E&P | Markets | NGI All News Access

Houston-Galveston Port’s Oil Exports Exceed Imports in April for First Time

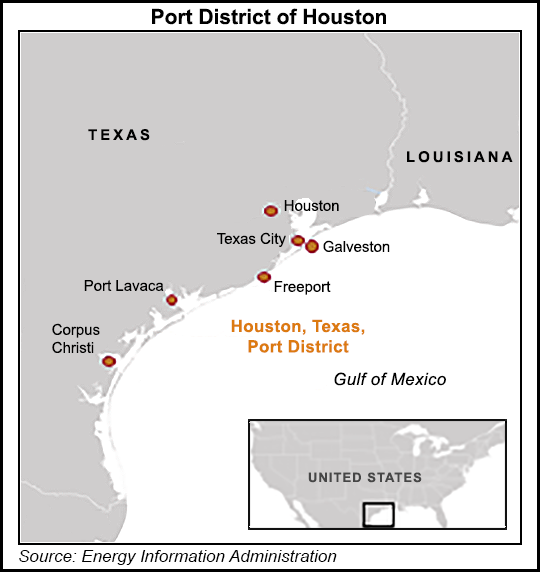

The U.S. port district of Houston-Galveston, which extends to Corpus Christi, for the first time ever in April began exporting more crude oil than it imported, the Energy Information Administration (EIA) said.

Since restrictions on domestic oil exports were lifted at the end of 2015, exports from the port district have increased, lifted by burgeoning onshore output from the Lower 48 states.

As of April, oil exports from the Houston-Galveston port surpassed imports by 15,000 b/d. In May the difference between exports and imports at the Gulf Coast port increased to 470,000 b/d.

The Houston-Galveston port district, a geographic region defined by U.S. Customs, includes the port of Houston and other ports along the Texas coast from Galveston, which is southeast of Houston, to Corpus Christi in South Texas.

“On average since mid-2017, the U.S. port district of Houston-Galveston has accounted for slightly more than half of the crude oil exported from the United States, and the share increased to a record 70% in May,” said EIA researchers led by principal contributor Rebecca George.

Efforts to expand oil export infrastructure on the Texas coast have improved export flows from the Houston-Galveston port district.

“The only other port district that has seen significant crude oil export volumes recently is the U.S. port district of Port Arthur, which includes the Texas ports of Port Arthur, Sabine, Beaumont and Orange.” The Port Arthur region in general is referred to as the Golden Triangle, which initially referred to the golden wealth from the 1901 Spindletop oil strike in Beaumont. The U.S. petrochemical and refining hub is centered in the region along the Houston Ship Channel.

The Port Arthur district “has on average accounted for close to a quarter of all U.S. crude oil exports since mid-2017,” EIA noted. “Despite infrastructure improvements, however, crude oil export capacity is still limited on the U.S. Gulf Coast, because most ports are unable to load large crude oil vessels.”

The Louisiana Offshore Oil Port in the Gulf of Mexico is today the only domestic facility able to accommodate a fully loaded very large crude carrier (VLCC), according to EIA. Earlier this month Trafigura Group Pte Ltd. proposed building a deepwater port near Corpus Christi to load VLCCs. Enterprise Product Partners LP in July also said it was considering an oil export terminal capable of loading VLCCs, with front-end engineering and design begun and initial work underway for permitting.

According to EIA, the Houston-Galveston port district accounted for 12% of total U.S. crude oil imports as of May, second only to the U.S. port district of Chicago at 19%.

Crude oil imported into the Houston-Galveston port district mainly has come from Mexico, South America and the Middle East, regions that in general produce and export heavier grades of oil. U.S. oil exports tend to be lighter grades of oil, which are shipped mainly to Europe and Asia.

This year, most of the oil exports from the Houston-Galveston port district have been transported to Canada, China, Italy and the UK.

“Canada is one of only a few countries that have both imported crude oil from and exported crude oil to that port district in 2018,” said researchers. “So far in 2018, the Houston-Galveston port district has exported about 30,000 b/d more crude oil on average to Canada than it imported from the country.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |