Infrastructure | LNG | NGI All News Access

Pacific Dredging Work Raises New Hope for Canadian LNG Exports

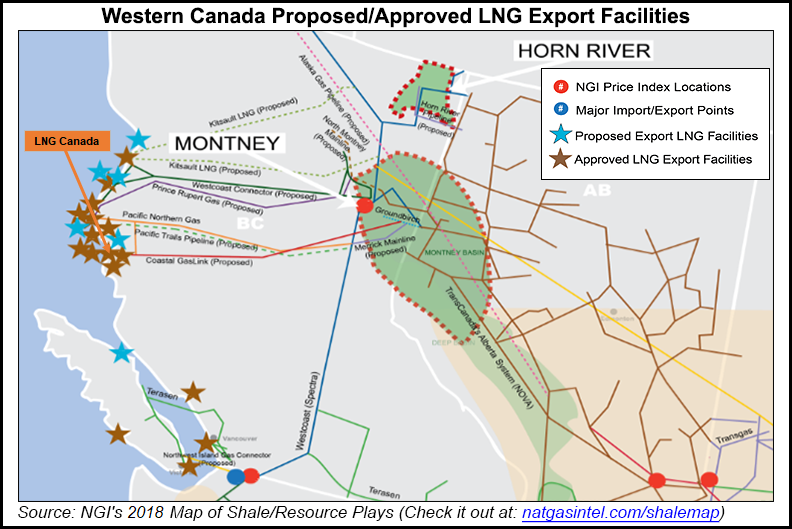

Preparations for Canadian liquefied natural gas (LNG) exports are advancing into a highly visible stage, fueling hope for delayed projects on the Pacific coast.

A jumbo heavy lift vessel is going to work for the rest of the summer on dredging a safe deep passage for tankers to the proposed LNG Canada terminal’s dock at the Port of Kitimat in northern British Columbia (BC).

Consortium leader Shell Canada Ltd. awarded the harbor job to Dutch international corporate peer Royal Boskalis Westminster BV, a century-old marine services empire with 10,700 employees operating more than 900 vessels in 90 countries. The ship dispatched to Kitimat will work around the clock, said LNG Canada.

But like recent announcements of conditional construction contracts for the terminal and TransCanada Corp.’s allied Coastal GasLink pipeline project, the export consortium’s explanation for the big vessel’s arrival stopped short of a commitment to proceed.

The public notice to Kitimat said, “LNG Canada is undertaking some seasonally sensitive work this summer to put the project in the best position to meet schedule requirements should LNG Canada’s joint venture participants take a final investment decision (FID) later in 2018.”

Wildlife protection requirements make the project choose between doing the dredging early or else waiting for a year. “LNG Canada needs to take advantage of a period of limited fish migration during the summer,” says the Kitimat notice.

At the same time, a gas industry review by CIBC World Markets highlights hopes raised by the LNG Canada plan: a C$14 billion ($11 billion) terminal to export up to 3.7 Bcf/d, collected from northern BC and Alberta by the C$4.8 billion ($3.8-billion) Coastal GasLink.

The investment arm of the Canadian Imperial Bank of Commerce rated the pending terminal and pipeline construction decisions as a potential dual boost, both in financial “sentiment” towards the industry and possibly depressed prices on its glutted market.

“Although we suspect it could take more than 2 Bcf/d of export capacity to meaningfully alter Western Canada’s supply-demand imbalance, the opening of new markets for Canadian gas is unquestionably a positive development,” CIBC said.

“Perhaps more importantly we see a positive FID from LNG Canada sending a strong signal to other global LNG proponents that Canada is open for business, materially increasing the likelihood that future projects could take flight.”

The decision is due this fall. The BC government has given LNG Canada until November to accept an incentive offer of C$6 billion ($4.8 billion) in provincial income, sales and carbon tax cuts. An exemption from federal import tariffs on low-cost Asian LNG hardware is also being sought.

An example of success, to break a pattern of deferrals and cancellations among more than 20 Canadian LNG export projects for nearly a decade, could light a fire under the industry lineup, said CIBC.

“We believe industry participants may move to green light project expansions quicker than people think. It’s not inconceivable that we could see 5 Bcf/d or higher being exported from Canadian shores by the end of the next decade.”

Native communities also provide encouragement. Tribes on the Coastal GasLink route reject a legal challenge against its BC approval by prominent environmentalist Mike Sawyer, who demanded lengthy further review by the National Energy Board too.

Burns Lake Band Chief Dan George said in an open letter responding to a proceeding Sawyer has launched before the National Energy Board that “the pipeline is supported by 19 of the 20 First Nations in BC through whose territories the line will run. The 20th has not publicly addressed the pipeline — but has long come out in favor of the LNG development the line will serve.”

The northern chief wrote that “those 19 Nations alone stand to receive up to C$1 billion ($800 million) in benefits from the pipeline, in contract and employment opportunities. They see the pipeline as a way of partially assisting with poverty and social issues, and building careers.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |