Weekly NatGas Prices on the Rise with Temps, But West Coast Points Post Steep Losses

Weekly physical natural gas prices settled in the black at most pricing locations for the Aug. 13-17 period as hot weather settled over much of the country. High temperatures up and down the Eastern Seaboard soared into the 90s, while Texas and California remained under scorching conditions.

Interestingly, despite the ongoing heat and pipeline imports in California, dramatic declines at the SoCal Citygate sent the NGI National Weekly Avg. down 16 cents to $2.91.

SoCal City-gate weekly prices plunged $9.25 to an average $7.30, while SoCal Border Avg. prices dropped $2.40 to $3.48.

Prices in Arizona/Nevada also tumbled from recent highs, with Kern Delivery sliding more than $4 to $3.73 and El Paso S. Mainline/N. Baja falling more than $3 to $3.73.

Most other pricing hubs across the United States shifted less than a dime on the week. The Rocky Mountain Regional Avg. rose a nickel to $2.58, while even the normally more volatile Northeast saw regional prices slip just 6 cents on the week.

That’s not to say there weren’t some standouts in the region. Maritimes & Northeast weekly prices plummeted 45 cents to an average $4.69, while Transco zone 6 NY fell 13 cents to $3.06.

In the Southeast, Transco zone 5 dropped 18 cents to $3.12, while Louisiana prices averaged within a nickel of the previous week.

Similar small changes were seen in the Midcontinent and Midwest, while double-digit declines were commonplace in West Texas/southeastern New Mexico. El Paso-Permian tumbled 18 cents to $2.00, and Waha was down 14 cents to $1.95.

On the natural gas futures front, the Nymex September contract shifted in and out of positive territory throughout the week as storage concerns continued to go head to head with earlier weather forecasts pointing to cooler weather in the next week or so. The prompt month climbed 1.6 cents from Aug. 13-17 to reach $2.946.

At the start of the week, weather models had indicated that cooler weather was around the corner. And while the dog days of summer are indeed winding down, weather guidance on Friday turned decidedly warmer in the six- to 10-day range, lessening “the trough through next week that should deliver the first colder shot of the season and then more amplified with a ridge across the East that will help return quite a bit of heat,” Bespoke Weather Services said.

“Forecasts do still cool rapidly into next week with at least one broad cold shot, though not quite to the intensity that was previously imagined, and it is quickly replaced by strong heat from the Midwest to the Northeast that should pull” gas-weighted degree days “back solidly above average,” the weather forecaster said.

EBW Analytics Group CEO Andy Weissman similarly pointed to a warmer shift in the six- to 10-day outlook that first began showing up in Thursday’s overnight weather guidance.

The shift “does not materially change the picture for the remainder of the summer, but has triggered a modest rebound in early trading,” Weissman said. Despite the higher close for the September contract, “our overall view remains bearish.” By the Aug. 31-Sept. 6 storage week, “injections could reach 90 Bcf per week, with continued increases later in September. By a week from now, the September contract is likely to fall to $2.85 or below.”

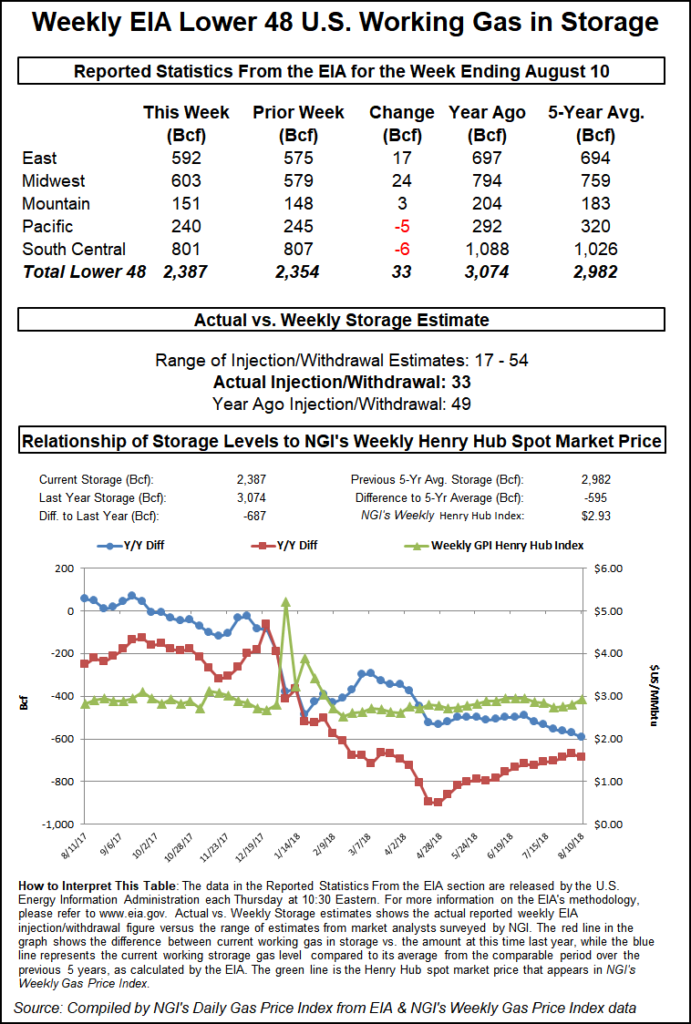

On Thursday (Aug. 16), the Energy Information Administration reported a 33 Bcf injection into gas storage inventories for the week ending Aug. 10. The reported build was slightly higher than the consensus that had built around a high 20 to low 30 Bcf injection. During the similar period last year, 49 Bcf was injected into storage, while the five-year average injection stands at 56 Bcf.

Broken down by region, the East injected 17 Bcf into gas stocks, while the Midwest boosted inventories by 24 Bcf and the Mountain region injected 3 Bcf. The South Central posted a 6 Bcf withdrawal, and the Pacific pulled 5 Bcf out of storage.

Inventories as of Aug. 10 stood at 2,387 Bcf, which is 687 Bcf below year-ago levels and 595 Bcf below the five-year average. The deficit to the year-ago level increased by 16 Bcf, while the deficit to the five-year average grew by 23 Bcf.

“Hefty deficits aren’t going to improve until summer heat abates, which puts a lot of pressure on record production reducing them during the fall shoulder season,” NatGasWeather said, adding that it expected storage deficits to stall through the end of the month.

Until deficits show signs of noticeably being reduced, the weather forecaster continues to expect that “any moderate sell-offs will find buyers.”

Data and analytics company Genscape Inc., which had estimated a 30 Bcf storage injection, said its estimates for the “current and upcoming gas weeks show relatively stronger injection numbers on the back of notably milder temperatures scrubbing cooling demand loads and exports to Mexico, along with already observable upticks in Lower 48 production.”

Still, for inventories to reach last year’s end-of-October level, nearly 120 Bcf of gas would need to be injected weekly, according to Genscape senior natural gas analyst Rick Margolin. In the last seven years, the market has only posted seven 100-plus Bcf injections after Aug. 10. Genscape’s Daily Supply/Demand (S&D) preliminary estimate for the EIA’s Aug. 23 report is about 53 Bcf, and the following EIA report (Aug. 30) is trending toward a 73 Bcf.

Its Forward S&D forecast indicates currently traded gas, oil and natural gas liquids forward curves are pricing fundamentals to average about 83 Bcf/week of injections, putting the end-of-season inventory estimate on track to start winter at a potential record low just shy of 3.37 Tcf.

If realized, that would be — by far — the lowest start to winter inventory since at least 2010, Margolin said. The previous low was 3,577 Bcf on Nov. 1, 2014 (the summer after the Polar Vortex winter of 2013-2014). That contributed to the following winter 2014-2015 ending with inventories about 175 Bcf (11%) below its prior five-year average.

Currently traded forwards are generating results in Genscape’s Forward S&D that indicate a similar dynamic for this winter. “While our production forecast is indicating this winter will see more than 11 Bcf/d more production than Winter ”14-’15, our Forward S&D shows this winter is priced to generate nearly 10.6 Bcf/d more demand,” Margolin said.

With that, the upcoming winter is currently priced to end with inventories above last year and slightly larger than end-of-winter 2014-2015, but about 10% below the five-year average, he said.

Despite the projected below-average gas stocks, Jefferies LLC analysts said investors are more comfortable with entering the winter with storage at a deficit to the five-year average.

August production month to date has averaged 81.2 Bcf/d, up another 0.6 Bcf/d sequentially after July posted 1.8 Bcf/d of sequential growth, according to the investment bank. Earlier this week, U.S. production set a new daily record, surpassing 82 Bcf/d for the first time.

Haynesville Shale production is up 0.3 Bcf/d sequentially, with production in recent days crossing 10 Bcf/d for the first time since 2012, according to Jefferies analysts. Permian Basin gas output has also ticked higher in August, up 0.2 Bcf/d sequentially to 7.4 Bcf/d afer five months of holding relatively steady.

Northeast supply has also continued to climb, analysts said, up 0.4 Bcf/d sequentially and averaging more than 28 Bcf/d for the first time on record. Denver-Julesburg Basin production is up slightly (60 MMcf/d), likely benefitting from the recent in-service of DCP Midstream LP’s Mewbourn gas processing plant. Eagle Ford Shale production is flat sequentially, while regions outside of the major shale basins have declined around 0.3 Bcf/d this month, analysts noted.

But just as production has grown, so too has consumption. U.S. demand, at 80.1 Bcf/d, is up 7.2 Bcf/d year/year (y/y) in August, compared to supply that has climbed 8.4 Bcf/d y/y. The growth in demand has largely been driven by power burn, which at 37.4 Bcf/d is up 4.5 Bcf/d y/y in August, after setting a new monthly record in July at 37.7 Bcf/d.

Liquefied natural gas demand has grown 1.6 Bcf/d y/y, while Mexican exports have increased 0.7 Bcf/d y/y and have averaged around 5 Bcf/d so far this month from the in-service of downstream infrastructure projects like the 600 MMcf/d Nueva Era Pipeline and the 670 MMcf/d El Encino-Topolobampo Pipeline. Industrial demand has risen 0.6 Bcf/d from a year ago. Residential/commercial demand, however, is down 0.3 Bcf/d y/y, according to Jefferies.

“It is very unlikely that storage reaches the five-year average (roughly 3.8 Tcf) by the end of summer,” Jefferies analysts said. If production continues at the same year/year growth rate as August (plus 8.4 Bcf/d) for the remainder of the refill season, “we estimate that the season will end with storage at 3.4 Tcf (about 9% below average).”

But analysts at Mobius Risk Group said that while bullish market commentary “is anything but commonplace at present”, sentiment regarding calendar 2019 prices is “confoundingly dismal” as more than 3 Bcf/d of LNG export capacity is staged to be operational next year.

“The Corpus Christi terminal is months away from start up, with Freeport and Cameron also expected to be complete during 2019,” Mobius analysts said. The Corpus terminal in South Texas late Thursday was authorized to begin feed gas injections, with commercial export beginning possibly by the end of the year.

While production growth is “unquestionably capable” of delivering more supply than LNG export demand, “a view this simplistic does not consider the impact of steady increases in Mexican exports (0.6 Bcf/d year/year in the past 60 days) and increases in baseload power consumption, plus steady industrial consumption gains,” Mobius said.

Meanwhile, Dominion Energy’s Cove Point LNG facility said in a Friday note to shippers that it will undergo planned maintenance in this fall, although each event is expected to last only a few days. A longer, 11-day outage is scheduled for next July.

Spot Gas Lower Despite Work Planned for Pipes

Spot gas prices were lower Friday for weekend and Monday delivery as high pressure and resulting hot weather was expected to hold over the East Coast for one last day before cooling was forecast to arrive during the weekend, according to NatGasWeather. Weather systems with showers were forecast to send temperatures down to more comfortable highs in the 70s and 80s across the eastern half of the country, easing national demand.

Additional weather systems were expected into the central and then east-central United States during the week before hot high pressure begins to regain ground. The West, however, was expected to remain hot, as was the South and Southeast, the weather forecaster said.

Aside from the weather, several pipelines were set to begin maintenance early next week that could restrict flows through portions of their lines.

Starting Monday, Midwestern Gas Transmission (MGT) plans to replace pipe on the mainline north of Simpson Sales in Simpson County, KY, which would fully restrict southbound flows through Compressor Station (CS) 2101 into Tennessee.

Flows through CS 2102 have averaged roughly 150 MMcf/d for the past 30 days, of which about 105 MMcf/d has been delivered to Tennessee Gas Pipeline (TGP) at the Portland interconnect, according to Genscape.

“It is likely deliveries to TGP at Portland will be restricted due to this event; however, TGP could instead deliver to MGT to fulfill the remaining demand south of the outage area,” Genscape natural gas analyst Vanessa Witte said.

This event could also cause flow reductions at the Scotland Rockies Express Pipeline interconnect farther north on the mainline, as this is where MGT sources the majority of its gas, Genscape said. Higher-than-average cooling degree days that are forecast for the Midwest could increase demand for northbound flow, Witte said. Per MGT’s notice, the outage is not expected to last more than 80 hours.

Tennessee zone 1 100 L spot gas traded at $2.90, down a penny on the day.

Elsewhere across the country, Texas Gas Transmission was set Monday to start planned hydro tests near Dillsboro, IN. Southbound capacity through the Harrison CS was to be restricted to around 673 MMcf/d, an 83 MMcf/d reduction in southbound operational capacity for the duration of the maintenance event, which is scheduled to end Sept. 30, according to Genscape.

Southbound flows through the Harrison CS have averaged 733 MMcf/d over the last month, Genscape natural gas analyst Allison Hurley said. Southbound flows may impact the Dillsboro and Jeffersontown compressor stations depending on scheduled deliveries going to the Lawrenceburg Power Plant, which has had average delivery nominations of 194 MMcf/d during the previous month. Genscape, however, “does not believe that this new event will be as impactful as the most recent” previous single-day June 2018 maintenance event where nominations dropped 233 MMcf/d day over day, due to a greater operational capacity restriction at Harrison CS, Genscape analyst Emily Allard said.

Indeed, Texas Gas Zone 1 held steady at $2.89.

In California, Southern California Gas Inc. (SoCalGas) has reached an agreement for a temporary extension of right-of-way (ROW) on Line 5000 (L5000) just days before the right-of-way was to expire. SoCalGas announced the Morongo Band of Mission Indians granted a temporary, 60-day extension on the ROW to give both parties more time to negotiate a longer-term agreement.

The existing agreement was set to expire on Tuesday (Aug. 21), and prospects for the extension were looking grim as negotiations had ground to a halt. The expiration of the L5000 ROW would have forced the line out of service and thereby reduced capacity through SoCalGas’ Southern Zone by several hundred MMcf/d, Genscape said.

“This would have certainly been a major contributor to SoCal Citygate volatility” because of SoCalGas’ limited access to storage in the wake of the Aliso Canyon leak placing increased reliance on flowing supply from import pipelines, but for which capacity on several import systems has also been limited to planned and unplanned maintenance, Genscape senior natural gas analyst Rick Margolin said.

The news of the ROW extension could have played a hand in sending California spot gas prices lower since the state continues to experience scorching temperatures. SoCal Citygate fell nearly $1 to $5.00, while Malin slipped 4 cents to $2.71.

Meanwhile, far off the West Coast, the National Hurricane Center (NHC) was keeping a careful eye on Hurricane Lane, a Category 2 storm Friday afternoon and expected to strengthen into a major storm (Category 3 or higher) that evening. At 11 AM ET on Friday, the center of Hurricane Lane was near latitude 11.2 North, longitude 132.9 West and moving toward the west near 16 mph. A motion between west and west-northwest was expected during the next few days. Lane was forecast to cross into the Central Pacific basin on Saturday.

Maximum sustained winds had increased to near 100 mph with higher gusts, the NHC said. Continued rapid strengthening was expected for the next 24 hours, but little change in strength was expected on Sunday. As of NHC’s Friday morning update, hurricane-force winds extended outward up to 15 miles from the center, and tropical storm-force winds extended outward up to 90 miles.

Infraestructura Energetica Nova’s Energia Costa Azul LNG import terminal, which is near Ensenada in the northwest Mexican state of Baja California, was among the gas infrastructure closest to the storm, but it remained well out of its current and projected path.

In the Rockies, spot gas prices were down more than a nickel on average, with steeper declines at CIG, which tumbled 13 cents to $2.46. Northwest Wyoming Pool fell nearly a dime to $2.59.

In the Northeast, Algonquin Citygate plunged 57 cents to $2.91, while Transco Zone 6 NY dropped 17 cents to $2.88. Both points had traded above $3 on Thursday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |