E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | Permian Basin

Texas Upstream Job Growth Still Moving Up, with Recovery in Full Swing

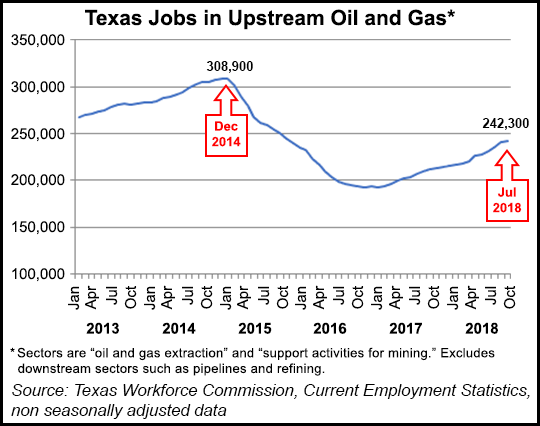

The Texas oil and natural gas industry added an estimated 800 upstream jobs in July, which marked the 20th consecutive month of job growth, according to the Texas Workforce Commission.

The state has recovered 43% of upstream jobs lost between the “high point” in employment in December 2014 and the “low point” in September 2016, according to the Texas Oil & Gas Association (TIOGA). Oil and gas extraction, as well as support activities for mining, are included in the upstream sector, but the tally excludes jobs in refining, petrochemicals, fuels wholesaling, oilfield equipment manufacturing, pipelines and natural gas utilities.

Since the low point two years ago, upstream sector employment has grown by 49,900 jobs, which pay among the highest wages in the state.

“What’s happening in the Lone Star State is making our nation more energy secure and bolstering our state and national economies,” said TIOGA President Todd Staples.

The latest employment report dovetails with a recent analysis by the Greater Houston Partnership (GHP), which declared the oil bust over for the nation’s largest energy complex. The economic development organization serves the Greater Houston area, including the counties of Austin, Brazoria, Chambers, Fort Bend, Galveston, Harris, Liberty, Montgomery, San Jacinto and Waller.

Exploration and production (E&P) companies, with the vast majority of nationwide companies headquartered in the Houston area, are reporting more profits than losses and fewer firms are filing for bankruptcy, the GHP said in its monthly report for August.

“The downturn in the oil industry is finally over,” said economists. “Oil now trades above breakeven cost for most producers. Exploration budgets continue to grow. The North American rig count has rebounded. Permits to drill have risen dramatically. Layoffs have slowed to a trickle. Crude inventories have fallen. U.S. production is at an all-time high. And global demand continues to grow.”

GHP noted that in 2Q2016, “only five of the 25 largest energy firms in Houston earned a profit,” as oil prices sank in 1Q2016. By the middle of 2016, oil prices had fallen by more than half from their peak.

“The expression that oil prices would be ”lower for longer was heard so often it became trite,” said GHP economists. “But companies heeded the warning, reducing headcounts, slashing budgets and focusing on only the best prospects in their portfolios. These steps helped the industry to regain its health.”

By 2Q2017, 16 of the 25 largest energy companies in the GHP region had returned to profit, and in 2Q2018, “20 of the 25 largest were in the black.”

Investors still are awaiting a full recovery following the oil price crash, however. And they also worry about the impact that climate change regulations may have on the industry, according to the partnership.

“Some fear that oil demand will peak in the not too distant future,” said economists. “Others are disappointed in the meager returns received on their energy investments, especially when compared to tech stocks. They also worry that as oil prices rise, exploration firms will focus on growing production, not profits.”

GHP cited law firm Haynes and Boone LLP, which tracks energy-related bankruptcy filings. Between 1Q2015 and 1Q2018, 335 North American energy companies had filed for bankruptcy, including 144 E&Ps, 167 oilfield service companies, and 24 midstream firms. Combined debt exceeded $169 billion.

Of the total nationwide filings, 162 were in Texas and 43 were in Delaware courts, where a substantial number of filings were for companies with significant operations in Texas. Bankruptcies peaked in 2Q2016, and by 2Q2017 they had fallen 65%. By 1Q2018, filings were down 83%.

More promising data also is coming from the Federal Reserve Bank of Dallas, which each quarter surveys energy firms headquartered in the Eleventh District. The Eleventh District includes Texas, northern Louisiana and southern New Mexico.

In the 1Q2017 survey, 12.7% said conditions were improving and 72.7% said conditions were getting worse.

“A year later, the responses flipped,” GHP noted. In the 1Q2018 survey, the most recent one published, 11.6% said the outlook had worsened and 76.9% saw improved conditions. “The shift suggests there will be fewer bankruptcies and layoffs in the near future,” said GHP.

For Houston, the future looks particularly bright, with growth expected to outpace the nation for the next five years. Renowned Waco, TX-based economist Ray Perryman, who has studied U.S., Texas and metro economies since the 1970s, is forecasting Houston’s economy will grow 4.11%/year over the next five years, versus 4.01% for Texas and 2.89% for the nation. The figures are adjusted to account for inflation.

Houston’s population also should eclipse the state and the nation at 1.67% growth over five years, versus 1.47% for Texas and 0.71% for the country. Perryman is forecasting Houston employment will grow at a 2.14% rate over the period, compared to 2.05% for Texas and 1.55% for the country.

“The longer-term outlook is more impressive,” said GHP economists. “Houston’s economy will nearly double in size over the next 20 years. The region will add nearly 2.6 million residents, more than 1.3 million jobs, and $650 billion in personal income. Even after accounting for inflation, Houston’s prospects look good, with real Gross Regional Product growing 89.3%, real personal income 102.5% and retail sales growing 98.2% over the next two decades.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |