September Natural Gas Slides as Weather, Storage Deliver One-Two Punch; Spot Gas Slips

September natural gas prices declined Thursday as a slightly higher-than-expected storage injection and cooler weather forecast for the next week or so weighed on the market. The Nymex September gas contract fell 3.2 cents to settle at $2.908.

Spot gas prices also moved lower as numerous weather systems with showers and cooling were expected to impact the northern, central and east-central United States beginning this weekend and continuing into next week for a swing back to lighter national demand. The NGI National Spot Gas Average slipped 11 cents to $2.88.

On the futures front, the prompt month traded at $2.939 at the open and held relatively steady ahead of the Energy Information Administration’s (EIA) storage report. When the EIA’s 33 Bcf print hit the screen, September futures immediately fell to $2.909, and then later to a low of $2.891, before rebounding a bit into the close.

Losses of around 3 cents or so were seen for the balance of the year, with October settling at $2.913, November at $2.95 and December at $3.046.

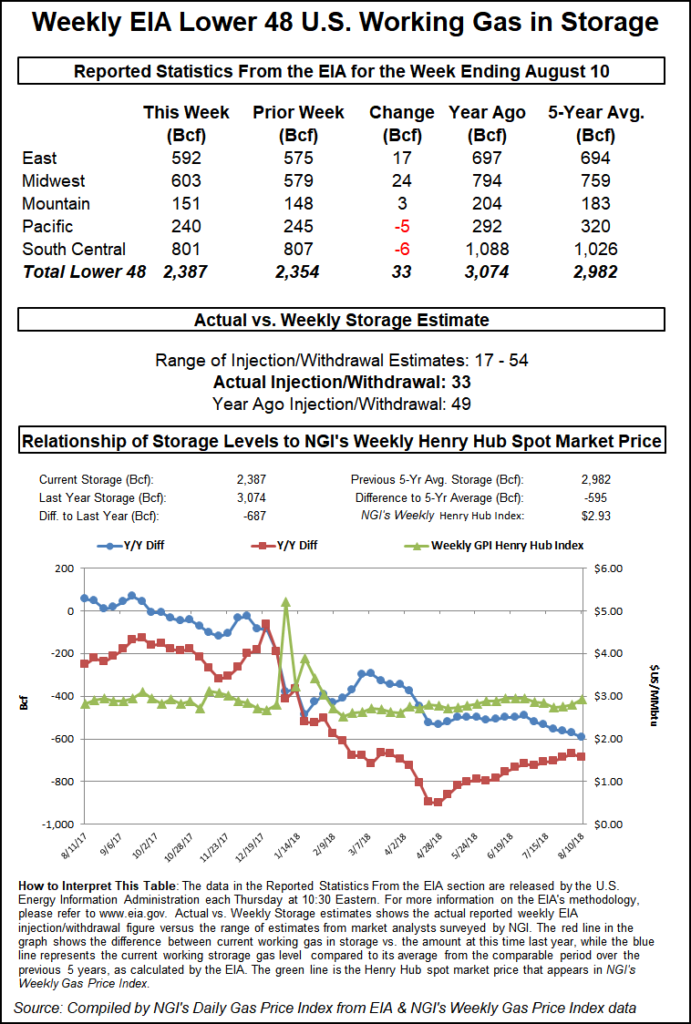

Estimates ahead of the 10:30 a.m. ET release were wide ranging, although consensus had built around an injection in the high 20 to low 30 Bcf range. During the similar period last year, 49 Bcf was injected into storage, while the five-year average injection stands at 56 Bcf.

Broken down by region, the East injected 17 Bcf into gas stocks, while the Midwest boosted inventories by 24 Bcf and the Mountain region injected 3 Bcf. The South Central posted a 6 Bcf withdrawal, and the Pacific pulled 5 Bcf out of storage.

Inventories as of Aug. 10 stood at 2,387 Bcf, which is 687 Bcf below year-ago levels and 595 Bcf below the five-year average. The deficit to the year-ago level increased by 16 Bcf, while the deficit to the five-year average grew by 23 Bcf.

“Hefty deficits aren’t going to improve until summer heat abates, which puts a lot of pressure on record production reducing them during the fall shoulder season,” NatGasWeather said, adding that it expected storage deficits to stall through the end of the month.

Until deficits show signs of noticeably being reduced, NatGasWeather continues to expect that “any moderate sell-offs will find buyers. The real question, it said, is what will it take to get the Nymex prompt month above $3 “since this week’s EIA report failed to add bullish fodder?”

For market bulls, $3 gas may be getting more and more out of reach. Genscape Inc., which had estimated a storage injection of 30 Bcf, said its estimates for the “current and upcoming gas weeks show relatively stronger injection numbers on the back of notably milder temperatures scrubbing cooling demand loads and exports to Mexico, along with already observable upticks in Lower 48 production,” according to senior natural gas analyst Rick Margolin.

Indeed, gas production continues to climb, again reaching a new high in August, which Jefferies LLC analysts said leaves investors more comfortable with entering the winter with storage at a deficit to the five-year average.

August production month to date has averaged 81.2 Bcf/d, up another 0.6 Bcf/d sequentially after July posted 1.8 Bcf/d of sequential growth, according to the investment bank. Earlier this week, U.S. production set a new daily record, surpassing 82 Bcf/d for the first time.

Haynesville Shale production is up 0.3 Bcf/d sequentially, with production in recent days crossing 10 Bcf/d for the first time since 2012, according to Jefferies analysts. After five months of production holding rather steady at around 7.2 Bcf/d, Permian Basin gas output has also ticked higher in August, up 0.2 Bcf/d sequentially to 7.4 Bcf/d.

Northeast supply has also continued to climb, analysts said, up 0.4 Bcf/d sequentially and averaging more than 28 Bcf/d for the first time on record. Denver-Julesburg Basin production is up slightly (60 MMcf/d), likely benefitting from the recent in-service of DCP Midstream LP’s Mewbourn gas processing plant. Eagle Ford Shale production is flat sequentially, while regions outside of the major shale basins have declined around 0.3 Bcf/d this month, analysts noted.

Just as production has grown, so too has consumption. U.S. demand, at 80.1 Bcf/d, is up 7.2 Bcf/d year/year (y/y) in August, compared to supply that has climbed 8.4 Bcf/d y/y. The growth in demand has largely been driven by power burn, which at 37.4 Bcf/d is up 4.5 Bcf/d y/y in August, after setting a new monthly record in July at 37.7 Bcf/d.

Liquefied natural gas demand has grown 1.6 Bcf/d y/y, while Mexican exports have increased 0.7 Bcf/d y/y and have averaged around 5 Bcf/d so far this month from the in-service of downstream infrastructure projects like the 600 MMcf/d Nueva Era Pipeline and the 670 MMcf/d El Encino-Topolobampo Pipeline. Industrial demand has risen 0.6 Bcf/d from a year ago. Residential/commercial demand, however, is down 0.3 Bcf/d y/y, according to Jefferies.

“It is very unlikely that storage reaches the five-year average (roughly 3.8 Tcf) by the end of summer,” Jefferies analysts said. If production continues at the same year/year growth rate as August (plus 8.4 Bcf/d) for the remainder of the refill season, “we estimate that the season will end with storage at 3.4 Tcf (about 9% below average).”

Spot Gas Softens Despite Persistent Heat

Spot gas prices across much of the United States moved lower Thursday despite ongoing heat in key demand regions. In the Northeast, Algonquin Citygate next-day gas retreated after Wednesday’s nearly 80-cent run, falling 66 cents to $3.48 as demand is projected by Genscape to tumble to 1.92 Bcf/d Friday from an expected high of 2.74 Bcf/d on Thursday.

At Tennessee zone 6 200L, spot gas plunged 62 cents to $3.41, and Transco zone 6 non-NY fell 9 cents to $3.03. Appalachia demand was expected to drop to 8.57 Bcf/d on Friday, down from an expected 10.96 Bcf/d on Thursday.

The declines come even as hot conditions were forecast to continue across major Northeast cities with daytime temperatures expected to reach the 90s up the Eastern Seaboard to New York City and beyond, resulting in strong national demand through Friday, according to NatGasWeather.

The West and the South also were expected to remain under sweltering conditions, with widespread highs forecast in the 90s to 100s. Demand was expected to ease this coming weekend and much of next week as numerous weather disturbances sweep across the northern and eastern halves of the country with showers and comfortable temperatures in the 70s and 80s, the weather forecaster said.

“This delays the rebuilding of very warm to hot high pressure” across the northern and eastern United States until late next week and beyond, it said. The high pressure system, however, is where the Global Forecasting System data remains a little hotter than other models. The forecaster also continues to see ways weak weather systems expose flaws in the ridge during the last week of August.

“Overall, still a neutral pattern due to the front and back end of the forecast being warm/hot weighted with cooling in between for this weekend and next week,” NatGasWeather said.

In the Rockies, Cheyenne Hub next-day gas dropped 7 cents to $2.61, while most other regional points slipped just a couple of pennies.

California prices also softened, with SoCal Citygate continuing to come off recent highs. Next-day gas at SoCal Citygate dropped nearly $2 to average $5.96. PG&E Citygate was down a dime to $3.38.

Texas markets continued to shift a few cents in either direction, with Houston Ship Channel next-day gas slipping 3 cents to $3.05 and Waha climbing as much to $1.98.

In the Midcontinent, OGT spot gas was down a couple of cents to $1.78, and Northern Natural Ventura slid 4 cents to $2.89.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |