Cooler Forecast for Much of the Country Spurs Sept. NatGas Forward Price Slide Last Week

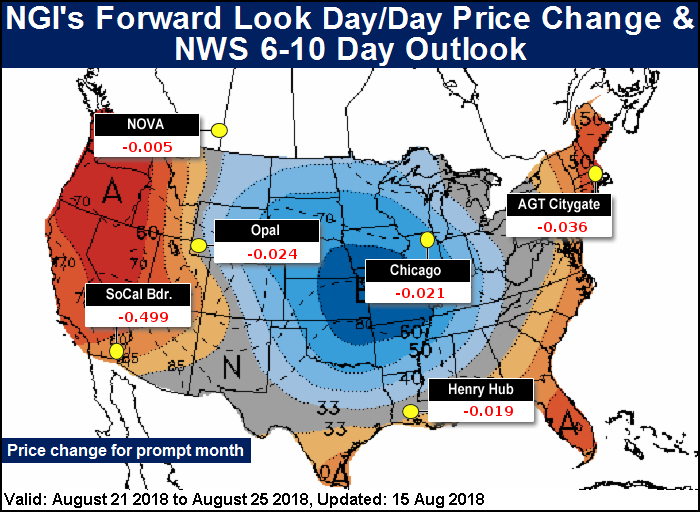

Natural gas prices for September fell an average 3 cents from Aug. 9-15 as weather forecasts began hinting of cooler weather in the weeks ahead. Northeast points, however, posted small gains as intense heat and humidity returned during the week, lifting demand and cash prices in the region, according to NGI’s Forward Look.

Most pricing hubs across the country followed the lead of Nymex futures, which began retreating last Friday (Aug. 10) on the first signs of cooler weather. Despite some back and forth among the various weather models, most guidance appeared to be pointing to milder weather as early as the next six to 10 days, Bespoke Weather Services said.

Cooler trends remained through that period with the first strong cool shot, but then models increased heat risks in the 11-15 day time period, the weather forecaster said. “Models are struggling to determine just how strong any eastern ridge gets later in week 2 and into week 3, as warmth builds from the Midwest to the Northeast but looks to generally remain out of the South,” Bespoke chief meteorologist Jacob Meisel said.

Meanwhile, there are long-range indications of another shot of cool air being possible into week 3, and these trends could arrive if weather patterns become more favorable, he said.

Even as hot summer days are winding down, adequate gas storage ahead of winter remained a concern for the market. The Nymex September gas futures contract traded in a relatively tight band throughout the week, ultimately slipping just 2 cents between Aug. 9 and Aug. 15 to reach $2.94.

By Thursday, however, some additional weakness was seen across the futures curve after the Energy Information Administration reported a 33 Bcf build into storage inventories for the week ending Aug. 10. The reported build was slightly higher than most estimates that pointed to an injection in the high 20 Bcf range, but was within the broader range of expectations.

The September contract, which traded at $2.939 at Thursday’s market open and held relatively steady ahead of the storage report, immediately fell to $2.909 after the EIA print hit the screen. It hit a low of $2.891 before going on to settle at $2.908.

“This was the first miss to the high side in five weeks, but was essentially in line with expectations as we saw slight upside risks and were generally bearish headed into the print given stronger wind generation and looser burns early in the gas week,” Bespoke said.

Despite the pullback in the September contract, storage concerns remained a bullish factor, with cash prices still strong as well, the weather forecaster said. Additionally, power burns on Wednesday and Thursday continued to run quite tight, “but production sits near highs too. This number should also ease some storage concerns and strengthen resistance around $2.92, with $2.85 in play off any further loosening,” Bespoke chief meteorologist Jacob Meisel said.

Broken down by region, the East injected 17 Bcf into gas stocks, while the Midwest boosted inventories by 24 Bcf and the Mountain region injected 3 Bcf. The South Central posted a 6 Bcf withdrawal, and the Pacific pulled 5 Bcf out of storage.

Inventories as of Aug. 10 stood at 2,387 Bcf, which is 687 Bcf below year-ago levels and 595 Bcf below the five-year average. The deficit to the year-ago level increased by 16 Bcf, while the deficit to the five-year average grew by 23 Bcf.

Estimates ahead of the 10:30 a.m. ET release were wide ranging. A Bloomberg survey of 17 market participants had a range of 17 Bcf to 54 Bcf, with both the average and median pointing to a 29 Bcf injection. A Reuters poll of 20 market participants pointed to an average build of 31 Bcf, with estimates ranging from 24 Bcf to 38 Bcf. Bespoke projected a 31 Bcf build, while Kyle Cooper of IAF Advisors estimated a build of 28 Bcf. Intercontinental Exchange settled at 28 Bcf.

During the similar period last year, 49 Bcf was injected into storage, while the five-year average injection stands at 56 Bcf.

Genscape Inc. senior natural gas analyst Rick Margolin said his firm had been expecting a 30 Bcf build, a print that would have come in well below the year-ago and five-year-average but “is actually loose to the five-year when accounting for degree days and normal seasonality.”

Genscape’s Spring Rock daily production estimate for the report week averaged 80.3 Bcf/d, 0.17 Bcf/d higher week/week (w/w) on the strength of gains in the Northeast, Permian Basin and Haynesville Shale.

Total demand for the report week was an estimated 80.5 Bcf/d, including an average 38.3 Bcf/d of gas burns, according to Genscape’s proprietary estimate, nearly 2.7 Bcf/d higher w/w “and this summer’s second strongest weekly average,” Margolin said.

While inventory storage deficits increased with the week’s report, “our estimates for the current and upcoming gas weeks show relatively stronger injection numbers on the back of notably milder temperatures scrubbing cooling demand loads and exports to Mexico, along with already observable upticks in Lower 48 production,” he said.

Meanwhile, EIA said Thursday it will publish beginning Sept. 13 estimates based on a new sample selected for the Weekly Natural Gas Storage Report (WNGSR). On Sept. 10, EIA plans to revise estimates for the eight weeks covering July 13-Aug. 31 to gradually phase in the estimates from the new sample.

Although the established sampling and estimation methodologies for the WNGSR have not changed, estimates produced are to reflect the most recent version of the EIA-912 form, which requires storage operators in the South Central region to separately report the volume of working natural gas held in salt facilities and nonsalt facilities, EIA said.

Looking at the individual pricing hubs across the country, Northeast points were the only markets that put up significant gains during the Aug. 9-15 period as hot weather, strong demand and some maintenance along a major pipeline created some uplift for forward markets.

At the Algonquin Citygate in New England, September forward prices picked up a nickel to reach $3.033, while the balance of summer (September-October) rose 3 cents to $3.03. The winter 2018-2019 strip, meanwhile, lost a dime to hit $7.84, according to Forward Look.

The increases at the front of the Algonquin Citygate curve stemmed from a cash rally that occurred ahead of a planned outage beginning Thursday between the Algonquin Gas Transmission (AGT) Stony Point and Southeast compressor stations (CS). The work coincided with pigging operations from AGT’s Lambertville meter to the Hudson River, just past the Stony Point compressor, according to Genscape. For both events, capacity through the Stony Point CS was to be limited to 810 MMcf/d for Thursday and Friday.

Stony Point implied flows (including no-notice) have averaged 1,242 MMcf/d and maxed at 1,346 MMcf/d during the last 30 days, meaning this event could impact up to 536 MMcf/d of mainline flows, Genscape said. “As Stony Point is the main constraint point for the AGT mainline, this event presents significant upside risk to Algonquin Citygate prices and downstream demand,” Genscape natural gas analyst Josh Garcia said.

Meanwhile, there are also several meter specific supply limitations affecting interconnects with Tennessee Gas Pipeline (TGP), Millennium Pipeline, Columbia Gas Transmission, Iroquois Gas Transmission System and Texas Eastern Transmission, all of which are upstream or near the Stony Point CS. Supply points downstream of Stony Point, including the Everett liquefied natural gas facility, the Salem Essex interconnect with Maritimes and the Lincoln and Mendon interconnects with TGP, will be relied on heavily, Garcia said.

AGT also declared an operational flow order (OFO) on Tuesday, and compounding the issue on the power side was the loss of a transmission line from Hydro Quebec on Aug. 10, which caused a loss of 500 MW of imports to Independent System Operator New England (ISONE), and the loss of about 400 MW of generation from the Pilgrim Nuclear Power Station in Southeast Massachusetts as of Tuesday, Genscape said.

With Algonquin Citygate cash prices surging above $4, generation on the pricier Portland and Maritimes pipelines might clear, as well as coal plants that have been offline since early July, Genscape said.

This round of pipeline work will serve as a small sample to predict the larger Stony Point-to-Oxford outage currently scheduled for late September. “That outage is expected to have greater impact on flows, a much longer duration and concurrent scheduled nuclear outages at the tail end of the event,” Garcia said.

Elsewhere in the Northeast, points along the Transcontinental Gas Pipe Line (aka Transco) also put up small gains for the remainder of the summer, while the back of the forward curve declined.

In addition to the heat wave-induced rally in cash markets and forwards, some of the strength could be related to the minor delay in getting Transco’s Atlantic Sunrise in service. A notice posted Wednesday on the pipeline’s website indicated that because of weather-related delays, Transco now expects mechanical completion of the 1,700 MDth/d project in late August, with full service anticipated to commence in early September. “The mechanical completion date is based upon current contractor schedules and may further be affected by weather,” Transco said.

The delay should come as no surprise for those following the pipeline’s construction. Williams LP management earlier this month said workers had faced record rainfall.

Transco zone 5 South September climbed 6 cents from Aug. 9-15 to reach $2.993, as did the balance of summer (September-October), which hit $3.00. The prompt winter, meanwhile, slipped 3 cents to $4.66, Forward Look data show.

At Transco zone 6-NY, September was up 6 cents to $2.739, the balance of summer (September-October) was up 4 cents to $2.72 and the winter 2018-2019 was down 8 cents to $6.07.

Across the country, Southern California markets continued to retreat from recent heat-induced highs, even as weather forecasts showed the hot weather lingering for several more days. SoCal Citygate September plunged $1.36 from Aug. 9-15 to reach $6.928, the balance of summer (September-October) tumbled 88 cents to $5.81 and the winter 2018-2019 dropped a quarter to hit $5.51.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |