Heavy Buying Into Close Sends September NatGas Off the Board; Cooler Weather Sinks Spot Gas

Near-term heat was enough to set the stage for a bump ahead of Wednesday’s expiration of the Nymex September natural gas futures contract, which settled 4.3 cents higher at $2.895. October, which takes over the prompt-month position on Thursday, was up 1.8 cents to $2.863. Spot gas prices, however, were generally lower as much of the country was set to get a brief break in the heat. The NGI National Spot Gas Avg. fell 9 cents to $2.76.

On the futures front, the September contract was fractionally higher at the open and traded in a tight range of about 4 cents for most of the day before some additional strengthening in the last half hour of trading. The October contract also nudged higher, and small gains of about a penny were seen through March.

Even with Wednesday’s modest increase, the September contract has softened nearly 7 cents since last Thursday (Aug. 23). “This steep decline reflects increasing recognition that, despite historically low expected end-of-summer storage, the market is likely to be significantly oversupplied this winter and much of next year,” EBW Analytics said.

Still, it should come as no surprise that September expired higher since that has generally been the case for expiring contracts since January 2017. On average, contracts gained 4.9 cents on expiration day, “a robust trend over the last 20 months,” EBW CEO Andy Weissman said.

Meanwhile, the recent three-day sell-off was a “little overextended” and was reason enough for ICAP Technical Advisors’ Brian LaRose to see the potential for a midweek bounce. “If we do get any sort of pop, I’m still inclined at this juncture to look for further downside.”

LaRose said he would “need to see a pretty significant shift in the technical picture to get back aboard the bullish bandwagon, and right now, I’m not convinced we’re going to be able to do that given the overwhelming majority of bulls that were in the market recently.”

Indeed, while weather models turned slightly more bullish for near-term heat, the consensus remains that summer heat will likely fade after Sept. 7. Most of the overnight Tuesday weather data was a little hotter trending except the European model, but all still comfortable with the pattern after September 7, according to NatGasWeather.

Both the early morning and midday Global Forecasting System (GFS) were trending hotter to add several additional cooling degree days/Bcf in demand by slowing the weakening of hot upper high pressure over the southern and eastern United States, the forecaster said.

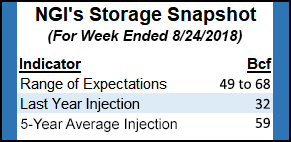

Meanwhile, storage — while it mostly has taken a back seat to production despite sitting near historic lows — will be front and center on Thursday as the Energy Information Administration (EIA) is set to release its weekly inventory report. Estimates are wide-ranging for the report (for the week ending Aug. 24), in the high 40s to low 70s Bcf. EBW projected a build of 59 Bcf, while Bespoke Weather Services expected a 66 Bcf build. Kyle Cooper of IAF Advisors projected a 64 Bcf injection. Early estimates of 18 market participants surveyed by The Desk reflected an average injection of 63 Bcf.

A Bloomberg survey of 14 market participants showed estimates ranging from 49-68 Bcf, with an average of 60 Bcf and a median of 62 Bcf. A Reuters poll of 20 market participants pointed to a 66 Bcf injection. The five-year average build stands at 59 Bcf.

An injection in the mid-60 Bcf range would boost stockpiles to the lowest for the week since 2003. That would be about 21% below the same week a year ago and about 19% below the five-year average. Last week, the EIA reported a 48 Bcf build into storage.

Despite the dismal storage picture, it appears that most market observers are banking on record production growth to quickly fill inventories to more comfortable levels once summer heat fades. Already, some storage fields are showing signs of stronger injections.

Transcontinental Gas Pipe Line Co.’s two reported storage fields, Washington and Eminence, are at near-record lows, though recent injection rates are on a trajectory to get end-of-season inventories slightly higher than last year, according to Genscape Inc.

Washington storage, in St. Landry parish, LA, was reported to be at 59.4 Bcf as of Aug. 26, 78.6% of its working gas capacity of 75.6 Bcf. Washington inventory is roughly 4.7 Bcf lower than last year’s level at this time of year and at its lowest level since 2014, Genscape natural gas analyst Josh Garcia said.

Eminence storage in Covington County, MS, is a much smaller storage field with a working gas capacity of 11.5 Bcf, but its storage levels are the lowest in the last five years. Eminence inventory is currently at 5.8 Bcf, about 900 MMcf lower than last year’s levels, according to Genscape.

“Despite low storage levels, Transco has injected an average of 167 MMcf/d across both its reporting storage fields. At that pace, Transco would reach a combined inventory level of 78.8 Bcf by mid-November, which is higher than last year’s end of season level of 77.3 Bcf,” Garcia said.

Furthermore, Transco reported last week that its inventory level was 77.5% full as of Aug. 17, which takes into account more storage than what is reported at Washington and Eminence. Comparatively, combined reported inventory at Washington and Eminence was at 73.4% on Aug. 17, Garcia said.

Cool Front Drives Spot Gas Lower

Spot gas prices across most of the country ended the day in the red as traders eyed a cool front that is expected to slowly make its way into the eastern United States beginning Thursday. Daytime temperatures were still expected to reach the mid-90s along the East Coast both Wednesday and Thursday, with hot and humid conditions expected to remain across the southern United States, according to NatGasWeather. But a notable cool front was pushing through the Midwest and Plains with showers and thunderstorms, easing national demand for Thursday and Friday as it advances farther into the East.

A swing back to stronger-than-normal national demand was expected to occur late this weekend through the Sept. 3-7 week as the hot ridge bounces back over the eastern half of the country, with highs in the mid-80s and 90s again becoming widespread across the Great Lakes, Mid-Atlantic and Northeast, the forecaster said. The southern United States was expected to remain hot and humid.

“The pattern is certainly hot enough next week to be considered at least somewhat bullish. But with the upper ridge favored to gradually weaken after Sept. 7, this will result in the coverage of 90s becoming greatly reduced to only include portions of the southern U.S.,” NatGasWeather said.

This is where the GFS weather model has been a little hotter by slowing the weakening of the upper high pressure ridge over the east-central United States in recent runs, although still gradually becoming comfortable over much of the country, it said.

As for spot gas prices, the steepest day/day declines were seen in the Northeast, where Algonquin Citygate plunged 50 cents to $3.55 and Iroquois Zone 2 tumbled 64 cents to $3.22. Tennessee Zone 5 200L was down more than 30 cents to $2.99, while Tennessee Zone 6 200L dropped 66 cents to $3.35.

Appalachia pricing locations also declined, but losses were limited to no more than a dime across the region. Millennium East Pool fell 10 cents to $2.40, and Tennessee Zone 4 Marcellus dropped 7 cents to $2.36. Texas Eastern M-3, Delivery also slid 7 cents to $2.82.

The regional declines come even as PJM Interconnection extended a Hot Weather Alert into Thursday for a portion of its territory as excessive heat was forecast to continue. The operator of the nation’s largest electric grid extended the alert for Thursday in the Dominion region, which includes Virginia and parts of North Carolina served by Dominion Energy.

Based on preliminary estimates, electrical usage reached its highest point this year on Tuesday (Aug. 28), peaking at more than 151,000 MW across 13 states and the District of Columbia. PJM’s all-time highest electricity usage was 165,492 MW in summer 2006. Last summer, demand peaked at 145,331 MW.

Meanwhile, most other pricing hubs across the country posted small decreases of less than 10 cents, while intensifying heat in California lifted SoCal Citygate more than $1 to $5.56.

On the pipeline front, Genscape reported that as of Monday evening, the Rover Majorsville supply lateral began showing nominations of a around 20 MMcf/d. As the firm had anticipated, gas was rerouted from Texas Eastern Transmission Company and Columbia Gas Transmission (TCO), primarily through points in West Virginia.

As of Wednesday, nominations were down to zero, but despite this day/day drop, “we are expecting the Majorsville point to continue to ramp with the potential to add 300-400 MMcf/d as the contracts roll out on September 1,” Genscape natural gas analyst Laura Munder said.

Genscape said its views have not changed regarding the remaining supply laterals. The company has not yet seen nominations from Burgettstown, “and we continue to expect little gas initially,” Lunder said. Sherwood and TCO laterals have yet to file an in-service request with the Federal Energy Regulatory Commission, “but we are expecting to see them come through in the near future.”

In addition, Cimarron on Tuesday morning posted a critical notice regarding unplanned maintenance at the Panhandle Eastern Pipeline 100 Line interstate interconnect with Panhandle in Kiowa county, KS. At the same time, another notice was posted notifying customers of an unplanned outage at the Beaver Station in Beaver, OK.

Both notices detail almost identical impacts to around 26 receipt/delivery locations, Genscape said. “These events will affect flows to Cimarron River Pipeline points and deliveries onto the Panhandle Pipeline,” Genscape natural gas analyst Dominic Eggerman said.

Current deliveries onto the Panhandle pipeline have dropped from a prior 30-day average of 138 MMcf/d to zero on Wednesday’s gas day. Aggregate scheduled flows at the impacted locations on Cimarron have averaged 80 MMcf/d over the same period, according to Genscape.

Both maintenance events are slated to be completed by Nov. 28.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |