Great Lakes, Mid-Atlantic and Northeast, while remaining hot and humid across the southern United States, the forecaster said.

“We continue to view the pattern next week as bullish,” NatGasWeather said.

Thereafter is where the weather models diverge with the European holding the hot ridge a few days longer over the eastern half of the country, while “most other datasets continue to usher in cooling after Sept. 7-8 as numerous weather systems track across the country to ease widespread late summer heat,” it said.

In East Texas, where summer heat refuses to loosen its grip, next-day gas at the Houston Ship Channel held steady at $2.98, while other pricing locations in the region dropped as much as 6 cents.

In West Texas/southeastern New Mexico, El Paso-Permian plunged 26 cents to $1.35 and Transwestern dropped 10 cents to $1.32.

Prices across the Midcontinent and Midwest continued to post more modest decreases, with Chicago Citygate coming off 3 cents to reach $2.69 and Northern Border Ventura sliding 7 cents to $2.62.

In the Southeast, Transco zone 5 fell more than a dime to 2.91, while Tennessee zone 1 100L barely slipped a penny to $2.77.

Most Appalachia pricing hubs posted losses of between a nickel and a dime, although Texas Eastern M-3, Delivery tumbled 14 cents to $2.68. Sharper declines were seen throughout the Northeast, where Algonquin Citygate spot gas plummeted 81 cents to $2.74 and Tennessee zone 6 200L dropped 57 cents to hit $2.78.

Rockies prices were a mixed bag, although day/day changes were rather modest at most pricing hubs. In California, SoCal Citygate continued to be a big mover as next-day gas plunged 75 cents to $4.81.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |